1 | Farmers First!

Tuesday marked an important day for U.S. farmers as politicians on both sides of the aisle introduced the Farmer First Fuel Incentives Act which would require the Treasury Dept to restrict eligibility of the 45Z tax credit to renewable fuels MADE ONLY FROM DOMESTICALLY SOURCED FEEDSTOCKS in addition to extending the credit until December 31, 2034 versus the current law which expires December 31, 2027.

In recent weeks and months U.S. agriculture groups like the Renewable Fuels Association, Growth Energy, National Oilseed Processors Association and countless other U.S. soy and corn groups have fighting hard in DC for legislation to ensure U.S. farmers' tax dollars are not subsidizing foreign feedstock imports. It is a long way from law but we have to start somewhere!

2 | Greasy

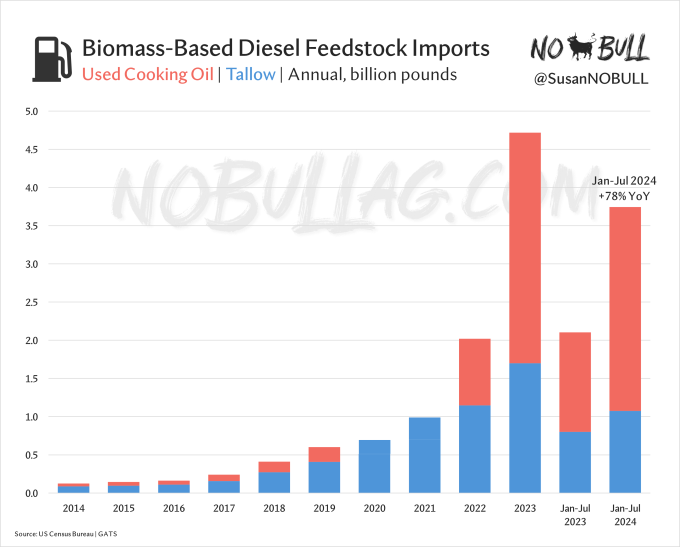

Looking back at biomass-based diesel feedstock demand for the first half of the year the past four years - it is easy to see where the growth in demand lies: tallow and used cooking oil - both of which are heavily dependent on imports.

Tallow use in biomass-based diesels has increased an astounding 357% since FH 2021, alongside used cooking oil - up 151%.

While domestic feedstocks like soybean and corn oil have seen demand increase on a tonnage basis, their percentage-share of overall feedstock demand and growth relative to years past has been relatively mild compared with that of tallow and UCO.

3 | Out with the old… in with the new…

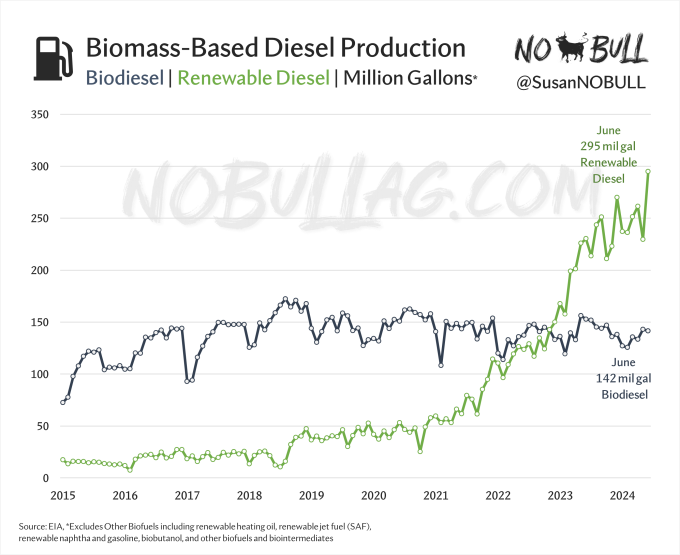

The U.S. produced a record 295 million gallons of renewable diesel in June.

We have now produced more renewable diesel than traditional biodiesel every single month since November 2022 and June 2024 marked an big milestone as this was the first time renewable diesel production has been more than double that of biodiesel in the same month.

4 | Four Hundred!

Thanks to the jump in renewable diesel production - combined renewable & biodiesel production hit a record high of 436 million gallons - surpassing the 400 mark for the first time on record.

Biodiesel production continues to decline (slowly), down 3% the past 12 months while renewable diesel production is off like a rocket - up nearly 50% during that same time.

5 | WHAT A CHART

A short 14 months ago soybean oil was trading at a $700 premium to palm oil on a per tonne basis. Going home Friday, nearby bean oil was at a $30/tonne discount to palm -incredible!

Veg oils & their price relationships have never been so important to US ags!

For the full version of this post and to subscribe, visit NoBullAg.Substack.com.

Thanks!

On the date of publication, Susan Stroud did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.