This year, copper prices have been significantly influenced by global economic policies, particularly those from China and the United States. The Federal Reserve's shift toward interest rate cuts and China's recent economic stimulus measures have created a bullish outlook for copper prices. The new measures out of Beijing include a cut to bank reserve requirements and reduced mortgage rates in China, among other initiatives directly aimed at propping up the country's economy and property markets - and, consequently, copper demand.

The role of copper (HGZ24) as a barometer of economic health is tied to its extensive use in construction, manufacturing, and emerging technologies such as electric vehicles (EVs) and renewable energy systems. Now, with artificial intelligence (AI) data centers emerging as another key driver of demand, investors might be considering how to take advantage of long-term upside in the red metal.

One copper play that really stands out is Freeport-McMoRan (FCX). It's a top copper miner with a strong market position, and at a good price. Right now, FCX is trading at 8.5 times EV/EBITDA, which is right in line with it's historical valuations - and a slight discount to its peers, despite FCX's prime position in the copper market. This makes the stock an interesting option for investors, particularly since FCX also pays regular dividends.

Here's a closer look at FCX's strategic position, financial health, and growth potential in today's copper market.

Evaluating FCX's Market Position

Valued at $74.5 billion, Freeport-McMoRan (FCX) is a big name in the global mining scene, mainly digging up copper, gold (GCZ24), and molybdenum. With operations in North America, South America, and Indonesia, FCX has primarily made a name for itself as a leader in copper production, which is crucial for industry and tech.

Over the past year, FCX stock has surged 40.5%, including a 20.6% rise in 2024. The mining stock has popped more than 15% in the past five days alone, driven by optimism over China's stimulus efforts.

FCX's latest earnings report highlights its strong financial standing. In the second quarter of 2024, the company reported a net income of $616 million, or $0.42 per share. Adjusted net income was a stronger-than-forecast $667 million, or $0.46 per share. The company's consolidated production during this period included 1.0 billion pounds of copper, 443 thousand ounces of gold, and 20 million pounds of molybdenum.

The miner's focus on operational efficiency and cost management has enabled it to maintain competitive production costs, even as it navigates fluctuations in commodity prices. Sales figures were similarly strong, with 931 million pounds of copper and 361 thousand ounces of gold sold. Operating cash flows reached $2.0 billion, bolstered by working capital and other sources.

On top of its solid fundamentals, FCX is committed to rewarding its shareholders with dividends. The company recently announced a quarterly cash dividend of $0.15 per share, split evenly between a base and a variable payout. With a current dividend yield of 1.16% and a solid track record of regular payments, FCX is an appealing choice for investors on the lookout for passive income.

Why FCX’s Demand is Set to Surge

The demand for copper, and consequently for Freeport-McMoRan as a leading copper producer, is poised to surge due to a combination of factors. Recent economic stimulus measures in China, the world's largest consumer of copper, are expected to boost demand significantly. China's 50 basis point cut to bank reserve requirements and lower mortgage rates are aimed at stimulating the property and construction sectors, which are major consumers of copper.

Additionally, the growing use of copper in AI data centers and renewable energy technologies is driving long-term demand. AI data centers require substantial amounts of copper, with each gigawatt of applied power needing around 65,000 tons of copper.

Given these factors, FCX is well-positioned to benefit from the surging demand for copper. The company expects to sell around 4.1 billion pounds of copper, 1.8 million ounces of gold, and 82 million pounds of molybdenum in 2024. This prediction is backed by key moves like ramping up the Manyar smelter in Indonesia and making their mining operations more efficient. FCX also forecasts operating cash flows of about $7.2 billion for the year, if commodity prices stay steady.

What Analysts Predict for FCX's Future

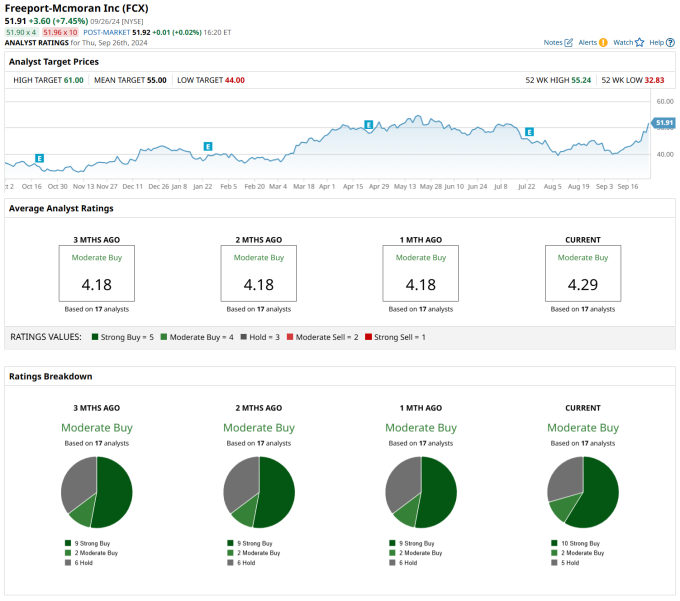

Analysts are optimistic on Freeport-McMoRan, with the consensus rating among the 17 in coverage standing at a "moderate buy." Ten say it's a “strong buy,” 2 call it a “moderate buy,” and 5 suggest a “hold.” Earlier this month, the stock landed an upgrade to “buy” at UBS.

On average, analysts have set a price target of $55.00 for FCX, indicating an expected 7.1% increase from current prices.

Conclusion

In conclusion, Freeport-McMoRan (FCX) emerges as a compelling investment opportunity in the copper market. With its strong financial performance, strategic initiatives, and favorable market conditions, FCX is well-positioned to capitalize on the growing demand for copper driven by the AI data center and clean energy sectors. The company's extensive reserves, geographical diversity, and integrated operations provide a solid foundation for long-term growth. Coupled with its attractive valuation and commitment to shareholder returns through dividends, FCX stands out as a copper stock that deserves serious consideration for investors seeking exposure to this essential metal.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.