Watch us on RFD-TV, today at 9:45am CT

USDA Report out at 11:00am CT

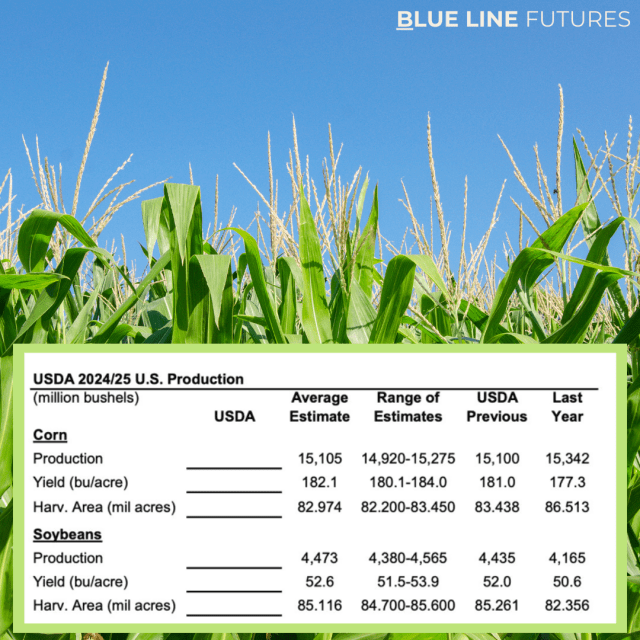

Below are the estimates for US Corn and Soybean production data

Corn

Technicals (December)

December corn futures were lower through the back half of last week’s trade which has spilled over into a softer start for this week’s trade. We do have a USDA report out at 11:00 am CT, this report has the potential to keep the bear trend intact or start turning the tide. We will be keeping a close eye on our pivot pocket from 399-403. A close above here in today’s trade could help prices recover ground lost last week. A failure to close out above that pocket keeps the Bears in clear control with the next downside objective we see coming in from 380-385.

Short Term Bias and Technical Levels of Importance

- Bias: Neutral/Bullish (cautiously optimistic)

- Resistance: 408-409, 412 3/4-413, 421 3/4-423 3/4*

- Pivot: 399-403

- Support: 380-385**

Average Estimates for August 12th USDA Report

- Production: 15.105 billion bushels

- Yield: 182.1 bushels per acre

- Harvested Acres: 82.974 million

- 23/24 Ending Stocks: 1.886 billion bushels

- 24/25 Ending Stocks: 2.106 billion bushels

Below: Daily Chart of December Corn Futures, depicting trendline resistance from the June highs as well as the 20-day moving average (in purple).

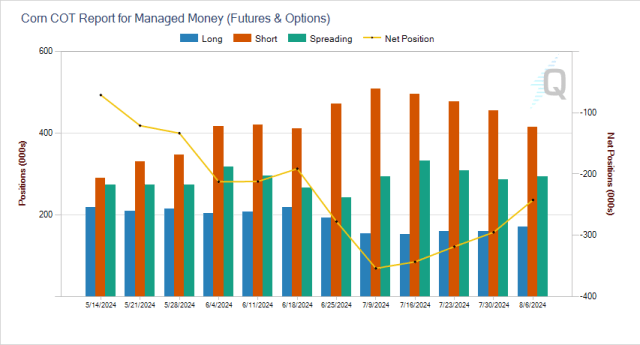

Commitment of Traders Update

Friday’s Commitment of Traders report showed Managed Money, aka Funds, were net buyers of 52,511 contracts through August 6th, 41,337 of that was short covering. This trimmed the Funds net short position to 242,545 futures and options contracts. This was the fourth consecutive week of short covering.

Want to keep reading?

Subscribe to our daily Grain Express for daily insights into Soybeans, Wheat, and Corn technicals, including our proprietary trading levels, and actionable market bias by claiming your free two-week trial!

https://bluelinefutures.com/2023-signup/?utm_source=Oliver-Sloup-

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Performance Disclaimer

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

On the date of publication, Oliver Sloup did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.