(ZSU24) (ZSX24) (SOYB) (ZCU24) (ZCZ24) (CORN) (ZWU24) (ZWZ24) (WEAT) (TAGS) (DBA)

“Playing the USDA Crop Report: What History says about Corn, Soybeans and Wheat”

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

- Monday Morning - August 12, 2024

The following report (below) is an excerpt of my Weather Wealth alert from Sunday evening, ahead of the Monday USDA crop production report. Not shown here are trading strategies and overall weather ideas. For a free trial to find out when and how we caught the big summer move down in corn and soybean prices (and what to expect next), click this link to receive complimentary access for 14 days: https://www.bestweatherinc.com/membership-sign-up/

Our newsletter is well worth the price, as many other firms were touting a hot and dry Midwest summer and trying to paint a “bull market” in grains, our subscribers were on the winning side. Will our bearish attitude of the last 2 months begin to change?

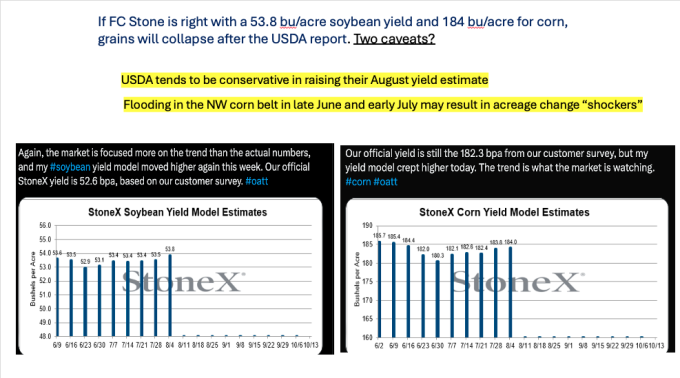

Whatever the USDA says with its yield estimate today (Monday - 12 noon EDT), the soybean yield will ultimately be at least 1 bushel-per-acre higher due to perfect August weather conditions. The question becomes a matter of yield adjustments (or not) for corn and soybeans from early summer Northwest corn belt flooding.

Thanks for your interest in commodity weather!

Jim Roemer, Scott Mathews, and The Weather Wealth Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He also is a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he established a unique standing among advisors in the commodity risk management industry.

Trading futures and options involves a significant risk of loss and is not suitable for everyone. Past performance is not necessarily indicative of future results.

On the date of publication, Jim Roemer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.