The dollar index (DXY00) Thursday rose by +0.42% on support from higher T-note yields. Gains in the dollar accelerated after the euro tumbled when ECB President Lagarde said risks to the economic outlook are tilted to the downside.

Thursday’s US economic news was mixed for the dollar. Weekly jobless claims rose more than expected, which is a dovish factor for Fed policy, while the July Philadelphia Fed business outlook survey rose more than expected, which is a hawkish factor for Fed policy.

US weekly initial unemployment claims rose +20,000 to 243,000, showing a weaker labor market than expectations of 229,000. Also, weekly continuing claims rose +20,000 to a 2-1/2 year high of 1.867 million, showing a weaker labor market than expectations of 1.856 million.

The US July Philadelphia Fed business outlook survey rose +12.6 to 13.9, stronger than expectations of 2.9.

US June leading indicators fell -0.2% m/m, better than expectations of -0.3% m/m.

Dovish comments from Chicago Fed President Goolsbee were bearish for the dollar when he said the Fed may need to cut interest rates soon to avoid a sharp deterioration in the labor market, which has cooled in recent months.

The markets are discounting the chances for a -25 bp rate cut at 5% for the July 30-31 FOMC meeting and 97% for the following meeting on Sep 17-18.

EUR/USD (^EURUSD) Thursday fell by -0.39%. On Thursday, the euro posted moderate losses and came under pressure after ECB President Lagarde said, "The risks to economic growth are tilted to the downside.” Losses in the euro were contained after the ECB kept its main refinancing rate unchanged at 4.25% and said borrowing costs will remain "sufficiently restrictive for as long as necessary" to ensure inflation returns to 2%.

Eurozone June new car registrations rose +4.3% y/y to 1.090 million units.

Eurozone May construction output fell -0.9% m/m, the third straight monthly decline and the biggest drop in 14 months.

The ECB, as expected, kept its main refinancing rate unchanged at 4.25% and said borrowing costs will remain "sufficiently restrictive for as long as necessary" to ensure inflation returns to 2%. The ECB also said it is "not pre-committing" to a particular rate path and that incoming data will determine the level and duration of policy restriction.

ECB President Lagarde said, "The risks to economic growth are tilted to the downside, and a weaker world economy or an escalation in trade tensions between major economies would weigh on Eurozone growth." She added that "the question of September and what the ECB will do in September is wide open and will be determined on the basis of all the data that we will be receiving."

Swaps are discounting the chances of a -25 bp rate cut by the ECB at 85% for the September 12 meeting.

USD/JPY (^USDJPY) Thursday rose by +0.76%. The yen on Thursday fell back from a 5-week high against the dollar and posted moderate losses after rising T-note yields pressured the yen. Also, weaker-than-expected Japanese trade news for June weighed on the yen. The yen Thursday initially moved higher on comments from a former BOJ executive who said the BOJ will cut its bond buying at its July 31 policy meeting.

Japanese trade data was weaker than expected as June exports rose +5.4% y/y, below expectations of +7.2% y/y, and June imports rose +3.2% y/y, below expectations of +9.6% y/y.

Hideo Hayakawa, a former executive at the BOJ, said the BOJ is unlikely to raise interest rates at the July 31 policy meeting and will instead cut its bond buying a little more than expected to avoid any fueling of yen weakness.

Swaps are pricing in the chances for a +10 bp rate increase by the BOJ at 46% for the July 31 meeting and 51% for the September 20 meeting.

August gold (GCQ24) Thursday closed down -3.50 (-0.14%), and September silver (SIU24) closed down --0.153 (-0.50%). Precious metals prices Thursday gave up an early advance and settled moderately lower. A stronger dollar Thursday weighed on metals prices. Also, higher T-note yields on Thursday were negative for precious metals. A bearish factor for silver prices is some negative carryover from Thursday’s -3% plunge in copper prices to a 3-1/4 month low.

Precious metals Thursday initially moved higher on dovish central bank comments. ECB President Lagarde said, "The risks to economic growth are tilted to the downside.” Also, Chicago Fed President Goolsbee said the Fed may need to cut interest rates soon to avoid a sharp deterioration in the labor market. Signs of weakness in the US labor market are dovish for Fed policy and bullish for precious metals after Thursday’s news showed weekly continuing claims rose more than expected to a 2-1/2 year high. In addition, fund buying of gold supports prices after long gold holdings in ETFs rose to a 3-1/4 month high on Wednesday.

More Precious Metal News from

- Dollar Firms on Higher T-Note Yields and Euro Weakness

- Dollar Tumbles on Yen Strength and Dovish Beige Book

- Broader Market Slides as Chip Stocks Plunge

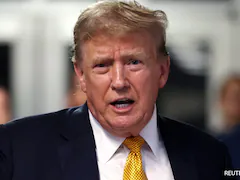

- Comments From US Presidential Candidate Trump Undercut the Dollar

On the date of publication, Rich Asplund did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.