Euro rose in European trade on Thursday against a basket of main rivals, as it maintained gains for the second day against the dollar, moving in a positive zone as focus pivots from EU political risks to the Europe-US interest rate gap.

Markets now expect one more interest rate cut by the Federal Reserve before the year end, while the Federal Reserve is expected to cut interest rates two, in September and November.

The Price

EUR/USD rose 0.1% to $1.0816, with a session-low at $1.0800.

The pair rose 0.65% on Wednesday, the first profit in four-days, marking the largest profit since December 2023.

The euro rebounded from six-week lows at $1.0719, as US inflation continues to slow down.

European Rates

The ECB cut interest rates earlier this month but offered little hints about policy easing in the future, and pointed to persistently high inflation.

Media reports indicated that the ECB policy makers ruled out another rate cut in July.

Markets are now betting on a single ECB rate cut before the year end.

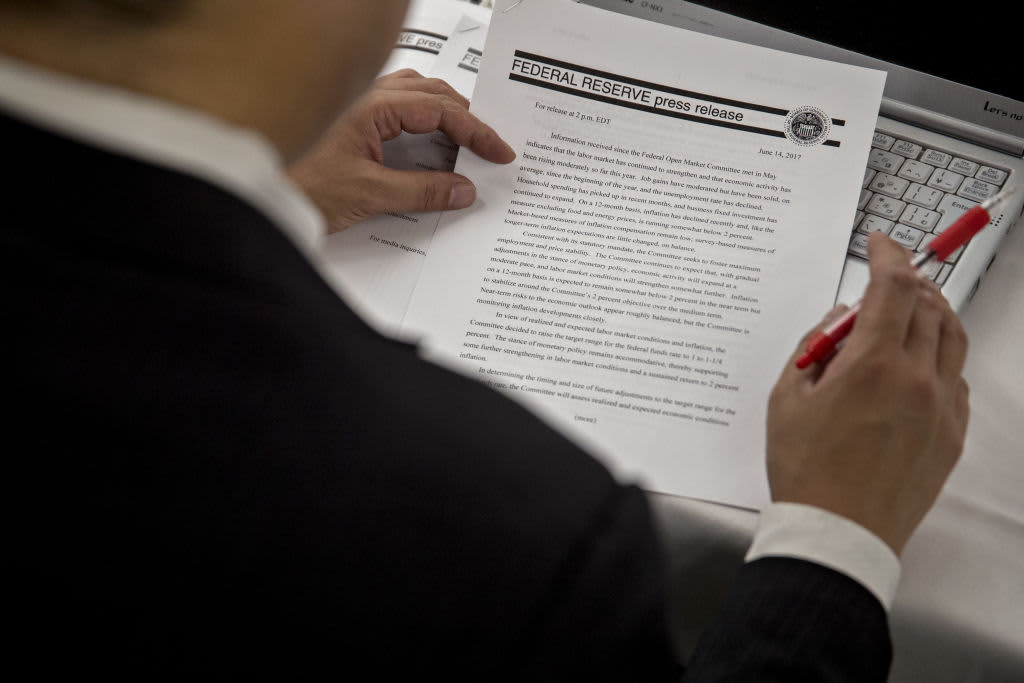

US Rates

As US inflation continues to slow down, the markets are now expecting two Federal Reserve interest rate cuts in September and November.

Rate Gap

The Europe-US interest rate gap stands at 125 basis points in favor of the US, and will likely hold steady throughout the year.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.