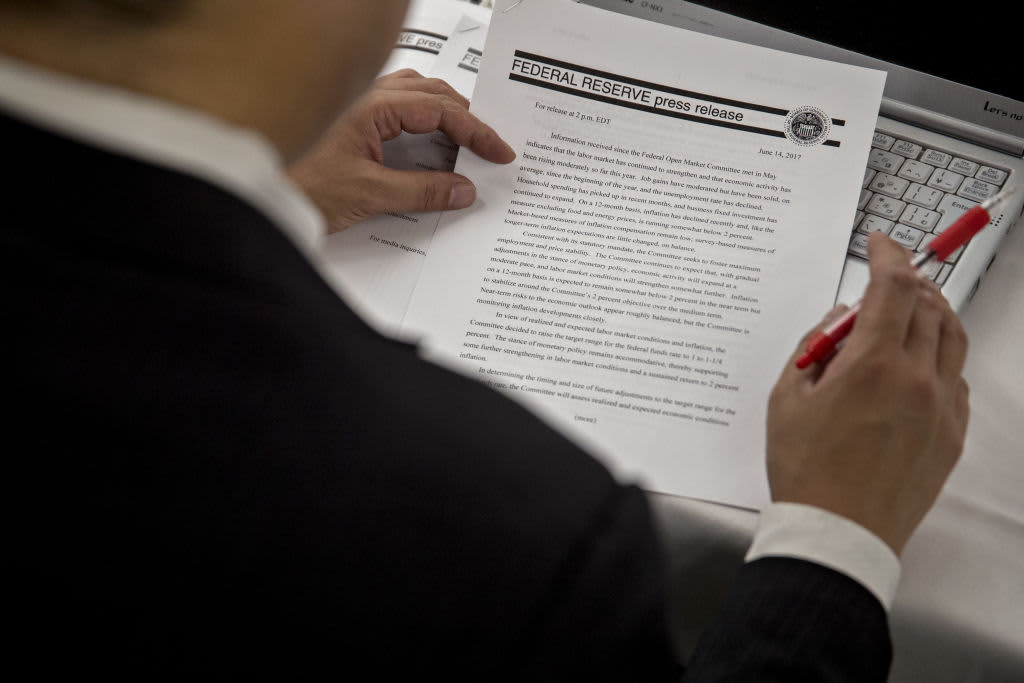

The Federal Reserve announced a decision to maintain interest rates unchanged between 5.25% and 5.5% at the June 11-12 meeting, maintaining them at 23-year highs.

The Fed’s policy statement explains that the Federal Open Market Committee considers the risks facing achieving better employment and inflation goals are moving towards a better balance, but the economic outlook remains uncertain.

More crucially, the Fed expects a single interest rate cut this year instead of three cuts mentioned at the March meeting statement.

The statement included the phrase: “The Committee remains very vigilant to inflation risks”, which shows continued concerns about the path of inflation.

It’s worth noting that mainline US inflation has slowed down to 3.3% in May from a peak of 9.9% in 2022.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.