Kellanova (K), headquartered in Chicago, Illinois, provides snacking, cereal, and noodles, as well as frozen foods. Valued at $20.34 billion by market cap, the company’s brands include Pringles, Cheez-It, Pop-Tarts, Kellogg’s Rice Krispies Treats, RXBAR, Eggo, MorningStar Farms, Special K, and Coco Pops.

Shares of this leader in global snacking have underperformed the broader market over the past year. K has declined 11.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 25.2%. But in 2024, the gap narrowed, with K stock rising 6.6%, while the SPX is up 10.4% on a YTD basis.

Narrowing the focus, K’s underperformance looks less pronounced compared to the iShares Emergent Food and Agtech Multisector ETF (IVEG). The exchange-traded fund has gained about 1.2% over this period. However, the stock’s gains on a YTD basis outshine the ETF’s marginal returns over the same time frame.

On May 2, K shares closed up more than 7% after the company reported its Q1 results. The company’s organic net sales rose 5.4%. Its non-GAAP EPS stood at $1.01, beating a $0.85 estimate, and its revenue of $3.20 billion beat the analyst estimates of $3.16 billion. K also reaffirmed its full-year guidance.

For the current fiscal year, ending in December, analysts expect K’s EPS to grow 12.1% to $3.62 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

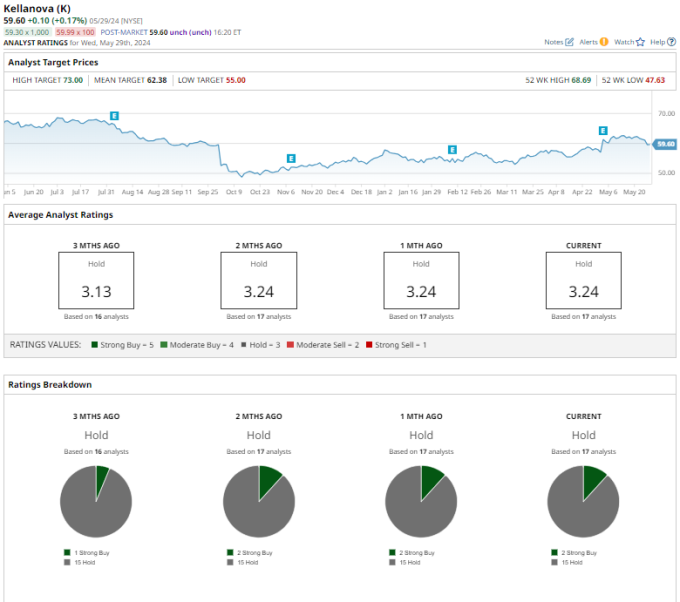

Among the 17 analysts covering K stock, the consensus rating is a “Hold.” That’s based on two “Strong Buy” ratings and 15 “Holds.”

This configuration is slightly more bullish than three months ago, with one suggesting a “Strong Buy.”

Recently, D.A. Davidson analyst Brian Holland maintained a “Buy” rating on K stock and raised the price target from $67 to $72, implying a potential upside of 20.8% from current levels.

The mean price target of $62.38 represents a 4.7% premium to K’s current price levels. The Street-high price target of $73 suggests an upside potential of 22.5%.

More Food & Beverage News from

- What Are Wall Street Analysts' Target Price for Tyson Foods Stock?

- Up 12% in May, Is This Wheat ETF Overbought?

- Wheat Pulled Lower To Start Thursday Trade

- Corn Hovering Near Unchanged

On the date of publication, Dipanjan Banchur did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.