Duke Energy Corporation (DUK), headquartered in Charlotte, North Carolina, is one of the largest energy holding companies in the U.S. The company’s electric utilities serve 8.4 million customers in North Carolina, South Carolina, Florida, Indiana, Ohio, and Kentucky. Valued at $78.09 billion by market cap, the company collectively owns approximately 54,800 megawatts of energy capacity. Its natural gas utilities serve 1.7 million customers in North Carolina, South Carolina, Tennessee, Ohio, and Kentucky. DUK is also investing in electric grid upgrades and cleaner generation.

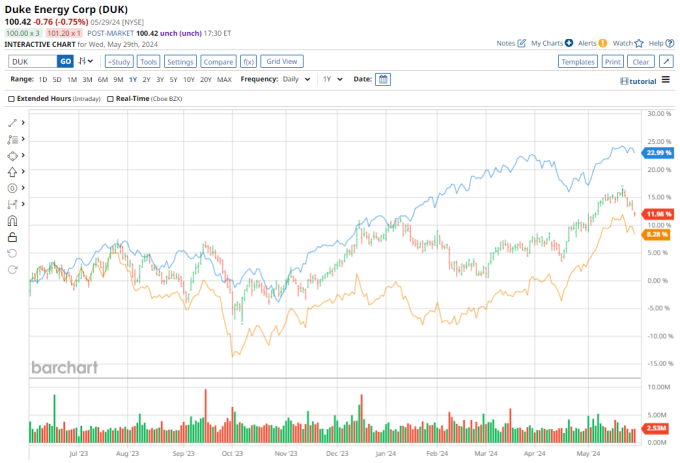

Shares of this leading energy company have underperformed the broader market considerably over the past year. DUK has gained 13.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 25.2%. But in 2024, the gap narrowed, with DUK stock rising 3.5%, while the SPX is up 10.4% on a YTD basis.

Narrowing the focus, DUK has outperformed the S&P 500 Utilities Sector SPDR (XLU). The exchange-traded fund has gained about 9.2% over the past year. However, the ETF’s 11.3% gains on a YTD basis compare to the stock’s marginal gains over the same time frame.

On May 7, DUK reported its Q1 results with a net income of $1.14 billion and an EPS of $1.44, beating Wall Street’s estimates of $1.39. The company’s revenue of $7.67 billion fell short of analyst expectations of $7.71 billion. DUK expects full-year earnings between $5.85 and $6.10. The stock gained 1.8% on the earnings release day.

For the current fiscal year, ending in December, analysts expect DUK’s EPS to grow 7.4% to $5.97 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

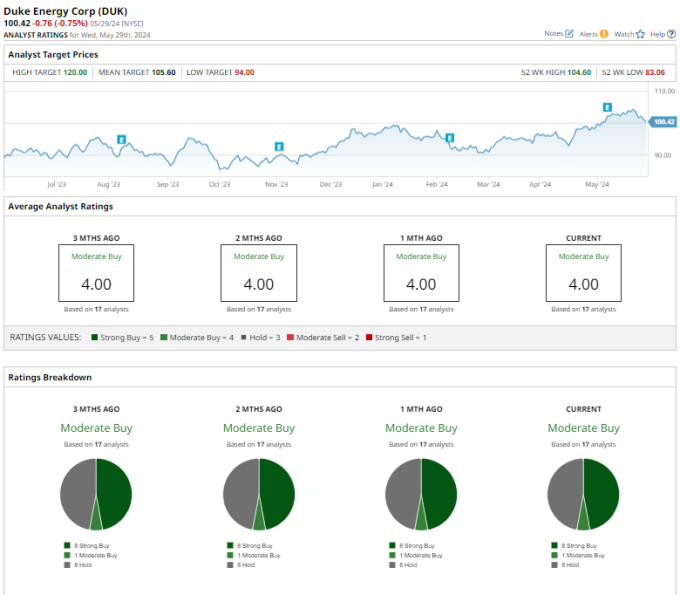

Among the 17 analysts covering DUK stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, one “Moderate Buy,” and eight “Holds.”

This configuration has been consistent over the past three months.

Recently, BMO Capital Markets reaffirmed its “Outperform” rating on DUK stock and raised the price target from $108 to $110, implying a potential upside of 9.5% from current levels.

The mean price target of $105.60 represents a 5.2% premium to DUK’s current price levels. The Street-high price target of $120 suggests an upside potential of 19.5%.

More Stock Market News from

- Fidelity National Information Stock: Is Wall Street Bullish or Bearish?

- Should You Follow Big Money Into Virgin Galactic Stock?

- Up 12% in May, Is This Wheat ETF Overbought?

- Halliburton Stock: Is Wall Street Bullish or Bearish?

On the date of publication, Dipanjan Banchur did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.