EOG Resources, Inc. (EOG), headquartered in Houston, Texas, is one of the largest and most efficient independent oil and natural gas companies in the United States. Renowned for its expertise in horizontal drilling and hydraulic fracturing, it explores, develops, produces, and markets crude oil, natural gas liquids (NGLs), and natural gas. Valued at $74.68 billion by market cap, the company operates primarily in key U.S. basins, as well as in the Republic of Trinidad and Tobago and other international locations.

EOG Resources has underperformed the broader market over the last year. The stock has gained 17.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 27.5%. But in 2024, the gap narrowed, with EOG stock rising 7.4%, while the SPX is up 11.2% on a YTD basis.

Narrowing the focus, EOG’s gains over the past 52 weeks are easily overshadowed by the iShares U.S. Oil & Gas Exploration & Production ETF (IEO). The exchange-traded fund has gained about 28.6% over this period. Moreover, the ETF’s 12.1% gains on a YTD basis outweigh the stock’s returns over the same time frame.

On May 2, EOG Resources reported its Q1 earnings, beating Wall Street estimates for both EPS and revenue. The stock gained 1.4% on the day it released earnings but has experienced a downtrend since then.

For the current fiscal year, ending in December 2024, analysts expect EOG’s EPS to grow 4.3% to $12.19 on a diluted basis. The company's earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

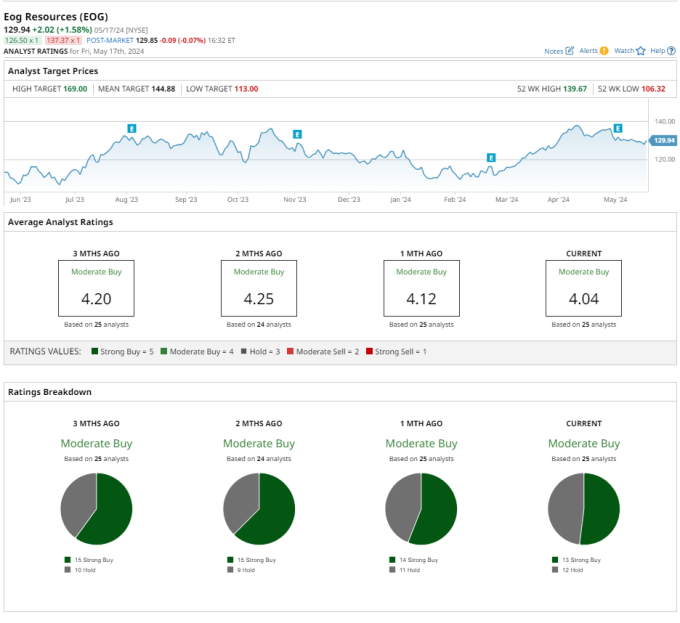

Among the 25 analysts covering EOG stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings and 12 “Holds.”

This configuration is slightly less bullish than three months ago, with 15 suggesting a “Strong Buy.”

On May 16, Analyst Neal Dingmann from Truist Financial downgraded the stock's rating to a “Hold” and gave it a $136.00 price target. However, Mark Lear from Piper Sandler maintained a “Buy” rating on EOG Resources, with a price target of $154.00.

The mean price target of $144.88 represents an 11.5% premium to EOG’s current price levels. The Street-high price target of $169 suggests an upside potential of 30.1%.

More Stock Market News from

- Nvidia Stock Forecast: Can NVDA Rise Above $1,000 After Earnings?

- Up 25% from April Lows, Is The Worst Over for Tesla Stock?

- Down 20% from Highs, Should You Buy the Dip in Palantir Stock?

- This 'Mag 7' Stock Could Rise Another 21%, Says Bank of America

On the date of publication, Rashmi Kumari did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.