#5 | A lesson in spreads

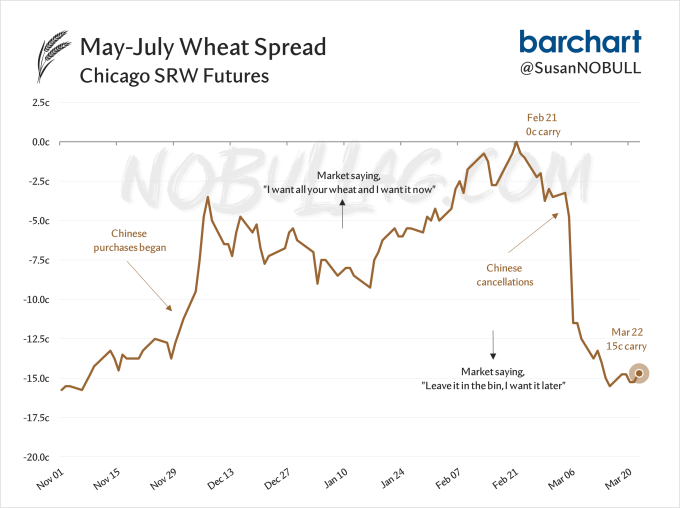

Although futures remain within spitting distance of contract lows, Chicago wheat has been on quite the ride the past few months thanks to none other than China.

After May soft red wheat futures spent the latter part of November into December and January rallying relative to July futures on China’s huge old crop purchases, the spread has given up its gains, settling back into a 15-cent carry on big cancellations.

Although the May-Jul SRW spread never crossed the line into an inverse, here’s a friendly reminder about why the structure of the market can be more important/telling than futures prices themselves:

The inverse (or narrowing of the spread, in this case) is the market’s way of saying, “I want your bushels and I want them now.”

A carry is saying the exact opposite - “I don’t want your bushels now, I want them later.”

Hence July futures trading at a 15c premium to May futures. That’s the market’s way of telling you it would rather have them a few months down the road.

Additionally, cash markets can reflect even larger inverses at times river and rail terminals or processors need bushels ASAP.

When there is a premium for nearby shipment - take note. Those are generally opportunities that need to be taken advantage of.

#4 | 4 of 6

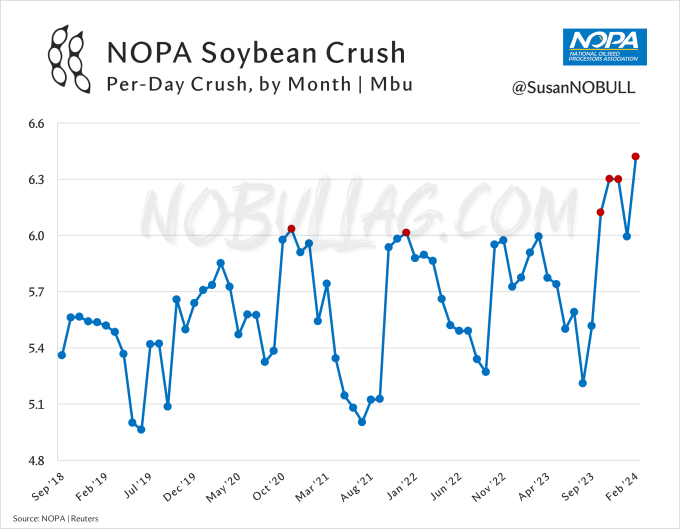

Even though February 2024 was two days shorter than January, NOPA members crushed a record 186.2 million bushels of soybeans - the sixth consecutive monthly crush record in a row while also hitting a new all-time high daily crush rate of 6.42 million bushels.

There have only been six months in history NOPA crush has been larger than six million bushels per day - four of which have happened in the current market year (red dots below).

The recent additions of new crush capacity is the obvious driver, but February’s record-breaker came as US crushers were pushing hard, playing catch-up from January’s weather-related slowdown.

Plus, with South American new crop crush about to be in full swing, the pressure is on to crush hard while you can still get rid of the excess meal.

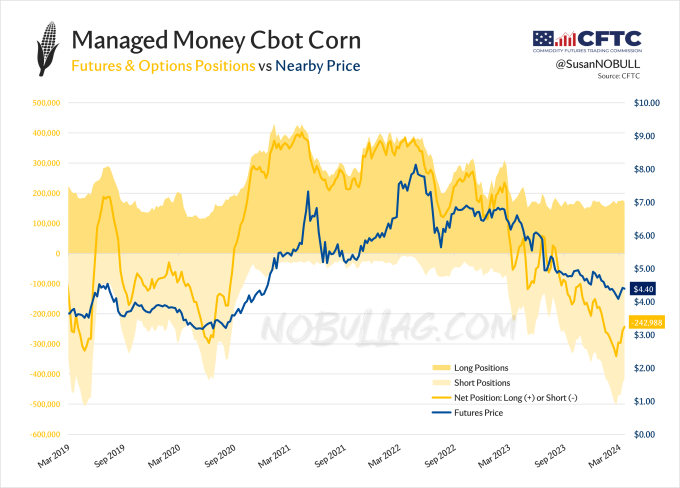

#3 | Funds Fun

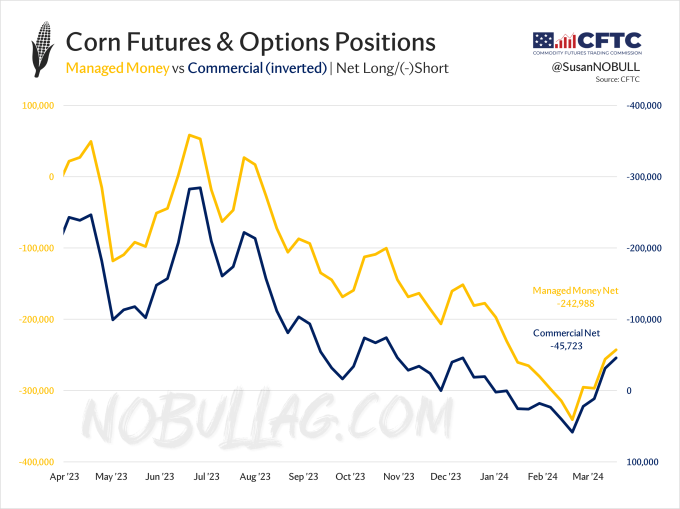

Managed money’s net corn short now sits nearly 100,000 contracts (500 million bushels) off their record short just one month ago but price action has been fairly muted as we have seen an uptick in producer selling during that time.

Weekly reductions in managed money’s net short have been moving in lockstep with weekly increases in the commercial net short.

Elevators (commercials) buy bushels from producers, sell futures to offset their long cash position - adding to their net short.

The farmer has essentially been selling directly to the fund since hitting a breaking point as the market made new lows amid a record fund short.

The producer capitulated, turning into a seller a few weeks ago and funds began to cover (or vice versa). The rest is history.

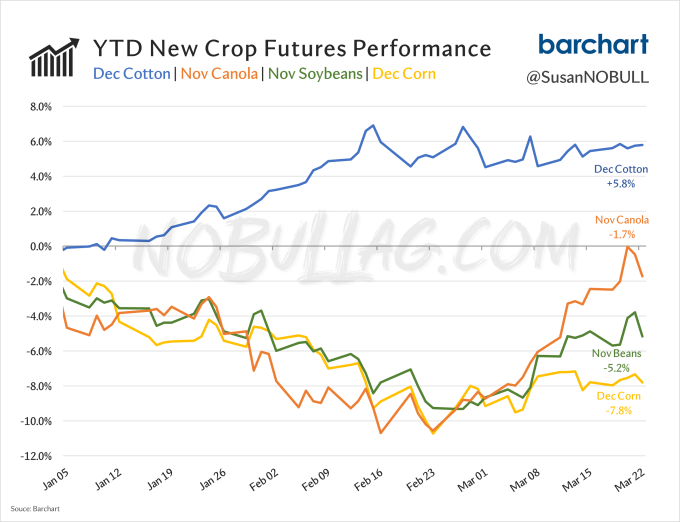

#2 | The race is on

Tis the season for a good old fashioned acreage battle.

Cotton continues to maintain a strong performance year-to-date, compared with new crop corn and soybeans. Canola is interesting too as it sits more than 10% off of its late-February lows and only down 1.7% year-to-date (chart as of closes, 03/22/2024).

Remember that USDA did its surveying for Thursday’s acreage report during the last days of February and into the first two weeks of March.

If the price action of the past couple weeks was to have an impact on acres - it wouldn’t show up until the June survey.

#1 | One big report

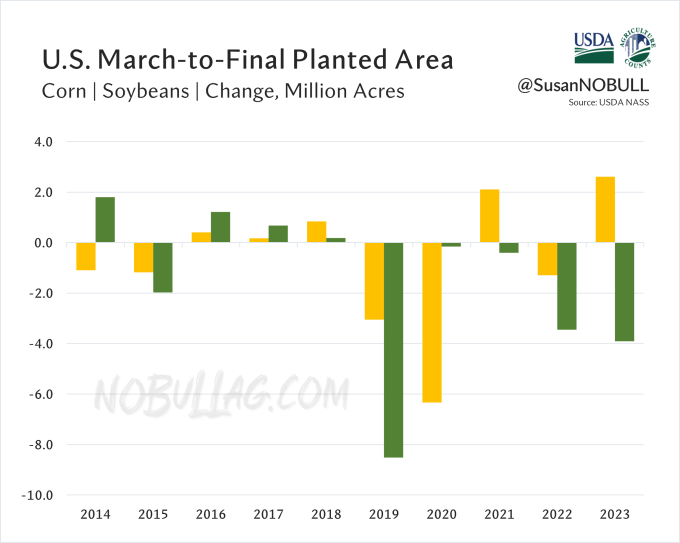

Below is a reminder that March’s Prospective Plantings acres (to be released on Thursday) are a far cry from final acres, in general.

March acres are what sets the tone for trade until the next acreage update in June, though, and sets the foundation for USDA's initial new crop balance sheet released in May.

2019 - record-late planting & high prevent plant due to wet spring

2020 - Initial corn estimate was 97m in March followed by the $3 days of covid & a record 5 mil ac decline by June

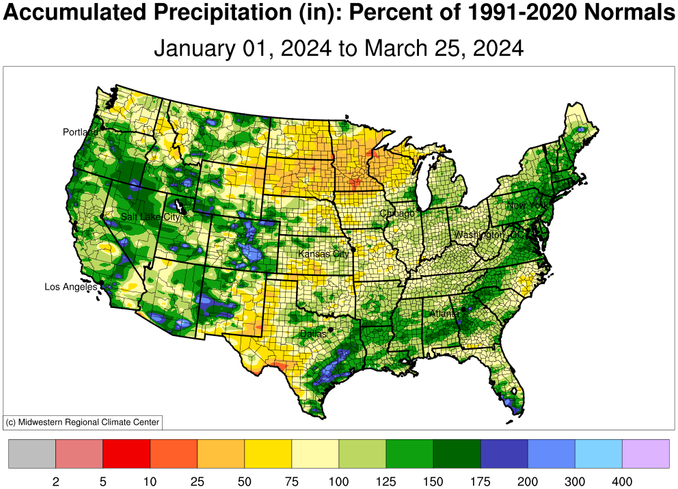

Perhaps more intriguing is the notable lack of precipitation in the Northern Plains and Upper Midwest thus far in 2024. While many want to look at this and scream DROUGHT, I look at it and see the potential for a lot of acres in the Dakotas.

For the full version of this post or to subscribe, visit NoBullAg.Substack.com.

Thanks!

On the date of publication, Susan Stroud did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.