3/15/24

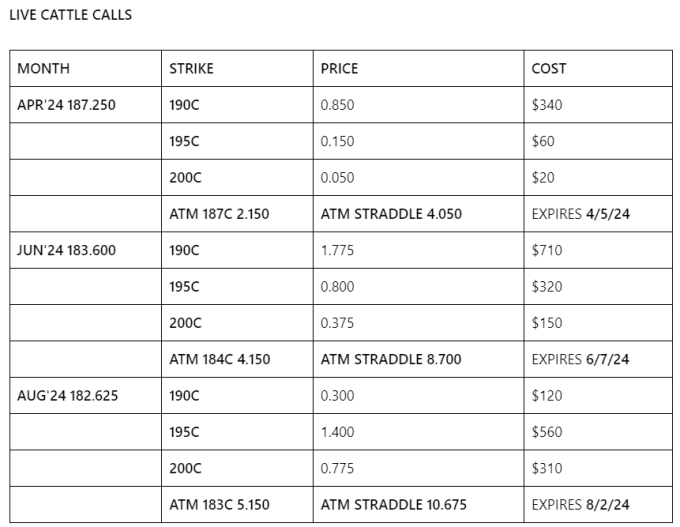

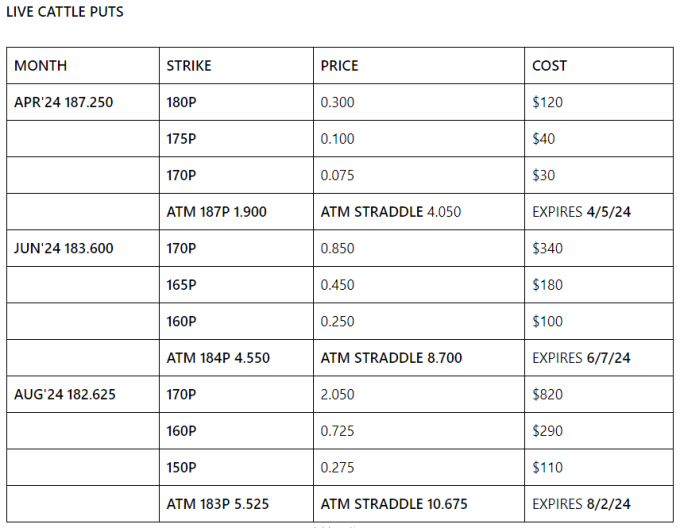

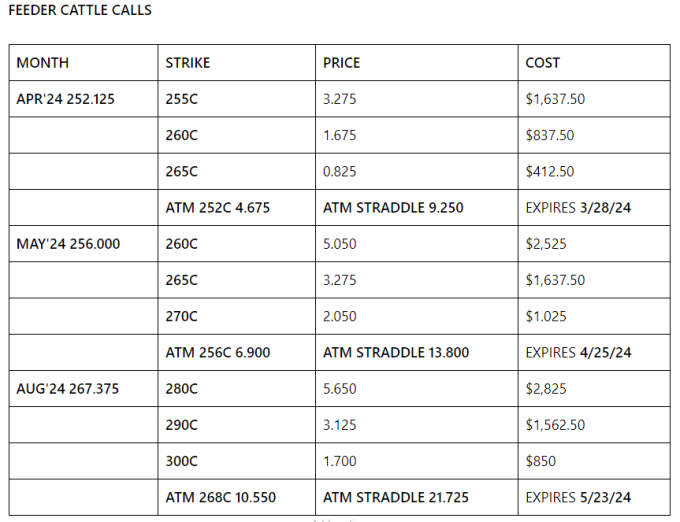

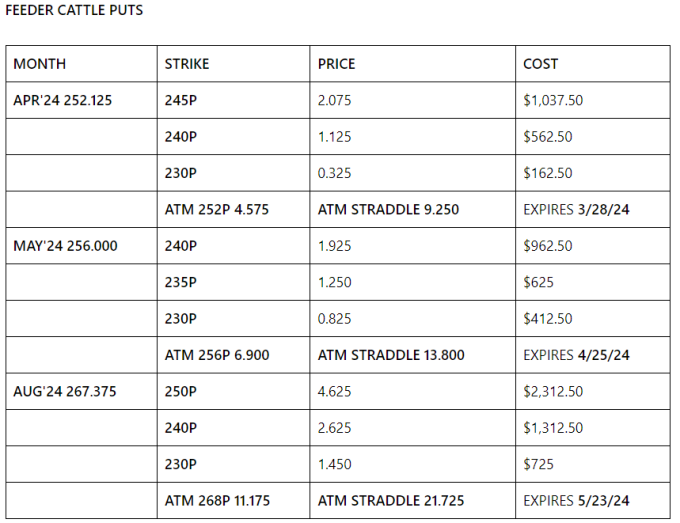

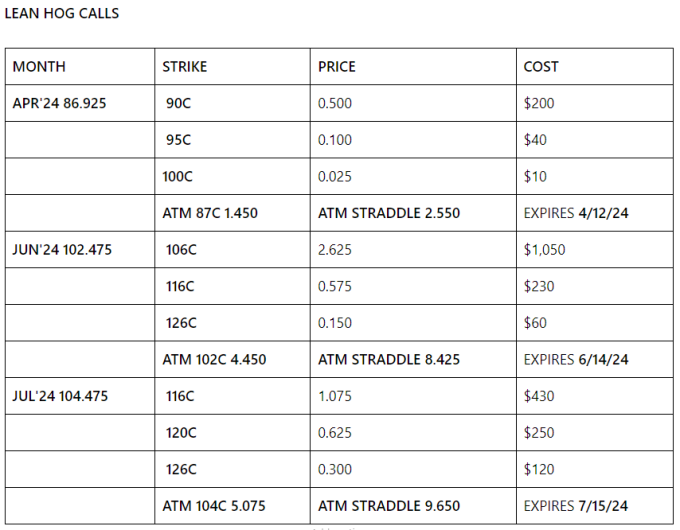

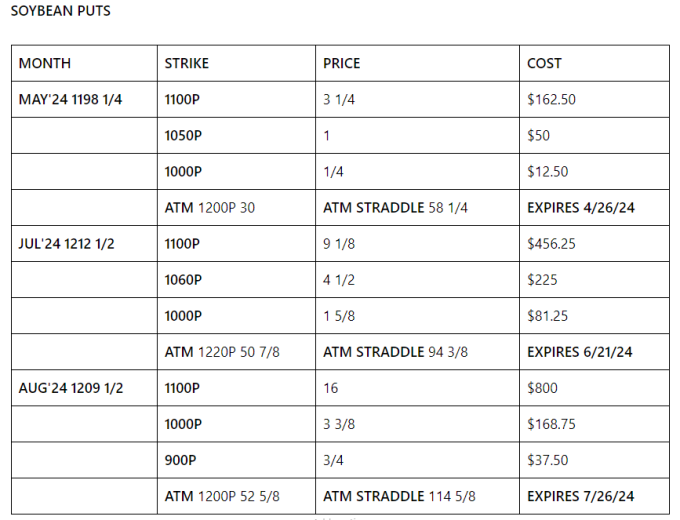

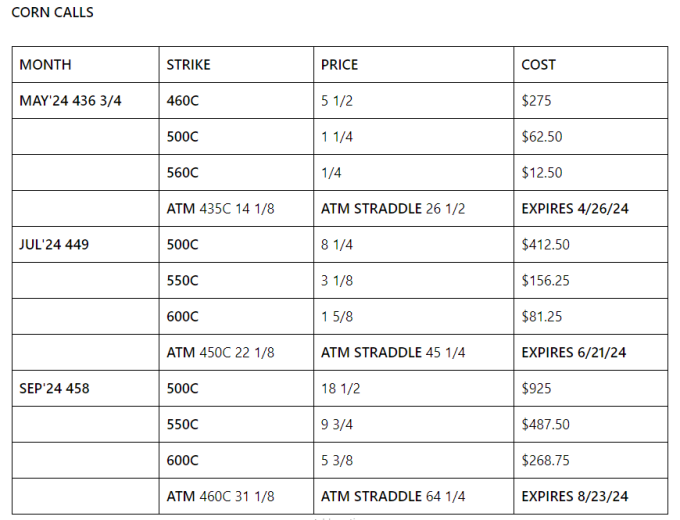

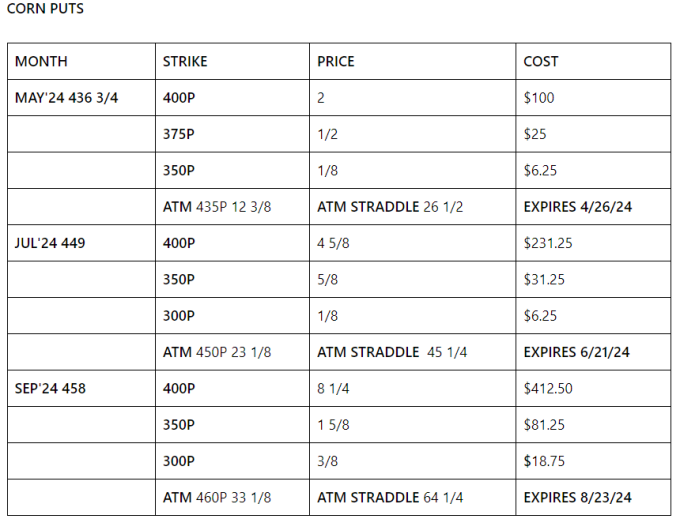

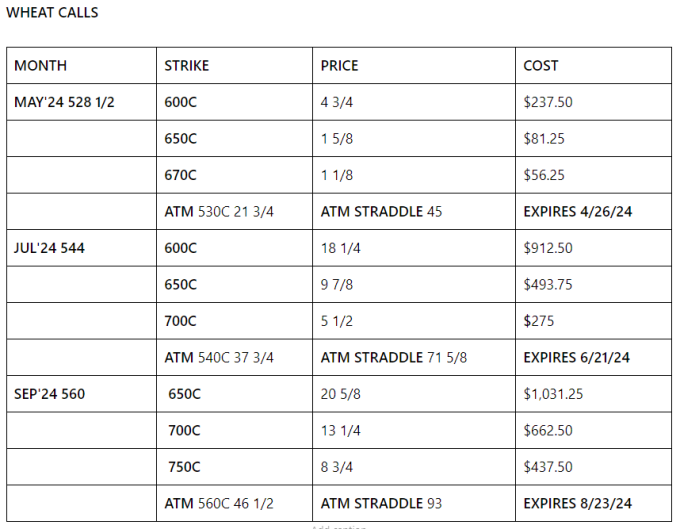

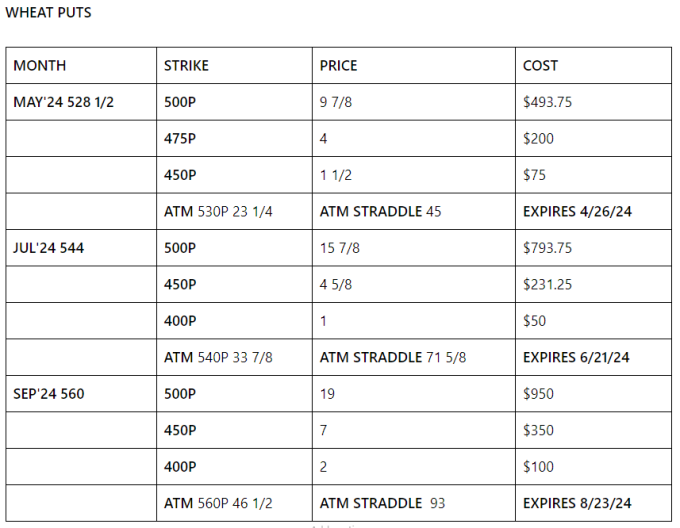

The Livestock Markets were all higher today, and the Grains were mixed. April'24 Live Cattle were 30 cents higher today and settled at 187.25, in the middle of today's range. Today's high was 188.425 and the 1-month high is 190.275. Today's low was 186.650 and the 1-month low is 184.475. Since 2/15 April'24 Live Cattle are 1.625 higher or almost 1%. The Feeders gained as well today. April'24 Feeder Cattle were 95 cents higher today and settled at 252.125. Today's high was 258.875 and the 1-month high is 260.800. Today's low was 251.250 and the 1-month low is 250.275. Since 2/15 April'24 Feeder Cattle are 1.975 higher or about ¾%. The Hogs kept climbing today. April'24 Lean Hogs were 1.90 higher today and settled at 86.925, not far below today's high of 87.525. The 1-month high is 88.900. Today's low was 84.950 and the 1-month low is 83.150. Since 2/15 April'24 Lean Hogs are 2.025 higher or almost 2 ½%. The Grains were mixed today, with the Wheat in the red again. May'24 Soybeans were 3 cents higher today and settled at 1198 ¼, not far below today's high of 12.00. the 1-month high is 1217 ½. Today's low was 1183 ½ and the 1-month low is 1128 ½. Since 2/15 May'24 Soybeans are 32 ¼ cents higher or almost 3%. The Corn made a few cents today. May'24 Corn was 3 cents higher today and settled at 436 ¾. Today's high was 440 and the 1-month high is 445. Today's low was 431 ¾ and the 1-month low and 52-week low is 408 ¾. Since 2/15 May'24 Corn is 7 cents higher or over 1 ½%. The Wheat Market continued lower today. May'24 Wheat was 3 ¾ lower today and settled at 528 ½. Today's high was 537 ½ and the 1-month high is 594 ¼. Today's low was 526 ¾ and the 1-month and 52-week low is 523 ½. Since 2/15 May'24 Wheat is 38 ¾ cents lower or almost 7%. The Cattle Markets floated between positive and negative for part of the morning and then headed higher but gave a lot back before the close. I still feel that the Cattle Markets will turnover soon, and head south. The Cattle looked heavy today, and with bad export numbers, and rising inflation, they look expensive too. I don't believe the demand will last much longer. The Soybeans opened lower today and were in the red most of the day but were able to post a three-cent gain. I still feel that in the short term the Bean Market can rise, and if gets around the 12.50 level, I feel that's a good spot to sell it again. Long-term I am still Bearish the Soybean Market and think it will head toward the $10.00 level by harvest. Have a good weekend and protect your downside exposure in these markets.

-Bill

312-957-8079

I have Option Strike prices every Friday.

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

at WWW.WALSHTRADING.COM

Call for specific trade recommendations.

1-312-957-8079

1.800.993.5449

Email me for free research.

BAllen@walshtrading.com

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

ballen@walshtrading.com

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

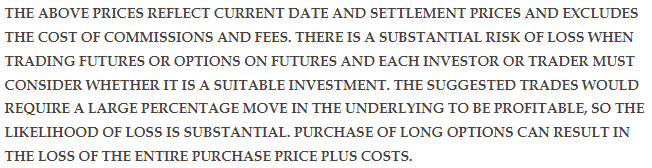

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

On the date of publication, Bill Allen did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.