Plug Power (PLUG), a key player in the hydrogen fuel cell technology sector stands at a pivotal juncture. In 2023, Plug Power's stock price dropped significantly, with investors worried about its ability to stay in business after a going concern warning in November. That news accompanied a report showing PLUG's bigger-than-expected losses for the third quarter, along with lower-than-expected sales, driven by higher hydrogen prices and supply chain challenges.

Overall, PLUG stock has now lost 70% of its value over the past 52 weeks, and carries a market cap of $2.62 billion. Priced below $5 per share, PLUG is trading down more than 95% from its 2004 highs.

Despite the uncertainty surrounding PLUG - and the broader clean energy space - some of the biggest bulls on Wall Street think the shares can double or more from here. Ahead of Plug Power's next quarterly earnings report in early March, here's a closer look.

Plug Power's Tough Earnings Track Record

Plug Power's most recent quarterly results came in light on both earnings and revenue, continuing a pattern of missing Wall Street's profit predictions. The alternative energy company has fallen short of bottom-line estimates in each of the past four quarters.

For the Q4 report, due out on March 6, the consensus is calling for a loss of $0.51 per share - wider than PLUG's reported loss of $0.38 per share in the year-ago quarter.

Analysts don't anticipated PLUG being profitable on a full-year basis until fiscal 2027, though losses are projected to narrow each year until then.

Deep Dive on PLUG's Q3 Results

The company's shares took a significant hit following the announcement of a third-quarter loss that surpassed analysts' expectations, along with revenues that failed to meet projections. The energy firm attributed its disappointing performance to "unprecedented supply challenges in the hydrogen network in North America."

In the third quarter, Plug Power reported a loss of $283.5 million, or 47 cents per share, a significant increase from the $170.8 million loss, or 30 cents per share, in the same period last year. The company's gross margin deteriorated dramatically to negative 69%, compared to negative 24% in the year-ago quarter.

Sales breakdown by segment revealed an 8.1% decrease in revenue from fuel cell systems, related infrastructure, and equipment to $145.1 million. However, revenues from power purchase agreements more than doubled, reaching $20.1 million from $9.52 million in the previous year. Additionally, the revenue from fuel delivered to customers and related equipment surged by 56% to $19.4 million.

Further, the company pointed out the significant impact of hydrogen facilities operating below capacity. "Unprecedented" was the word used to describe the number of hydrogen facilities running below nameplate capacity, leading to "significant hydrogen shortages impacting deployment schedules, fuel prices, shipping efficiencies, service on hydrogen infrastructures, and timing of varied reliability rollout programs."

As a result, Plug Power included “going concern” language in its quarterly report, which CEO Andy Marsh downplayed as an “accounting technicality,” citing PLUG's lack of short-term debt and easy path to raising capital.

Why Is Plug Stock Higher in 2024?

Given this backdrop, the stock received a shot in the arm in early February on reports that Plug Power was working to secure more than $1 billion in government funding, having sent in the application for final review on a $1.6 billion loan line facility from the U.S. Department of Energy (DoE). News of the potential Department of Energy (DoE) loan was much better received by investors than the company's mid-January fundraising effort, when it announced plans to sell up to $1 billion in stock.

Separately, PLUG said a Georgia plant has started to produce liquid green hydrogen, addressing some of its operational snags. The Georgia plant, recognized as the largest of its kind in the U.S. market, has a production capacity of 15 tons of liquid electrolytic hydrogen per day.

In an investment call, Marsh talked about how important the possible funding was. He said it would make it easier to build and own up to six hydrogen production sites, which would speed up the use of green hydrogen in the U.S. He also said that the Georgia plant's current status and the upcoming Tennessee plant's status as key factors in lowering production costs.

Marsh also noted that the Georgia plant's building was a little behind schedule, but stressed that it would play a key role in improving the company's supply of liquid hydrogen to users in many fields, such as material handling, fuel cell electric cars, and fixed power.

What Do Analysts Expect for PLUG Stock?

Craig Irwin of Roth MKM upgraded PLUG to “Buy” from “Neutral” in late January, and hiked his price target to $9 - implying expectations for the stock to rally about 97% from Monday's closing price.

In a note to clients, Irwin said a trip to Plug Power's Georgia plant “gives us confidence the facility is ramping smoothly and all major technical issues are handled, addressing our prior concerns about backlog and margin visibility.” While he thinks a DoE loan approval could be a catalyst higher, Irwin also observed that "Plug has several [financing] options available including strategic investment, sale leasebacks, and a variety of common debt and equity instruments.”

H.C. Wainwright also weighed in bullishly on PLUG in early February, maintaining a “Buy” rating and setting a Street-high target of $18.00. That's a hefty 293% premium to Monday's close.

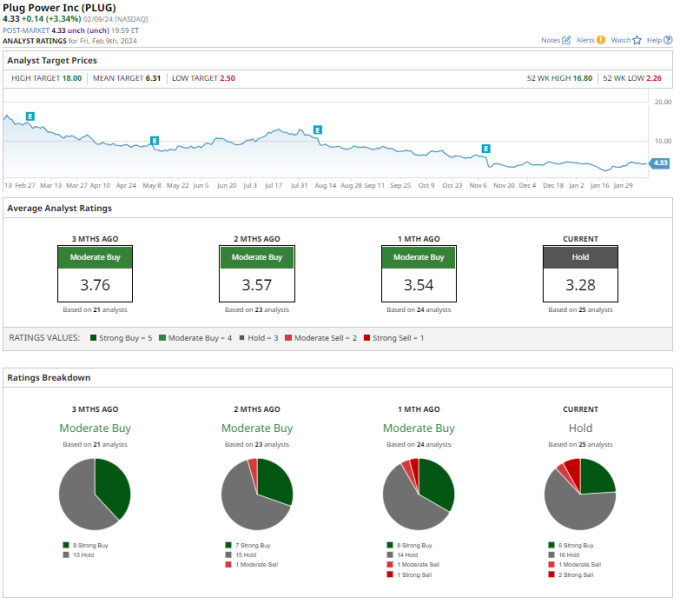

On average, Wall Street has grown a bit more cautious on PLUG recently, with the average rating declining from “Moderate Buy” to “Hold” over the last month. Out of 25 analysts in coverage, six say it's a “Strong Buy,” 16 suggest “Hold,” 1 recommends “Moderate Sell,” and 2 call it a “Strong Sell.”

The mean price target is $6.31, about 38% higher than current levels.

What's the Bottom Line on PLUG Stock?

Despite a significant sell-off from its highs, Plug Power may yet be able to avoid a worst-case scenario when it comes to its “going concern” woes. However, the upcoming quarterly report should be a crucial one, as analysts and investors alike carefully scrutinize the key metrics and management commentary to determine whether PLUG is finally in the process of clearing the financing and supply-chain issues that plagued the stock throughout 2023.

On the date of publication, Faizan Farooque did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.