While some analysts are predicting that 2024 will be a comeback year for small-cap stocks, as proxied by the Russell 2000 Index (RUT), not all of these names are off to a running start in the new year. Russell 2000 stocks like iRobot (IRBT) and Spirit Airlines (SAVE) have collapsed in 2024 as investors respond to news of unfavorable antitrust rulings and dashed mergers, while Cano Health (CANOQ) lost its place in the small-cap benchmark entirely after filing for bankruptcy and being delisted from the NYSE.

However, these extreme examples aren't the only Russell 2000 components that have taken a hit in 2024. Here, we'll take a look at two small-cap stocks that have lost roughly half their value so far this year, why they're selling off, and what Wall Street expects next.

#1. WW International Stock

WW International Inc. (WW), formerly known as Weight Watchers International Inc., is a fitness company focused on weight management and maintenance. WW offers its members access to digital and in-person sessions on diet tracking, nutrition planning, recipes, and more. Its operations span across the U.S., Canada, Europe, and Latin America, with a growing customer base of more than 4 million individuals.

WW stock shot up 135% in 2023, but has lost more than 47% since the turn of the year. The stock has been declining steadily since its peak last October.

WW announced its Q3 results last November, where it missed analysts' expectations on both the top and bottom lines. Revenue of $214.9 million was down 15.3% YoY, while EPS of $0.06 came in lighter than forecast. The company’s gross margin increased from 61% in the prior year to 66%, driven by cost-cutting steps and a higher margin in digital business.

For the full year, WW anticipates revenue to be in line with the previously stated range of $890 million to $910 million, but lowered its operating income forecast to a range between $31 million and $43 million on higher restructuring costs.

WW has been coming under pressure due to the threat of stiff competition from blockbuster obesity and weight-loss drugs, particularly after Eli Lilly (LLY) unveiled plans to sell direct to consumers - undercutting a key Weight Watchers telehealth acquisition. Craig-Hallum piled on with a bearish note citing weak digital trends for WW, which was shortly followed by a short report from Cedar Grove Capital.

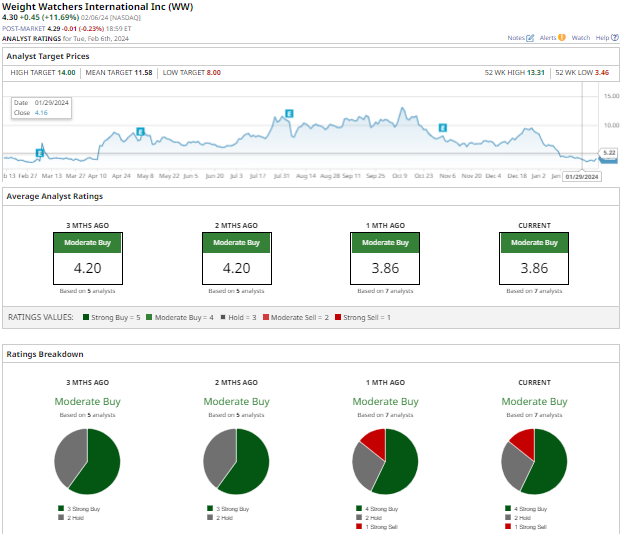

For now, WW still has a consensus “Moderate Buy” rating from analysts, with a mean price target of $11.58 - signifying an upside potential of 150% from the current price level. Out of the 7 analysts tracking the stock, 4 have a “Strong Buy” rating, 2 have a “Hold” rating, and 1 has a “Strong Sell” rating for the stock.

#2. Vertex Energy Stock

Vertex Energy (VTNR) is an energy transition company focusing on the refining and distribution of petroleum products. It procures used oil from businesses such as automotive repair shops, petroleum refineries, oil change service stations, and petrochemical manufacturing operations.

Vertex stock is down 54.7% so far this year, and is trading not far from its 52-week low.

Vertex’s most recent quarterly results were released back in November, and the company beat on earnings and revenue, even as profit decreased 10.8% to $19.8 million, or $0.17 per diluted share. Cash and cash equivalents stood at $79.3 million. Vertex reported an increase in its production from the Alabama refinery to 80,171 barrels per day.

More recently, Vertex said in January that its volumes for the fourth quarter will be lower than previously expected for both conventional throughput and renewable diesel, due in part to “deteriorating crack spreads,” according to a company release.

In response, Fitch downgraded the company's long-term issuer default rating from B- to CCC+, noting the outsized impact of lower U.S. Gulf Coast refining crack spreads on Vertex's free cash flows. Northland Securities also downgraded the shares, and dropped the price target to $2.

Overall, Vertex stock isn’t very popular among analysts. The consensus rating is a “Hold,” down from “Moderate Buy” one month ago. VTNR still has a mean price target of $4.80, though - about a 213% premium to current levels. Out of the 6 analysts tracking the stock, only 1 has a “Strong Buy” rating, and 5 have a “Hold” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.