#5 | Lousy Logistics

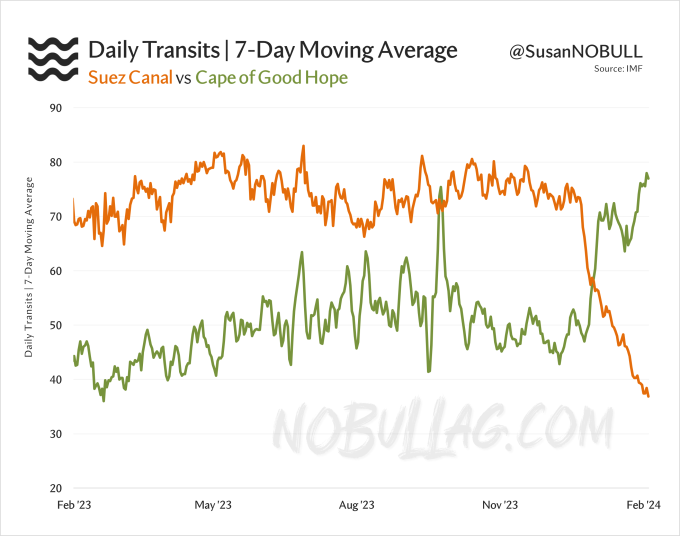

Transits around the Cape of Good Hope remain elevated as the Houthis continue to attack ships transiting the Red Sea. The Iranian-backed rebel group claims they are targeting ships which are Israeli-owned, flagged or operated, or ships that are heading to Israeli ports.

Many of the vessels which have been attacked have no connection with Israel, however, causing major shipping companies to stop transits through the area, opting for the long way around the Cape of Good Hope instead.

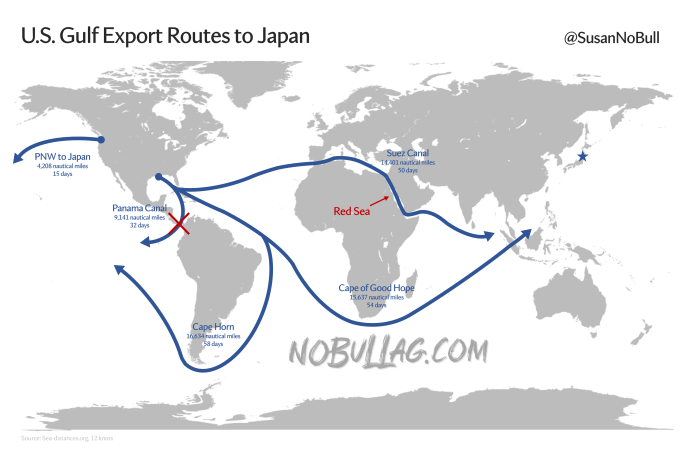

A geographical reminder of why this matters:

It is important to point out that this does not necessarily have far-reaching market implications but it is yet another headwind for U.S. exports (especially out of the US Gulf).

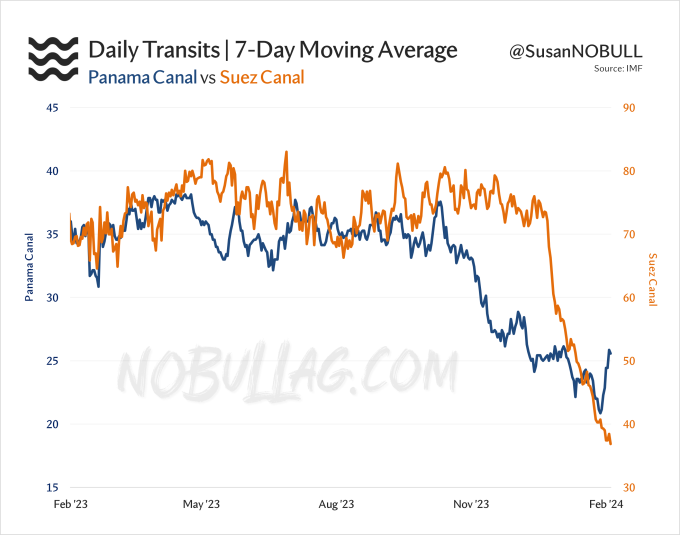

The Suez Canal has been the go-to alternative amidst the Panama Canal's low water struggles. These logistical challenges only add to the uphill battle United States exports have been facing, especially as it relates to increased competition from Brazil.

#4 | The Black Sea Glut

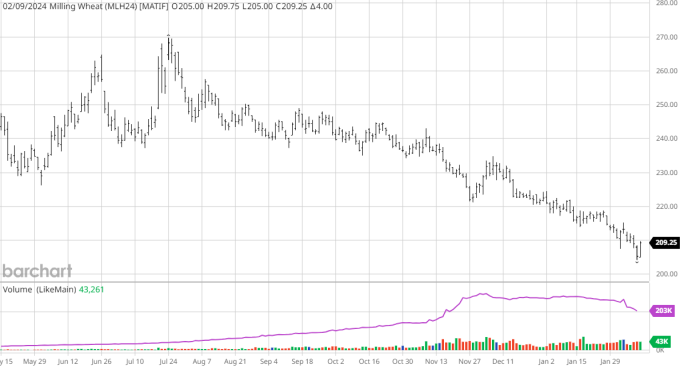

Frustrated with corn and wheat? Join the club where wheat has been struggling for well over a year and now corn is right there with it, grinding lower for the past several months.

There are several things at work here - all of which you can be connected by way of dotted lines.

First, Russia has cranked out two whopper crops in a row, followed by record exports as FOB values continue to undercut the rest of the world by a mile.

Second, let’s not forget about Ukraine. Although both corn and wheat production has faltered from pre-war highs, Ukraine continues to hold their own when it comes to exports, especially as the new humanitarian corridor has helped tradeflows return to pre-war levels.

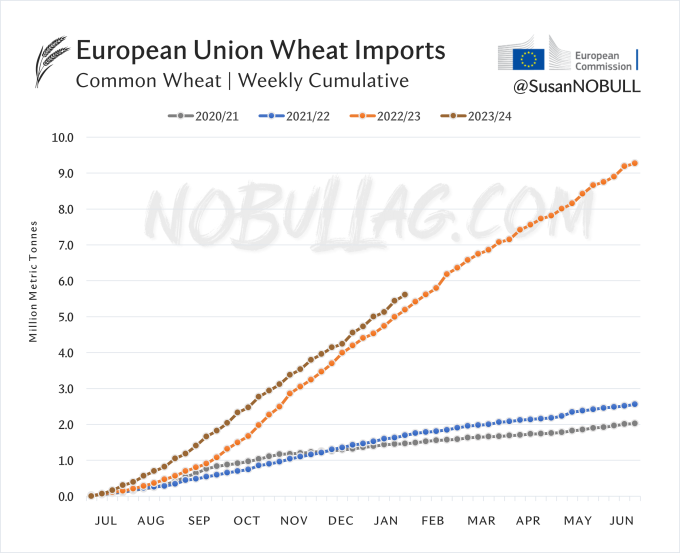

The glut of bushels leaving the Black Sea has resulted in record EU imports of wheat for the second year in a row (predominantly thanks to an uptick in Ukrainian imports):

This has been weighing on futures, with Matif wheat continuing to make new lows:

This is also part of the reason European farmers have been protesting as cheap Ukrainian bushels continue to flood the market - both wheat and corn.

Farmers in central and eastern Europe are feeling the brunt. Since Russia invaded Ukraine, the EU has allowed Ukrainian goods to enter without quotas or duties, making their bushels far less expensive than those domestically produced.

#3 | Three in Five

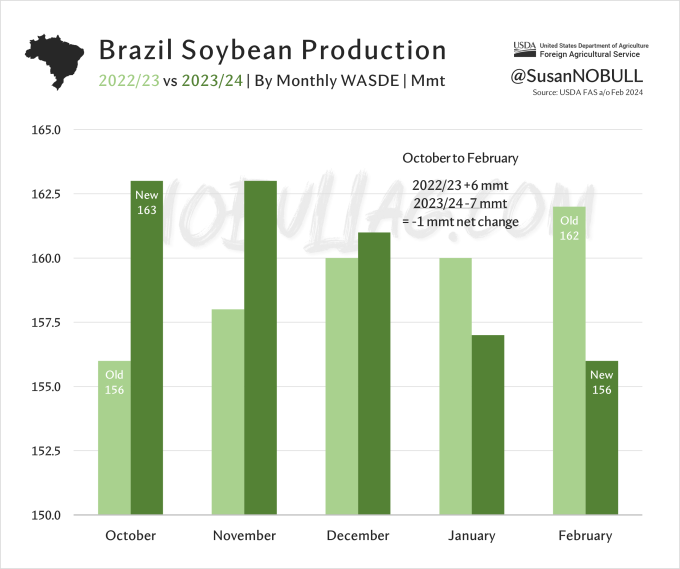

Did you know that USDA has quietly increased Brazil's old crop production while also decreasing their new crop production estimate in three of the last five monthly WASDE reports?

The cumulative changes from the Oct WASDE to Feb are a 6mmt increase in old crop production and a 7mmt decrease in new crop. The increases in Brazilian old crop production have almost entirely offset the reductions in new crop - mitigating the impacts of this year’s lackluster weather.

2022/23 +6mmt (+220mbu)

2023/24 -7mmt (-257mbu)

Net change = -1mmt (-37mbu)

As the old saying goes, it's always the alligator you don't see that bites you.

#2 | 2X

If I didn't anger the masses enough with #3, #2 will likely cause mass browser and app closings…

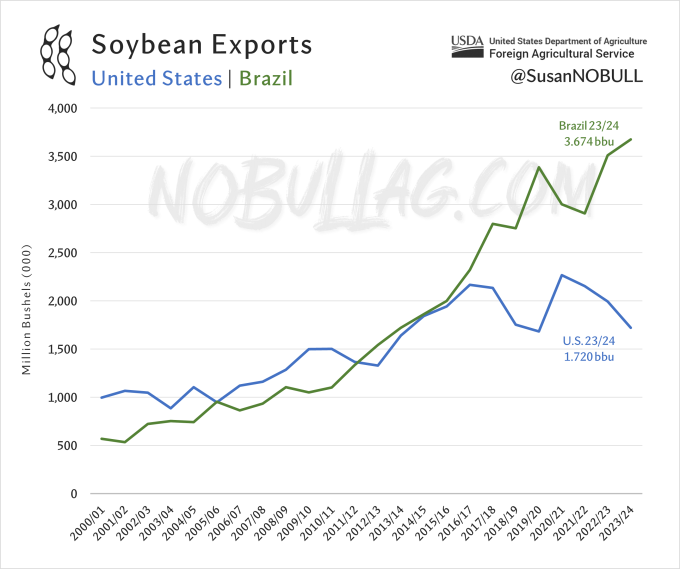

With Brazil's larger carry-in stocks (resulting from USDA's bump to 2022/23 production), exports are estimated to hit a record 100mmt (3.674bbu) in 2023/24 - the second annual record in a row and more than double the United States' current 46.8mmt (1.720bbu) estimate.

Even more shocking - 2023/24 makes the 12th consecutive year Brazil has out-exported the United States on soybeans.

#1 | We're #1

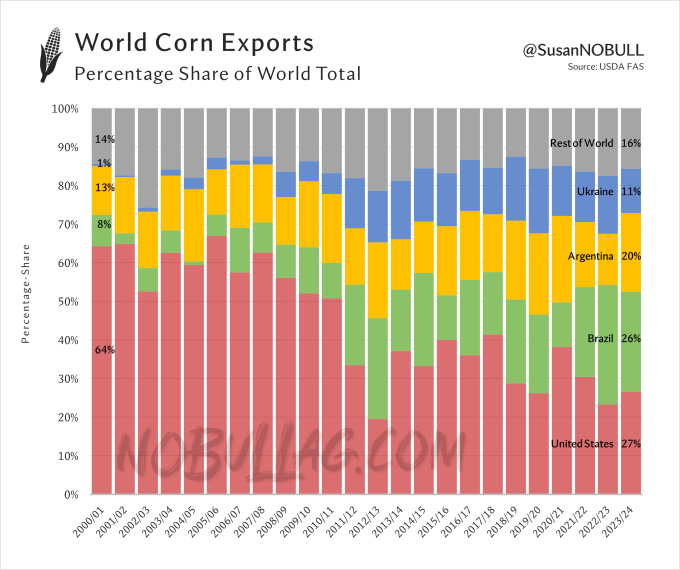

All is well with the world though as the United States is reclaiming its title as the world's largest corn exporter in the 2023/24 marketing year.

Brazil's 3mmt (120mbu) drop in new crop production and subsequent 2mmt (~80mbu) reduction in Brazil's 2023/24 marketing year exports in the February WASDE lifted the United States into the #1 spot, maintaining its full-year export estimate of 53.3mmt (2,100mbu) versus Brazil's new estimate at 52mmt (2,050mbu).

If I haven't depressed you too much with all the Brazil stats, you can check out the full version of the updates above and subscribe by visiting NoBullAg.Substack.com.

Thanks!

On the date of publication, Susan Stroud did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.