Sterling fell in European trade on Thursday against a basket of major rivals, extending losses for the third straight day against the dollar following the bullish Fed’s meeting.

The decline comes ahead of Bank of England’s policy decisions later today, expected to hold interest rates flat.

GBP/USD

GBP/USD fell 0.4% to 1.2642, with a session-high at 1.2698, after closing down 0.1% on Wednesday.

The Dollar

The dollar index rose 0.3% on Thursday, extending gains for the second session against a basket of major rivals.

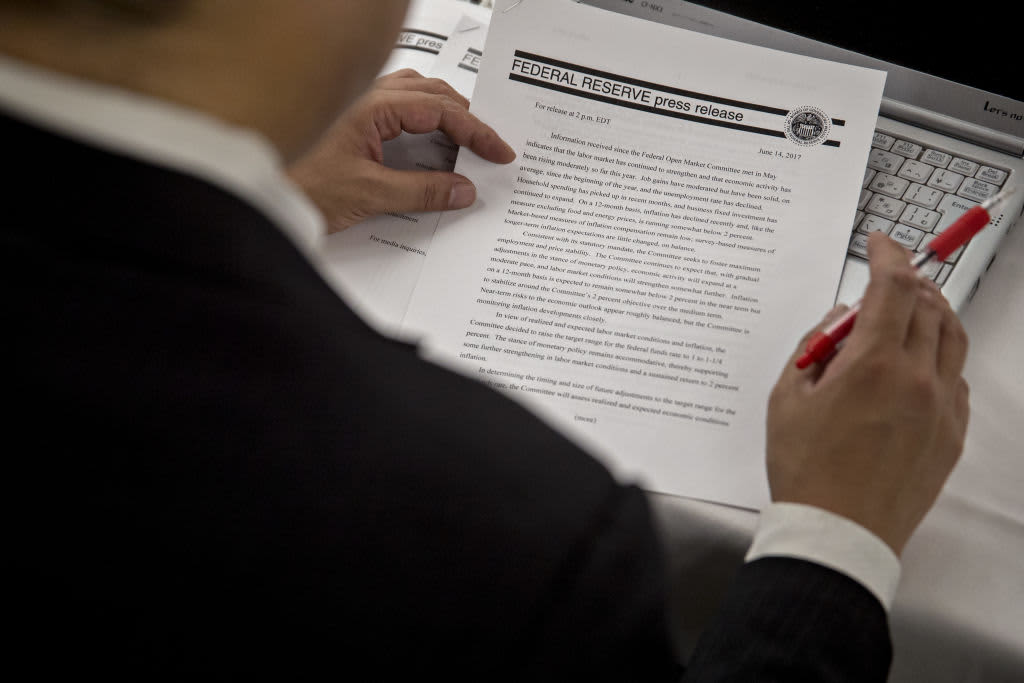

The gains come after the Federal Reserve’s policy meeting yesterday, at which the Fed held rates unchanged, while Chair Jerome Powell said that an interest rate cut at the March meeting is unlikely.

Following the meeting, the odds for a 0.25% Fed interest rate cut in March tumbled from 52% to 35%, down from over 80% just a month ago.

Bank of England

Bank of England is widely expected to hold interest rates unchanged at 5.25%, already the highest since 2008.

The policy statement will likely include clues on the future of interest rates in the UK, especially as consumer prices rose once again in December.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.