A mixture of oil and water is called an emulsion, a mixture of two liquids that do not combine. Our science teachers would be proud of us for remembering this. Is the Middle-East conflict causing a similar mixture and getting the same results?

Economically, a similar mixture occurs as tankers try to deliver oil through the Red Sea. The ongoing attacks on tankers put a war premium back on crude oil. Combine this with a dominant seasonal buying pattern as US refiners prepare for the upcoming driving season, and we have the perfect storm for higher crude oil prices.

Iran's largest trading partner, China, has threatened to sever business ties if Iran does not reign in the Iranian back Houthi rebels who have been causing havoc in the Red Sea. Global supply chains are beginning to strain as ships are required to take longer routes to avoid the Red Sea attacks. Container shipping prices have escalated recently as tanker insurance companies are not allowing insured vessels through the Red Sea.

Similar situations occurred when the Ukraine–Russia war began. The Black Sea became too dangerous for insurers to allow ships in the region, resulting in a temporary worldwide spike in grain prices. Fortunately, recent reports show that Black Sea grain exports have increased to levels not seen since the outbreak.

China's economy is struggling; without oil, they cannot jumpstart their anemic economy. The grain imports from the Ukraine region to China, while smaller than in the past, are also impacted by the Red Sea problems.

It is rare to see the Chinese government step up and get involved in helping other countries unless there is something in it for them. Perhaps they can use their leverage over Iran to halt these Red Sea attacks.

Crude Oil's most significant moves occur in the coming months

My last article on crude oil, "Has Crude Oil Put in an Early Seasonal Low?" outlined the possibility that crude oil had already bottomed in December for this upcoming high-demand period until May 1. Recent US economic reports showed that GDP, consumer spending, and employment point to a bullish economy, which is bullish for crude oil. One concern for many traders will be the possibility of revisions to these recent reports.

Technical picture

Source:

The daily nearby futures contract chart illustrates the December lows and has recently posted a higher high and higher low. The current channel supports the uptrend bias and may offer traders opportunities to participate in higher prices.

Seasonal Pattern

Source: Moore Research Center, Inc. (MRCI)

MRCI research shows a 15-year seasonal pattern (blue line) that usually bottoms in late December. Gasoline refiners typically become aggressive crude oil buyers as they prepare for the summer driving season, generally beginning at the end of May and lasting until the first week of September.

The previous article revealed a macro timeframe view of December to May. MRCI research has refined the optimal buying seasonal window (yellow box), representing an 80% reoccurrence over the past 15 years. The duration of the pattern is about 55 calendar days. With longer durations, more trading opportunities may be found as a trader would have a bullish outlook on crude oil. The key is having supporting evidence from your trading plan and risk management rules before taking the trades.

MRCI has found that crude oil closed higher on approximately February 26 than on January 21 for 12 of the past 15 years. While this is one of the lowest probability seasonal patterns, there are ways to enhance this that may improve the success rate.

The Commitment of Traders (COT) Report

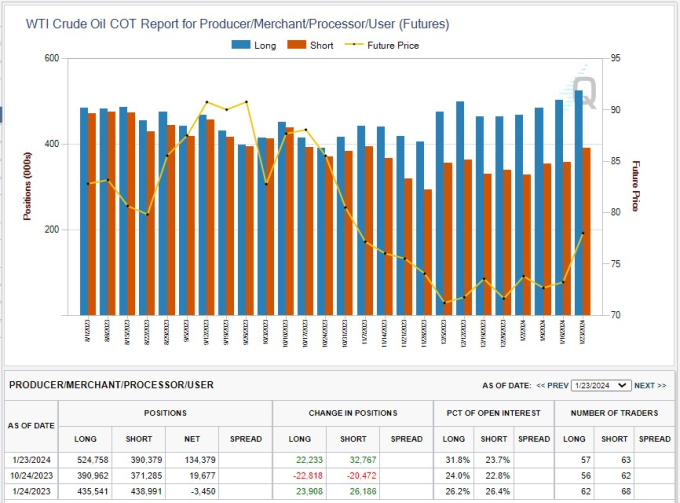

Source: CMEGroup Exchange

The above COT report looks at the commercial trader positions in crude oil. Commercial traders have their finger on the pulse of the physical markets they deal in daily. For example, the summer driving season comes every year. Commercial users will need to refine crude oil to make gasoline. They will have historical and current data from the energy and economic sectors to assist them in determining how many gallons of gasoline they will need to refine this year. In years when the economy is strong, they will need to accumulate more crude oil aggressively. And in years of slower economic growth, they may refine fewer gallons of gasoline, reducing their demand for crude oil.

As we discussed earlier, the economy is showing growth, possibly leading to higher-than-normal demand for gasoline this year. The COT report reveals the refiners were buying crude oil (blue bars) as the price (yellow line) declined towards the low $70 per barrel. And, this is typical for commercial traders to scale into positions and not chase price.

But, what is not typical is to see commercial traders buying as prices increase, resulting in much more aggressive behavior. The prior four weeks have seen more buying than selling by the commercial traders as prices were basing and began to move higher. The table in the COT report illustrates that this year, the commercials are holding almost 100k more long positions than the same time last year.

In closing

The optimal seasonal window pattern is for 55 calendar days. During this time, traders can trade in and out of positions or perhaps build a core position as the price increases. Technically, we've seen a daily uptrend form confirming the path of least resistance is up. In my opinion, the COT report is crucial. Because it's not every year that commercial traders build a significant position in this seasonal pattern. But, when they do, it adds credence to the upcoming seasonal buy pattern. It does not add a guarantee but adds a valid odds enhancer.

It's important to note that while seasonal patterns can provide valuable insights, they should not be the sole basis for trading decisions. Traders must also consider other technical and fundamental indicators, risk management strategies, and market conditions to make well-informed and balanced trading choices.

More Stock Market News from

- Stocks Settle Mixed with Big Tech Earnings and FOMC Meeting on Tap

- This AI Chip Stock Has a Near-Monopoly

- 1 Magnificent AI Stock to Buy With $200 Now

- Is Now a Good Time to Buy Beaten-Down Boeing Stock?

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.