Starbucks Corp (SBUX) sat out the broad-market rally of 2023, giving up 3.2% over the course of the year. And the shares haven't fared much better so far in 2024; while the S&P 500 Index ($SPX) is hitting new highs, SBUX is still negative on a year-to-date basis.

Following the pullback, is Starbucks stock - with its 2.43% dividend yield - a good buy right now? Here's a closer look at the coffee stock's price action, financial performance, and what analysts are expecting next.

Why Is Starbucks Stock Dropping?

Beyond the stock's relatively modest year-over-year decline, the shares have pulled back significantly from their 52-week high around $115. Since that peak, set last May, SBUX is down more than 19%. The steady decline off that May high was prompted by a disappointing outlook that accompanied the coffee brewer's fiscal Q2 earnings report.

The stock gapped higher to start November after roundly beating fiscal Q4 earnings expectations, but SBUX has since pulled back to fill that bull gap. The Seattle-based coffee chain is currently worth $106.7 billion by market cap.

While its annualized returns are less than impressive, SBUX has become a reliable dividend stock over the years. Currently, it dishes out a quarterly dividend of $0.57 per share, which translates to a forward yield of 2.43%. That's backed by over a decade of consistent dividend growth, and a reasonable payout ratio of 60%.

Additionally, the dividend at Starbucks is backed by a robust and growing free cash flow. Given the company's history of regular dividend increases and its current yield, Starbucks could be an attractive option for investors seeking income as well as potential capital appreciation.

But despite its tepid price action, the stock isn't cheap. SBUX is valued at 2.70x forward sales and 22.79x forward earnings, both of which represent a premium to consumer discretionary sector medians.

Growth Drivers for SBUX

Despite Starbucks' recent stock dip, there are a few reasons to believe a comeback could be brewing. The company has been stirring up some strategic initiatives that could perk up growth and give the stock price a jolt.

First up, Starbucks is setting its sights on India. The company's expansion plans in this region could give revenue a nice boost. As Starbucks taps into India's growing coffee culture, the resulting surge in its customer base and sales could give the stock price a lift.

Plus, the company is spicing up its menu to drive growth. After a 20% increase in sales for its all-day breakfast menu during the first nine months of 2023, SBUX is looking to leverage this demand with new, diverse additions to the lineup.

Overall, the chain is projected to outpace its sector peers in terms of growth this year. The consensus is calling for forward revenue growth of 10.40%, compared to the sector median of 5.23%, with EPS growth pegged at 26.5% against a sector median of -1.74%.

However, Starbucks faces headwinds that include rising costs related to labor, commodities, and supply chain issues. There are also concerns about consumer spending, as inflation remains high. The potential for higher-than-average growth is there, but the macroeconomic climate poses headwinds.

SBUX is set to report earnings again later this month.

What Do Analysts Expect for SBUX Stock?

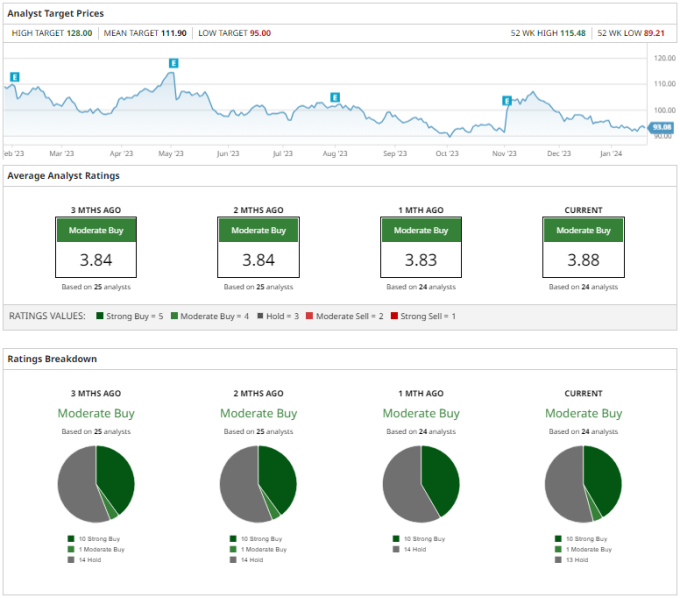

Out of 24 analysts following SBUX, the consensus is a “moderate buy,” with 10 shouting “strong buy,” 1 saying “moderate buy,” and 13 suggesting “hold” for now.

The average target price from this group is $111.90. That implies upside potential of 20% from current levels.

Should You Buy the Pullback in Starbucks Stock?

So, is Starbucks stock a buy after its recent dip? Well, the financial tea leaves suggest a mix of challenges and potential perks. Despite the rollercoaster, Starbucks' strategic moves and positive analyst forecasts hint at a possible rebound. Whether you're eyeing growth or a reliable dividend, this coffee giant might still have some steam left.

That said, with a quarterly earnings announcement just around the quarter, conservative investors may want to wait until after any event-related volatility settles out to consider picking up shares.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.