Colorado-based Molson Coors Beverage Company (TAP) manufactures, markets, and sells beer and other malt beverage products under various brand names. With a market cap of $11.6 billion, Molson Coors’ operations span the Americas, Europe, the Middle East, Africa, and the Indo-Pacific.

Companies worth $10 billion or more are generally described as "large-cap stocks," Molson Coors fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the brewery industry. Its portfolio includes brands like Aspall Cider, Blue Moon, Coors Original, Hop Valley brands, Leinenkugel's, and more.

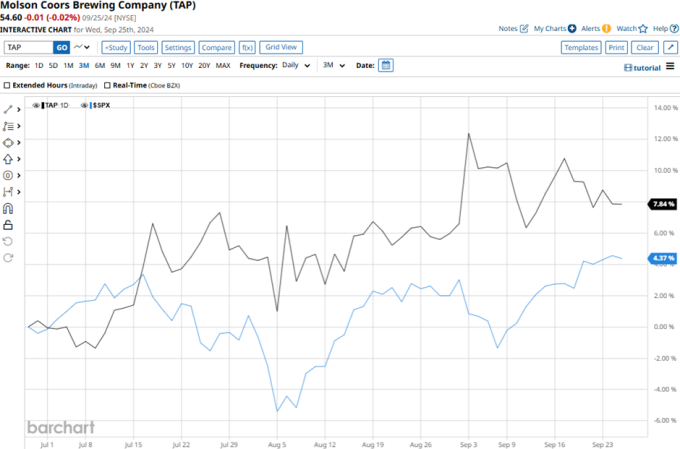

Molson Coors touched its 52-week high of $69.18 on Apr. 9 and is now trading 21.1% below that peak. TAP gained 6.9% over the past three months, outpacing the S&P 500 Index’s ($SPX) 4.6% gains during the same time frame.

Over the longer term, TAP has underperformed SPX. TAP dipped 10.8% in 2024 and 13.3% over the past year compared to SPX’s 20% gains on a YTD basis and 31.9% returns over the past 52 weeks.

To confirm the bearish trend and recent uptick in prices, TAP has consistently traded below its 200-day moving average since late April and above its 50-day moving average since mid-July.

Shares of Molson Coors surged 5.4% after the release of its better-than-expected Q2 earnings on Aug. 6. The company’s net sales declined marginally to $3.3 billion. However, due to effective cost management, its net margin expanded by 2.6% to 13.1%. This translated into a 24.7% year over year net income growth, exceeding Wall Street’s expectations. Moreover, Molson Coors’ adjusted EPS grew by 7.9% to $1.92, exceeding the consensus estimates by 14.3% and bolstering investor confidence.

Molson Coors’ competitor, Constellation Brands, Inc. (STZ), dipped 1.8% over the past year and gained 4.2% in 2024, outperforming TAP.

Among the 16 analysts covering the TAP stock, the consensus rating is a “Hold.” The mean price target of $59.44 suggests a potential upside of 8.9% from current price levels.

More Stock Market News from

- How Is Skyworks Solutions’ Stock Performance Compared to Other Semiconductor Stocks?

- Catalent Stock: Is CTLT Outperforming the Healthcare Sector?

- Tesla Surge? Goldman Recommends Call Options Before Key October Events

- How Is Kimco Realty's Stock Performance Compared to Other REITs?

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.