(KCK24) (CCK24) (RMN24) (CTK24) (ZSK24) (SOYB) (ZWK24) (WEAT) (ZCK24) (CORN) (NGH24) (UNG) (KOLD) (BOIL)

”The AO, MJO, El Niño index and their effect on Argentina's soybeans and natural gas weather"

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

- Weekend Report: January 19-21, 2024

To View Video > > > PLEASE CLICK HERE

(Our video addresses why we reversed our bullish attitude in natural gas early this past week and enumerates the implications for South American grain weather.)

It is common knowledge that more than 80% of the time, El Niño brings above normal corn and soybean yields in Argentina and southern Brazil, but can often bring dryness and reduced crops in northern Brazil. This certainly happened earlier this winter (South American summer) with drought hurting Matto Grosso soybean yields. Nevertheless, we have been in the bearish camp for weeks in soybeans due to worries over the Chinese economy and our early forecast that South American weather and crop conditions would improve.

In the above video, I cover the following:

- A) Why late January and February heat and dryness in Argentina is unusual during El Niño but some problems may develop from excessive heat;

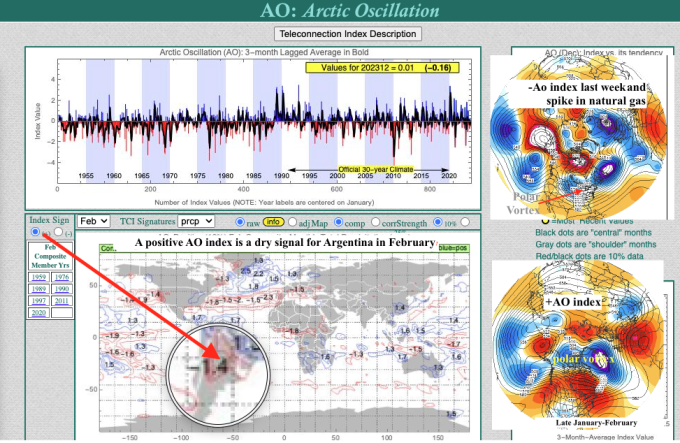

- B) How teleconnections such as the MJO and AO index can affect South American corn and soybean weather in February and offset typical ideal “El Niño type” weather (too wet at times for the northern Brazil soybean harvest and some potential minor issues resulting from hot and dry in Argentina);

- C) How we warned clients of a top in the natural gas market by predicting a +AO index;

- D) How the Red Sea tensions have helped markets such as Robusta coffee and cocoa soar. These two markets already have had tight supplies due to El Niño-related crop problems (Brazil coffee weather will continue to improve vs some previous crop reduction issues);

- E) If February is hot and dry in Argentina, then, this might suggest that the 1987-88 El Niño analog could hold true, suggesting the potential for summer Midwest weather problems affecting corn and soybeans (right now we are not calling for this, but something to watch).

If you have not yet had a complimentary trial to WeatherWealth, please request one, and join farmers, ETF investors, and futures traders on six continents and those who just want better (more accurate) short and long-range weather forecasts, often before markets react. While past performance is not indicative of future results, calling the $1 collapse in soybeans the last 6 weeks and the recent huge weather market natural gas volatility pays for the newsletter for years in just a matter of weeks.

Enjoy! Find out more here https://www.bestweatherinc.com/new-membership-options/

Thanks for your interest in commodity weather!

Jim Roemer, Scott Mathews, and The Weather Wealth Team

- Please feel free to learn about Jim Roemer, our track record, and how we use weather to help traders, hedgers, and investors. If you have any questions, please don't hesitate to drop me a line - Scott Mathews, Editor

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He also is a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he established a unique standing among advisors in the commodity risk management industry.

Trading futures and options involves a significant risk of loss and is not suitable for everyone. Past performance is not necessarily indicative of future results. There is no warranty or representation that accounts following any trading program will be profitable.

On the date of publication, Jim Roemer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.