Valued at $2.14 billion by market cap, Uranium Energy Corp. (UEC) is a Texas-based mining and exploration company involved in the pre-extraction, extraction, and exploration of uranium mines and projects in the southwestern U.S. states and Paraguay. The company is the largest resource and land owner in Canada’s Athabasca Basin and also the holder of the world’s highest-grade ferro-titanium deposit.

UEC specializes in a process known as in-situ recovery (ISR) for uranium extraction, which is a lower-cost and more environmentally friendly method of producing yellowcake. Incorporated in 2003, the small-cap company is headquartered in Corpus Christi, Texas.

Uranium Energy stock is down 20% on a year to date basis, and set a new 52-week low as recently as Sept. 6. However, UEC has bounced back sharply from that recent low, up 20% in just the past week.

Insider Buying on UEC

On Sept. 6, two top company insiders bought shares of Uranium Energy, marking the first insider buying activity on the stock in over a year. First up, Executive Vice President Scott Melbye bought 9,500 shares at $4.1803 in a transaction worth $39,713. The move takes his total stake in the company to 0.2418%.

More notably, CEO Amir Adnani purchased 60,000 shares priced at $4.1045 in a transaction worth nearly $250,000. The latest purchase took the CEO's total stake in UEC to 1.0382%, with over 4.2 million shares held.

The last time this pair of insiders bought UEC stock was in March 2023, and UEC has roughly doubled in value since then.

Such insider buying is often watched with interest by investors and market watchers, as it can signal confidence about the company’s health and future prospects on the part of key insiders.

Uranium Price Pressures

Earlier this month, Kazatomprom (NATKY), the world’s largest uranium producer, slashed its targets for 2025, citing difficulty in securing adequate sulphuric acid alongside construction delays in newly developed projects. Sulphuric acid is a key component in extracting uranium from deposits, and the delay in building new acid plants along with a host of other problems has led to a shortfall in supply. In response, Kazatomprom cut their uranium target for 2025 by 17% to an updated range of between 25,000 tonnes to 26,500 tonnes.

Separately, Russian President Vladimir Putin said on Wednesday that the country should consider restricting the export of uranium, titanium, and nickel as a form of retaliation against sanctions imposed by the West - which includes a uranium ban, though it allows for import waivers through 2028.

Ultimately, Kazatomprom’s move coupled with Putin’s remarks on restricting exports is expected to put upward pressure on uranium (UXU25) prices, which have slowed down after registering a 16-year high above the $100 per pound mark earlier this year.

Uranium Energy is Pre-Revenue

Uranium Energy posted its fiscal Q3 results in early June, with the loss of $0.05 per share falling short of analysts' expected $0.01 per share profit. UEC reported no revenue for the quarter, compared to expectations for $20 million, as there was no sale of purchased uranium inventory during the period and no fees from toll processing services.

The operating loss totaled $13.8 million in Q3, as operating expenses rose 43% YOY, while general and administrative expenses increased 12.7% to $4.2 million.

Cash outflows totaled $93.9 million in the nine-month period ended April 30, reversing UEC's cash inflow from operating activities of $43.8 million in the year-ago period. However, the company ended the quarter with a cash and equivalents position of $95 million, more than double the $45.6 million it had on hand at the end of fiscal year 2023.

Analysts Say UEC Stock is a Strong Buy

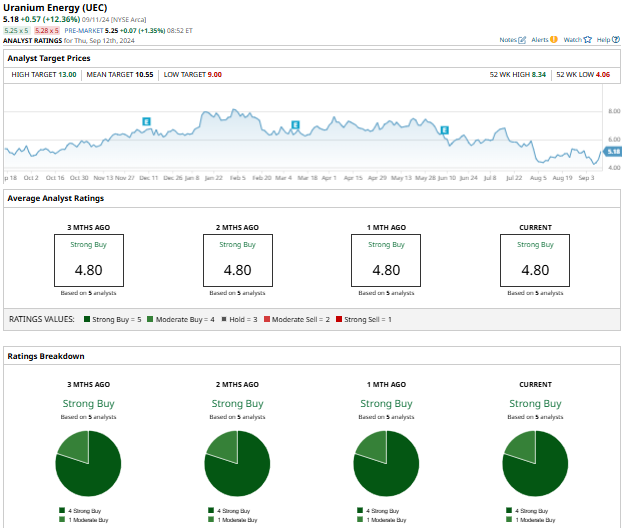

Wall Street analysts are overwhelmingly bullish on Uranium Energy, which has a consensus “Strong Buy” rating. Out of five analysts in coverage, four recommend a “Strong Buy,” while one suggests a “Moderate Buy.”

The mean price target for the uranium stock is $10.55, reflecting an expected upside potential of 106.5% from current prices.

More Stock Market News from

- Is Phillips 66 Stock Underperforming the Nasdaq?

- Stocks Push Higher on Chip Stock Strength and Positive Economic News

- Is Ross Stores Stock Outperforming the Nasdaq?

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.