Brazil Crop Production Preview

The calendar turning over to September marks the beginning of the planting season for first-crop corn and soybeans in Brazil, and the end of second-crop corn harvest. Trendline yields in Brazil have been on a steady rise over the course of the last 10 years, and there are a few key areas to monitor as the crop year progresses. Moreover, Brazil is facing one of the worst droughts in nearly 40 years, and we will analyze how that may affect projected production.

Production Calendar:

Soybean planting in the key Central-West region of Mato Grosso is set to begin next, as the remainder of the second crop corn harvest is finalized. Brazil’s first crop corn production accounts for only 27% of their total production, and is predominately used for domestic consumption. Second-crop production accounts for 73% of total production, and represents their export capacity while supplies in the Northern Hemisphere (U.S. predominantly), are depleted. Any delays in second-crop corn harvest stand to inhibit early soybean planting progress in the key Central-West region of Brazil.

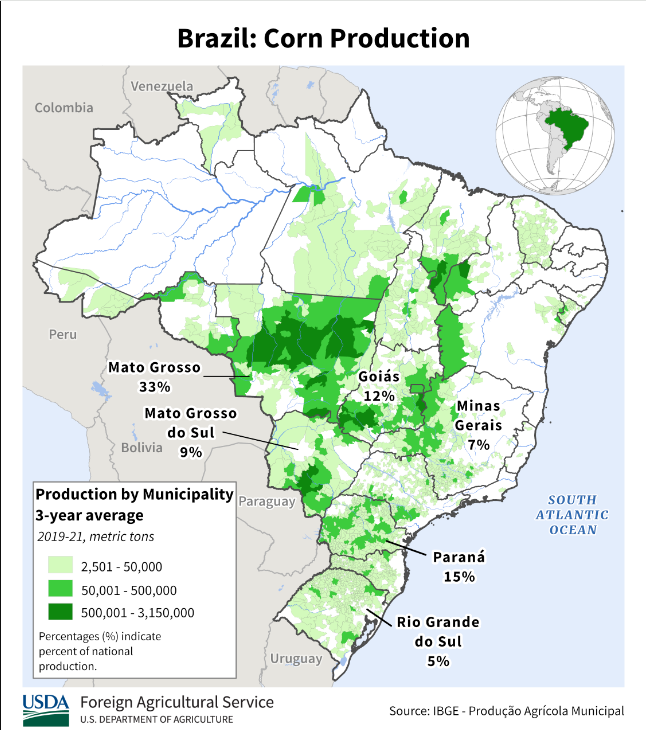

Production Areas:

The Central-West region of Mato Grosso is the most important area to monitor as it accounts for 33% of total corn production, and 26% of total soybean production. Moreover, this same region is where the remaining second-corn harvest remains to be completed. The second most important region to monitor would be the Southern regions of Parana, and Rio Grande do Sul. Soybean planting in Parana will not start until mid-late October, but accounts for roughly 26% of Brazil’s total soybean production.

Weather Outlook:

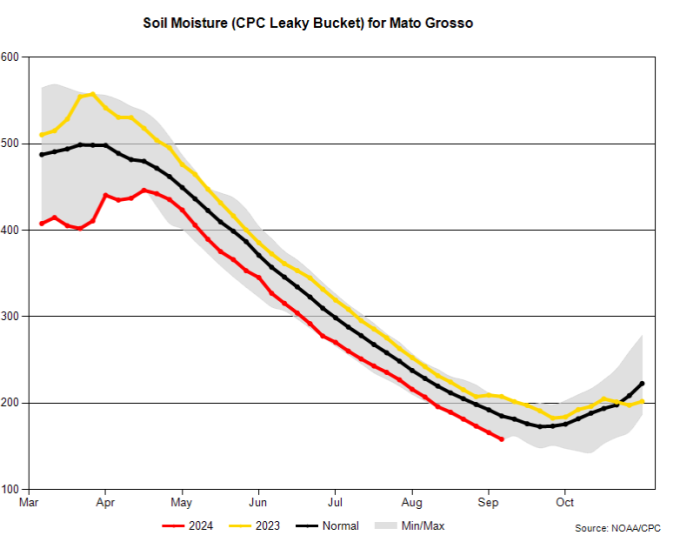

As previously mentioned, Brazil is faced with one of the worst droughts in nearly 40 years. The maps below express the latest soil moisture projections, and the deviations from normal. The Southern region of Parana is best suited for the upcoming planting season, while the key Mato Grosso region is distressed. Soil moisture in Mato Grosso is limited, and is well below average for this period in the year.

To put this into perspective, the chart below shows the current soil moisture content relative to historical norms, a 3-year rolling average, and historical extremes. Currently, soil moisture in Mato Grosso is the lowest on record for the month of September. Brazil’s rainy season does not begin until October, and prolonged dryness may adversely affect early progress for first-crop corn and soybeans.

Trend Line Production & Planted Area:

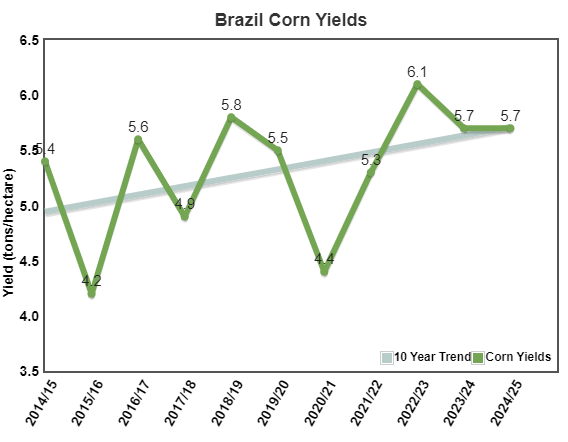

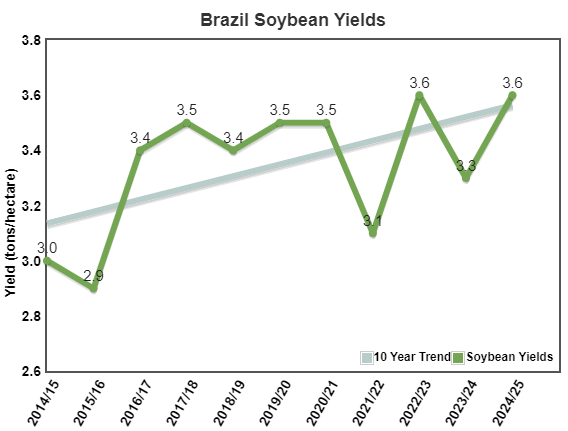

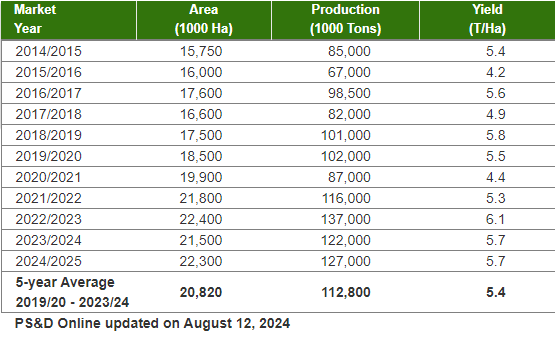

While trendline yields for Brazilian corn and soybean production have steadily increased on a 10-year rolling basis, there have been deviations from the mean. The graphs below show yields in tonnes/hectare for each crop year over the past 10 years. While yields have trended higher, there is a propensity for substantial deviation from trend as observed in ‘20/’21 corn and ‘21/’22 soybean yields. Interestingly, the depressed yields in both of those crop years corresponded with a prolonged La Nina event spanning from 2020-2022.

Planted areas for Brazilian soybeans have trended higher over the same 10-year period as yields. The tables below express the total number of hectares allocated to corn and soybean production increased in conjunction with rising yields.

Summary:

Brazil will enter this soybean planting season with a number of key production areas, namely Mato Grosso, in distress. With the driest soil on record in Mato Grosso, corn and soybean yields may show greater variance in the upcoming crop years compared to the last three. However, conditions in other key areas like the Southern region of Parana, are in line with historical norms. Longer-term forecasts and early planting progress reports will be key in estimating potential variance in total production for both first crop corn and soybeans. For more detailed information, specialized reports and analysis, call the Blue Line Futures trade desk at (312) 278-0500.

Matthew Bresnahan

Market Strategist – Blue Line Futures

Phone: 312-858-7305

Email: mbresnahan@bluelinefutures.com

Enjoy the benefits of Blue Line Futures

Open an account with Blue Line Futures and you will gain access to our daily commodity commentary, free desktop/mobile trading platforms, 24-hour trade desk, and more!

Brazilian Crop Production Preview - Blue Line Futures

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

On the date of publication, Blue Line Futures did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.