Hey there! Because this week is shorter, the weekly export sales will be released tomorrow morning. If you want to receive this info, as well as other flash sale updates, directly to your phone, just text “Alerts” to 888-839-7631.

Corn

Technicals (March)

March corn futures made new lows in yesterday’s session but are attempting to find their footing in the early morning trade. That may not be all that encouraging since any recent overnight strength has been overridden by an 8:30am sell program. The bears are in clear control, but a close back above 450-452 could be enough to spark some technical buying, whether that be from covering shorts or from bottom pickers.

Bias: Neutral

Resistance: 460-462***

Pivot: 450-452

Support: 440-441**

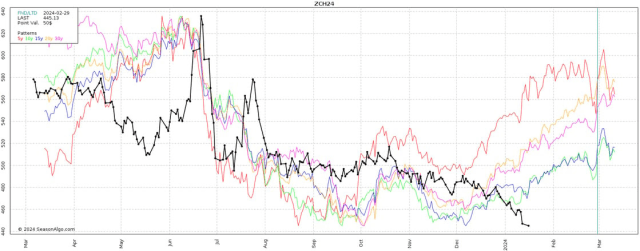

Seasonal Tendencies

Below is a look at historical seasonal averages for March corn futures (updated each Monday) VS today’s prices (black line).

*Past performance is not necessarily indicative of futures results.

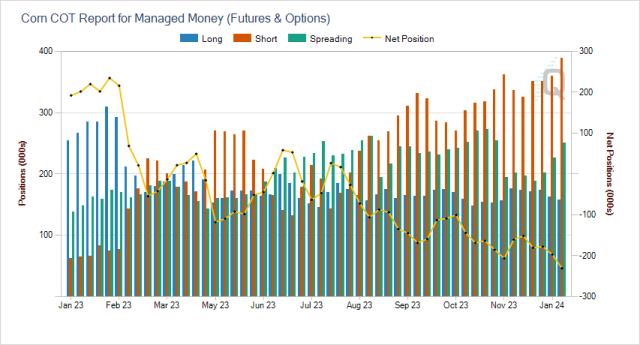

Commitment of Traders Snapshot

(updated on Mondays)

Below is a snapshot of the most recent Commitment of Traders report which showed Managed Money (Funds) were net sellers of roughly 32k futures and options contracts, expanding their net short position to 231k contracts, their largest net short position since 2020. Broken down that is 388,437 shorts VS 157,714 longs.

Soybeans

Technicals (March)

Soybeans broke lower yesterday to close just a hair away from Friday’s low. It almost seemed like a break below that and a break below the psychologically significant $12.00 level was inevitable in the overnight trade, but the market has been able to defend that. Now as mentioned in the corn section, the overnight strength may be taken with a grain of salt as it has not been able to hold through the day, at least as of late. If that support pocket can hold, the upside targets would be 1230-1235 and 1250-1260. A bounce back to those upper levels would not necessarily mean the low is in, it would likely be viewed as a Bear market rally until we see closes out above there.

Bias: Neutral/Bullish

Resistance: 1250-1260***, 1282-1285***

Pivot: 1230-1235

Support: 1200-1203***

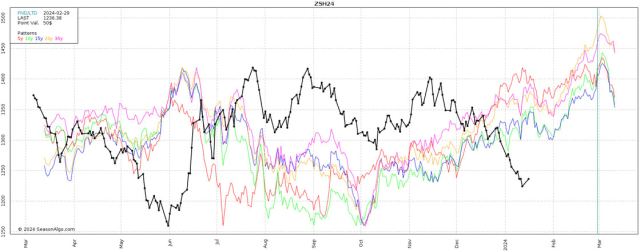

Seasonal Tendencies

Below is a look at historical seasonal averages for March soybean futures VS this year’s price (black line), updated each Monday.

*Past performance is not necessarily indicative of futures results.

Commitment of Traders Snapshot

(updated on Mondays)

The most recent Commitment of Traders report showed funds were net sellers again, for the eighth consecutive week. The are seen holding a net short position of 31,248 futures and options contract, broken down that is 64,373 longs VS 95,621 shorts. This is the largest net short position since 2020.

Wheat

Technicals (March)

Wheat futures attempted to stage a rally early in yesterday’s trade, but it was very short lived as sellers saw it as an opportunity. 570 remains intact as first support with the first barrier to the upside coming in from 587-591. The recent strength in the US Dollar has been a likely headwind for prices as it tends to have a more meaningful inverse correlation compared to other grain markets.

Bias: Neutral/Bullish

Resistance: 608 1/2-611***, 618-622****

Pivot: 587-591

Support: 570**

Seasonal Tendencies

Below is a look at historical seasonal averages for March Chicago wheat futures VS this year’s price (black line), updated each Monday.

*Past performance is not necessarily indicative of futures results.

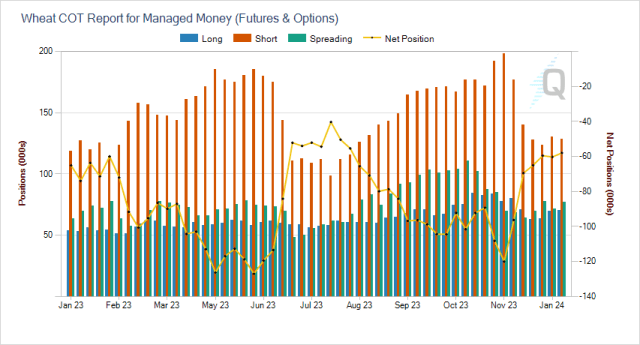

Commitment of Traders Snapshot

(updated on Mondays)

The most recent Commitment of Traders report showed fund positioning little changed from the previous week. Managed Money are still holding a net short position to the tune of about 58k futures and options contracts. Broken down that is about 128k shorts VS about 70k longs.

Oliver Sloup, VP & Co-Founder, Blue Line Futures

Sign up below for a FREE trial of our daily commentary!

https://bluelinefutures.com/2023-signup/?utm_source=

📉Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

📈Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

On the date of publication, Oliver Sloup did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.