As trade tensions between the United States and China intensify, the global commodities market is beginning to feel the impact, particularly in sectors where China holds a significant production advantage. Among the commodities affected, antimony - a critical mineral used in various industrial applications - has come into sharp focus.

On Aug. 15, China’s Commerce Ministry declared that it would impose export controls on antimony and related elements beginning Sept. 15. The ministry said in a statement that the restrictions are being implemented “in order to safeguard national security and interests, and fulfill international obligations such as non-proliferation.” Anyone seeking to export the mineral in various forms will be required to obtain a license. Notably, China accounted for 48% of the world’s mined antimony output last year.

In this increasingly tense environment, two companies stand out: United States Antimony (UAMY) and Perpetua Resources Corp. (PPTA). Both stocks have soared in response to China’s export curbs, highlighting their strategic importance in the global supply chain for critical minerals. UAMY, with its established antimony production and refining operations, and PPTA, advancing its significant antimony-gold-silver project in Idaho, are well-positioned to capitalize on this geopolitical shift.

Let’s take a closer look at these stocks.

1. United States Antimony Corporation

United States Antimony (UAMY), with a market capitalization of $67.3 million, is engaged in refining, producing, and selling antimony products, including antimony metal, antimony oxides, and sodium antimonate. Also, the company mines, mills, and concentrates rock containing silver (SIU24) and gold (GCZ24). In addition, UAMY participates in a joint venture to mine and distribute zeolite.

Shares of United States Antimony have skyrocketed 163.5% since the start of the year and increased 53.3% from Aug. 15 to Aug. 20, following China’s announcement that it would impose export controls on certain antimony products beginning next month.

On Aug. 21, shares of UAMY climbed an additional 13.8% following the company’s announcement of acquiring 69 new mining claims in Alaska, spanning over 11,000 acres. This acquisition includes an 8-foot wide quartz vein noted for its exceptionally high copper (HGU24) values. State geologists’ assay of 13 samples from the vein showed an average copper content of 16.5%, accompanied by 0.076 ounces per ton of gold and 2.21 ounces per ton of silver.

On Aug. 13, United States Antimony announced that it had agreed to acquire a 100% ownership interest, subject to a 2.5% net smelter royalty, in 97 mining claims and three mining leases spanning 4,300 acres in Ontario's Sudbury region, with a focus on high-grade cobalt, nickel, copper, and bismuth.

On Aug. 9, UAMY reported its earnings for the second quarter and first half ended June 30, 2024. In the second quarter, United States Antimony reported a 24% year-over-year increase in revenue to $2.813 million, while gross profit soared 135% to $0.909 million. The company’s loss from continuing operations for the quarter was $55,700, compared to a loss of $23,000 in the same period last year.

The company highlighted its ongoing enhancements at Bear River Zeolite, including mechanical and equipment upgrades, which contributed to an operational runtime of 94.3% during the second quarter of 2024. UAMY continues to observe a marked improvement in the overall operating conditions at Bear River Zeolite, resulting in increased throughput and enhanced customer order delivery times. Management also highlighted that antimony remains a scarce commodity globally due to supply constraints and trade restrictions placed on certain countries.

UAMY reported sales of $5.6 million for the first half of the year, marking a 26% increase from the previous year, fueled by higher volumes of antimony sales and increased prices for its zeolite products. Its gross profit reached $1.7 million for the first six months of the year, up 122% over last year, primarily due to improved efficiencies.

Operating expenses totaled $2 million for the first six months of 2024, rising by $1.1 million compared to the same period in 2023. The increase was mainly due to $300,000 in noncash stock compensation expenses, $310,000 in project costs, $360,000 in salary and Board fee expenses, and $130,000 in costs associated with 10-K and 10-Q filings, which were incurred earlier this year due to one-time SEC filings. During the Q2 earnings call, management stated that the $310,000 in project costs were part of the company’s strategy for growth and improvement. The company reported net income of $30,000 from continuing operations for the six-month period ending June 30.

For UAMY’s antimony business, sales in the first six months of this year increased 36% compared to the previous year, and the gross margin more than doubled compared to last year’s figure. The expansion in gross margin was attributed to increased efficiencies achieved through higher volume. Its average sales price per pound of antimony for the first half of this year was $4.65.

As of June 30, UAMY’s inventory levels were lower compared to the end of 2023, primarily due to reductions in its antimony inventory. Management said that its primary antimony supplier experienced some planned downtime at the end of the second quarter; however, it has resumed ore deliveries, and the company is now focusing on meeting demand and boosting inventory levels. The company is also actively seeking additional sources of antimony ore to expand sales and ensure a more robust inventory supply.

UAMY's cash and cash equivalents stood at $12.4 million as of June 30, reflecting an increase of $492,000 since Dec. 31, 2023.

Regarding valuation, the company’s trailing twelve-month EV/sales ratio is 5.62x - significantly above the sector median of 1.74x, but closely aligned with its five-year average of 5.30x. Also, the stock’s TTM price-to-sales ratio is 6.80x, higher than the sector median of 1.40x and its five-year average of 5.92x.

Currently, there are no analysts offering recommendations for UAMY stock.

2. Perpetua Resources Corp.

Valued at about $567 million, Perpetua Resources Corp. (PPTA) specializes in exploring, restoring, and redeveloping gold-antimony-silver deposits, primarily located in the Stibnite-Yellow Pine district of central Idaho, as part of the Stibnite Gold Project.

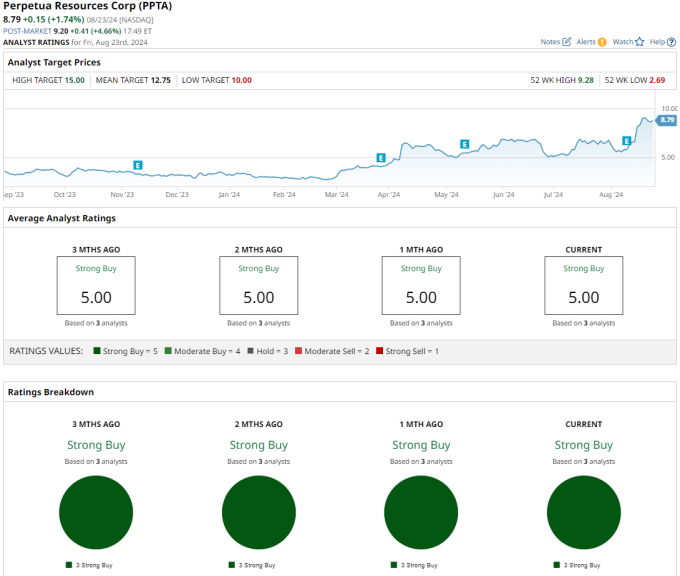

Shares of Perpetua Resources Corp. have jumped 189% on a year-to-date basis.

On Aug. 14, John Paulson’s Paulson & Co. revealed its holdings in an SEC filing for the period ending June 30, 2024, listing Perpetua Resources as one of the fund’s largest holdings by size.

On May 14, H.C. Wainwright analyst Heiko Ihle raised the firm’s price target on Perpetua Resources to $13.25 from $10.50 and kept a “Buy” rating on the shares following the company’s Q1 report.

Perpetua Resources is developing a U.S. antimony and gold project with backing from the Pentagon and the U.S. Export-Import Bank. Situated in the abandoned Stibnite Mining District, PPTA's Stibnite Gold Project is one of the largest economic reserves of antimony outside of China’s control. The Stibnite Project will supply the U.S. with its only domestically mined source of antimony, potentially fulfilling about 35% of the country’s antimony demand in its first six years of operation and addressing long-term defense needs. Antimony is critical to national defense, prompting the Defense Department to commit around $60 million to support the mine’s permitting process, which has spanned eight years, to enhance U.S. production of bullets and other weaponry.

The company is completely renovating the site, including significant environmental rehabilitation. The Stibnite Gold Project is set to be the fourth-largest U.S. gold operation by grade and is expected to produce between 4 and 5 million ounces of gold. As the sole domestic source of mined antimony, the project is anticipated to produce approximately 115 million pounds of antimony.

Perpetua Resources reported its financial results for the second quarter of fiscal 2024 on Aug. 10. Perpetua Resources reported a net loss of $3.7 million for the period, an improvement from a net loss of $7.7 million in the same quarter last year. PPTA reported a GAAP loss of $0.06 per share for the quarter, compared to the consensus estimate of -$0.05. The company has not yet generated revenue, as it is currently progressing the Stibnite project through the permitting process.

PPTA received an additional $34.4 million in funding through a modified Technology Investment Agreement under Title III of the Defense Production Act and secured an indication for up to $1.8 billion in financing from the Export-Import Bank of the United States for the Stibnite Gold Project during the second quarter.

As of June 30, Perpetua Resources reported having around $1.9 million in cash and cash equivalents, about $7.6 million in receivables, mainly from Department of Defense grants, $0.8 million in prepaid assets, and $4.3 million in trade and other payables. The company said its most recent liquidity forecast shows that its available cash resources are anticipated to run out in the fourth quarter of 2024. It also mentioned that funding received through the modified TIA under Title III of the DPA is designated solely for specific expenses such as permitting, environmental baseline data monitoring, environmental and technical studies, and advancing construction readiness.

Perpetua initially aimed to start production by 2028, contingent on securing final permits this year. However, actions taken by China have prompted the company to explore methods to accelerate antimony production.

In its most recent 10-Q filing, the company declared that it “will continue to focus on advancing the permitting for the Stibnite Gold Project through the National Environmental Policy Act process in addition to state ancillary permits and other federal authorization in 2024. The NEPA process is intended to ensure that federal agencies and the public are informed of a proposed action’s potential environmental impacts before a final decision is made by the agency regarding the action. The company is also advancing construction readiness activities in parallel with the permitting process.”

Analysts tracking Perpetua Resources expect the company’s net loss to narrow to $0.21 per share in fiscal 2024, down from $0.30 per share in fiscal 2023.

Perpetua Resources stock has a unanimous “Strong Buy” rating from the three analysts in coverage. The mean price target for PPTA stock is $12.75, which is about 45% above Friday’s closing price.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.