Houston, Texas-based Targa Resources Corp. (TRGP) owns, operates, acquires, and develops a portfolio of complementary domestic midstream infrastructure assets in North America. With a market cap of $31.6 billion, Targa Resources operates through Gathering & Processing, and Logistics & Transportation segments.

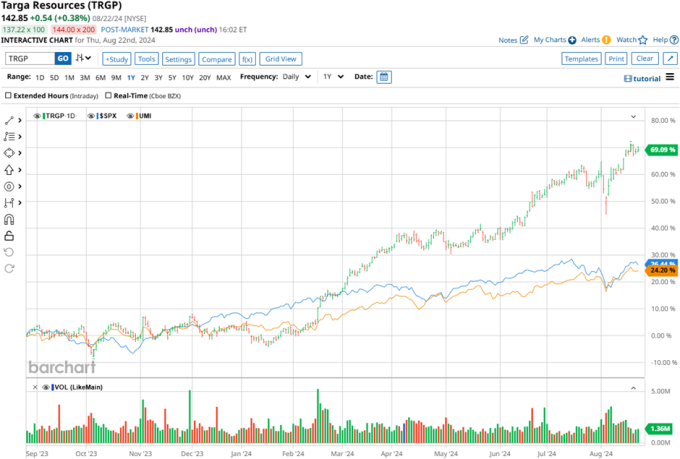

The midstream giant has substantially outperformed the broader market over the past year. Over the past 52 weeks, TRGP surged 70.7%, outpacing the S&P 500 Index’s ($SPX) 27% returns. In 2024, TRGP is up 64.4% compared to SPX’s 16.8% gains on a YTD basis.

Zooming in further, TRGP also outperformed the Uscf Midstream Energy Income Fund ETF’s (UMI) 24.4% returns over the past 52 weeks and 20.2% gains on a YTD basis.

Shares of Targa Resources rose marginally after the release of its Q2 earnings on Aug. 1. The company's total revenues grew 4.7% year over year to $3.6 billion, but its net income dropped 9.4% to $298.5 million. Despite the initial positive response, TRGP stock plummeted by 4.1% in the subsequent trading session.

For the current fiscal year, ending in December, analysts expect Targa Resources’ EPS to grow 58.5% year over year to $5.80. The company’s earnings surprise history is grim. It surpassed the consensus EPS estimates in just one of the past four quarters while missing on three other occasions. Its EPS for the last reported quarter surpassed the consensus estimates by 9.9% to $1.33.

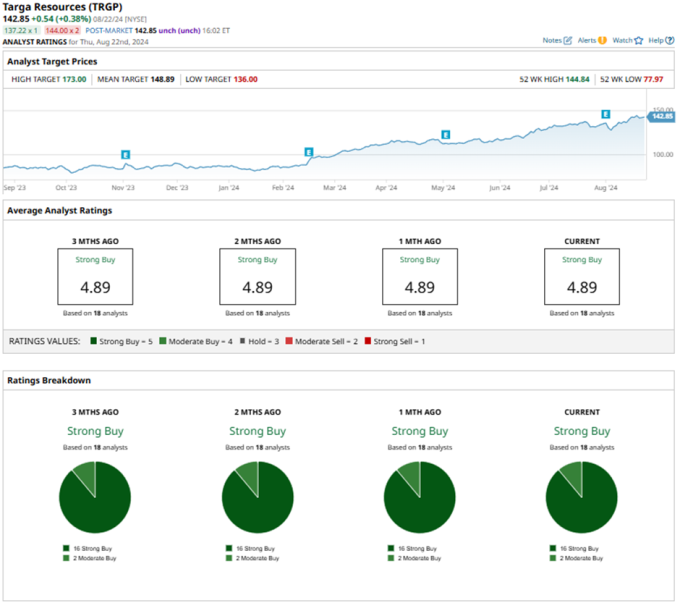

Among the 18 analysts covering the TRGP stock, the consensus rating is “Strong Buy.” That’s based on 16 “Strong Buy” ratings and two “Moderate Buys.”

This configuration has been consistent over the past months.

On Aug. 13, RBC Capital analyst Elvira Scotto maintained a “Buy” rating with a price target of $153.

TRGP’s mean price target of $148.89 represents a premium of 4.2% from current price levels. The Street-high target of $173 indicates a potential upside of 21.1%.

More Stock Market News from

- Stocks Climb Ahead of Fed Chair Powell’s Comments

- Are Wall Street Analysts Bullish on FedEx Stock?

- Is Wall Street Bullish or Bearish on DexCom Stock?

- PTC Stock: Analyst Estimates & Ratings

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.