5 | Surprise!

Today, I will start with this wise nugget from my friend Dan Hueber: It’s seldom the alligators you are looking at that will bite you.

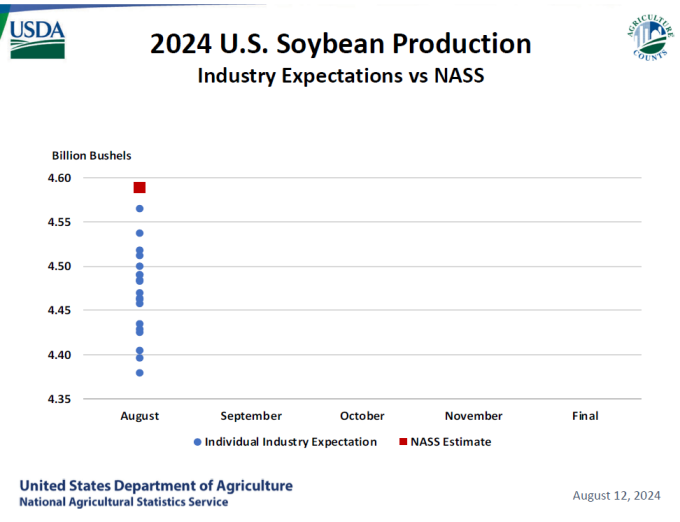

While we were all expecting a big bean yield in the August WASDE, USDA dished out a record 53.2bpa for the 2024 crop - coming in 0.7bpa above the average pre-report estimate and at the upper end of the range. If realized, 53.2 will be 1.3bpa over the previous all-time high set in 2016 at 51.9.

We have all known yield was going to be big - and we have been pricing it for weeks.

The kicker was finding an additional million acres of planted and harvested area on top of a larger-than-expected yield, producing a record 4.59 billion bushel crop, a number no one was expecting heading into Monday's report.

4 | Swimming in Stocks

Unfortunately August's big supply surprise was hardly offset by a small uptick in export demand, ballooning ending stocks another 125 million bushels to 560 million for 2024/25.

This pushed new crop stocks/use up 2.8% to 12.8% and average farm prices down 30 cents to $10.80.

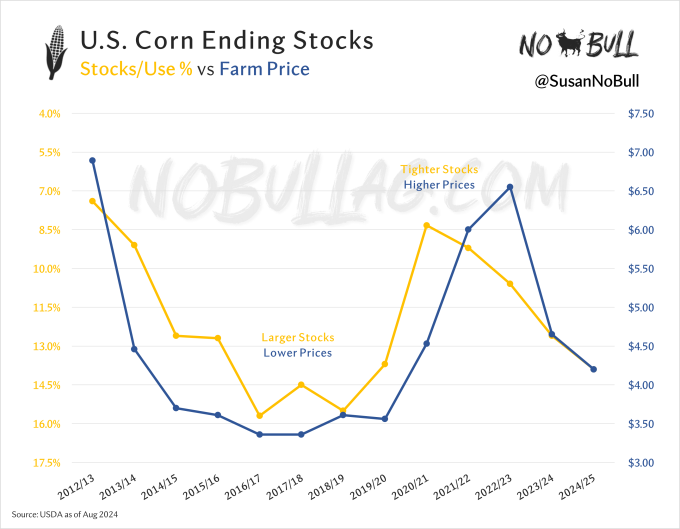

Although the August report was much easier on corn with small reductions to both old and new crop stocks, 2024/25 farm price estimates were reduced 10 cents to $4.20 per bushel as stocks/use hovers near 14%. The close relationship between stocks and price remains intact.

3 | Three striking lines

US soybean carryout wasn't the only thing that grew on the August report as USDA raised their estimate of Chinese soybean imports for the second month running.

At 111.5mmt (4.1bbu), China’s 2023/24 import estimate has been raised 6.5mmt (240mbu) since the June WASDE - when USDA first noted they were changing their methodology to reflect origin shipments vs Chinese customs data for imports.

Related - Brazilian bean exports were raised (again) to a record 105mmt (3.86bbu) for the 23/24 marketing year. US exports were left unchanged at 49.7mmt (1.7bbu) for 23/24.

2 | #2 Yellow Corn

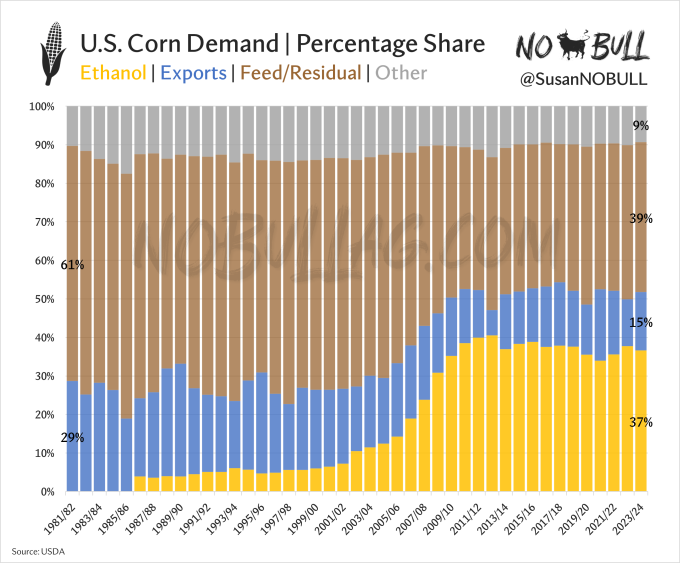

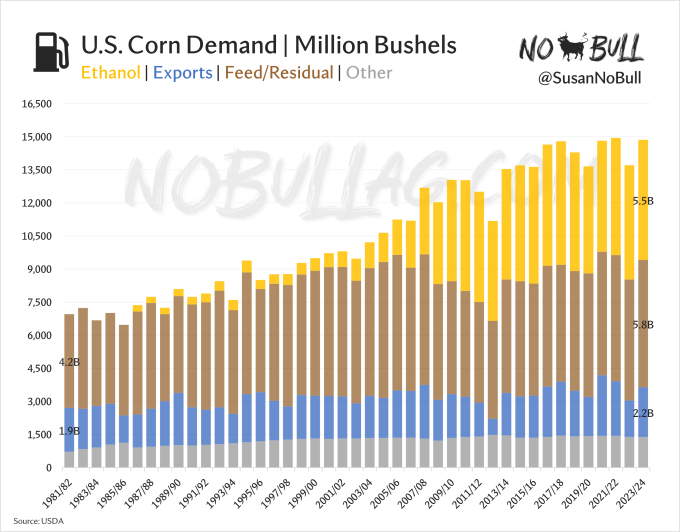

Check out the way U.S. corn demand has evolved over time:

Thirty years ago, feeding and exports accounted for 90% of corn demand.

Today, feed continues to hold the largest percentage share of demand but it runs neck and neck with domestic ethanol demand, who has been the predominant driver in demand growth since the Renewable Fuel Standard’s inception nearly 20 years ago.

1 | One Thing

As you can see above, US corn NEEDS ethanol and its more-than 5.5 billion bushels of demand each year.

Love it or hate it, biofuels are a big part of agriculture and an even bigger part of the rural economy…

and….

Love it or hate it, carbon capture and storage along with CO2 pipelines play an instrumental role in where biofuels (and corn) go from here.

WHY?

Sustainable aviation fuel presents a tremendous opportunity for US agriculture - corn ethanol in particular.

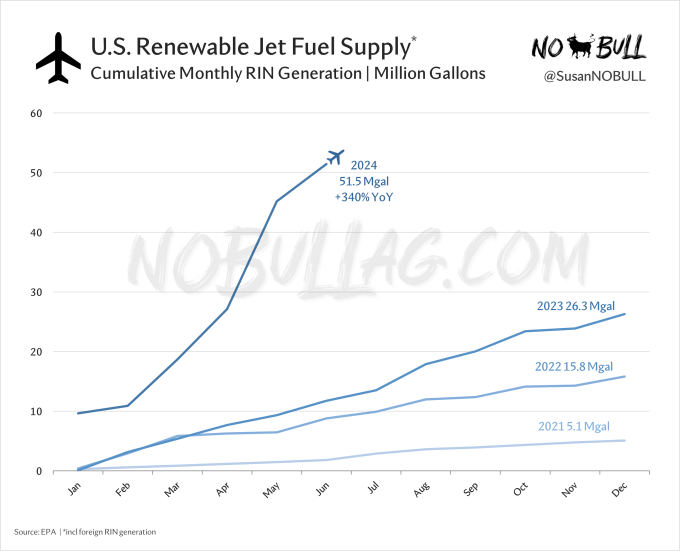

Renewable jet fuel production is literally taking off in the United States as the airline industry aims to meet emissions reductions targets set forth by the Federal government.

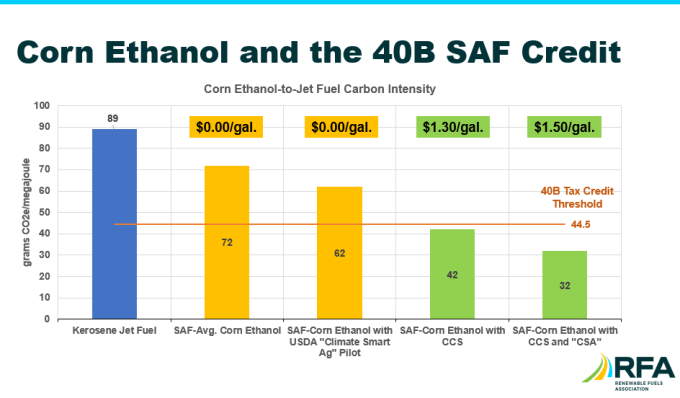

Sustainable aviation fuel is expensive though, making it cost-prohibitive to both produce and use. In this newly-emerging market’s infancy, the government is helping buoy the cost of production with tax incentives laid out in the IRA.

The kicker is, the carbon intensity score of SAF made from US corn ethanol is TOO HIGH to qualify for the tax credit needed to (yellow bars/orange line).

The ONLY WAY US CORN ETHANOL CAN MAKE ITS WAY INTO SAF PRODUCTION IS VIA CARBON CAPTURE & STORAGE (CCS - green bars).

If there is one thing you should read today, it's my latest post highlighting the importance of carbon capture and storage and CO2 pipelines to the long-term viability of the ethanol industry and US corn demand which can be found HERE.

Today, we are presented with one of the biggest opportunities ag has ever seen, yet we are reluctant to change.

Something’s gotta give, otherwise we are going to miss this flight altogether.

Thanks!

On the date of publication, Susan Stroud did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.