- Euro targets $1.1

- Markets await US inflation data

Euro rose in European trade on Monday against a basket of major rivals, moving in a positive zone for the first time in five sessions against the dollar, amid a positive outlook with the common currency aiming to surpass $1.1 with hopes for a reduced US-eurozone interest rate gap.

Recent hot eurozone inflation data hurt the odds of another rate cut by the ECB in September, while the US Federal Reserve is heavily expected to cut rates next month.

The Price

The EUR/USD rose 0.15% to $1.0928, with a session-low at $1.0910.

Euro closed down 0.1% on Friday against the dollar on profit-taking off seven-month highs at $1.1008.

Euro rose 0.1% last week, the second weekly profit in a row amid speculation about a reduced interest rate gap with the US.

European Inflation

Recent European consumer prices data beat expectations for July in another sign of mounting inflationary pressures on the ECB.

The data, combined with aggressive remarks by Fed officials, reduced the odds of additional European rate cuts this year.

European Rates

The odds of a 0.5% ECB interest rate cut this year remain at less than 50% as markets await more growth and inflation data to gauge the path forward.

US Rates

According to the Fedwatch tool, the odds of a 0.5% interest rate cut by the Federal Reserve in September stands at 46%, with a 54% chance of a 0.25% rate cut.

Rate Gap

The US-eurozone interest rate gap is currently standing at 125 basis points and could easily shrink to 100 basis points in September, in favor of the US.

- Odds of additional Japanese rate hikes decline

- Markets await US inflation data

The yen lost ground in Asian trade on Monday against a basket of major rivals as the odds of additional interest rate hikes by the Bank of Japan this year tumbled following recent remarks by BOJ officials.

Now markets await important US data for July this week, which will cast light on the path ahead for US policies.

The Price

The USD/JPY rose 0.5% today to 147.12 per yen, with a session-low at 146.45.

Yen closed Friday up 0.4% against the dollar, the first profit in four days as US treasury yields dipped.

Yen also lost 0.1% last week against the dollar, the first weekly loss in a month and a half on profit-taking off seven-month highs at 141.68 yen per dollar.

Bearish Remarks

Bank of Japan Deputy Governor Shinichi Uchida said the central bank won’t raise interest rates when the markets are unstable.

He said that given the current turmoil, the BOJ will prefer to maintain current levels of monetary easing unchanged.

Japanese Rates

Naturally, following the remarks, the odds of a BOJ interest rate hike for the third time this year tumbled considerably, which would likely reduce the pressure to unwind carry trades.

US Rates

According to the Fedwatch tool, the odds of a 0.5% interest rate cut by the Federal Reserve in September stands at 46%, with a 54% chance of a 0.25% rate cut.

Rate Gap

Investors sold the yen mercilessly for months due to the massive interest rate gap between Japan and the US.

The rate gap created profitable opportunities, with traders borrowing cheap yen to invest in dollar assets with higher yields, the so-called Carry Trade.

However, after the BOJ and the Fed’s latest decisions in July, the rate gap between Japan and the US shrank to 525 basis points, the smallest such gap since July 2023.

And now investors expect the gap will shrink to 500 basis points by September as the Fed prepares a new rate cut.

Decreased Probability of Canadian Interest Rate Cuts in September

- Oil Price Recovery Supports the Canadian Dollar's Rise

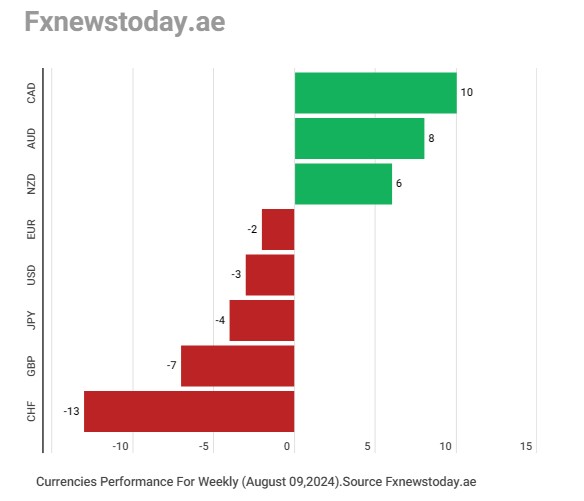

At the end of last week's trading, the Canadian dollar topped the foreign exchange market, outperforming most major and minor currencies. This was due to a noticeable increase in buying activity for the Canadian currency as the best available investment, amid declining expectations that the Bank of Canada will cut interest rates at its September meeting.

The gains were also supported by a broad recovery in global oil prices, as the Canadian economy heavily relies on oil exports to boost its GDP.

Looking at the list of winning currencies, the Swiss franc ranked last due to improved risk appetite in global markets, as well as the increasing likelihood of Swiss interest rate cuts in September.

Before delving into the reasons that supported the Canadian dollar and heavily pressured the Swiss franc, let's first review the performance of the eight major currencies in the foreign exchange market over the past week.

| Currency | Performance (Points) |

|---|---|

| Canadian Dollar | +10 |

| Australian Dollar | +8 |

| New Zealand Dollar | +6 |

| Swiss Franc | -13 |

Canadian Dollar

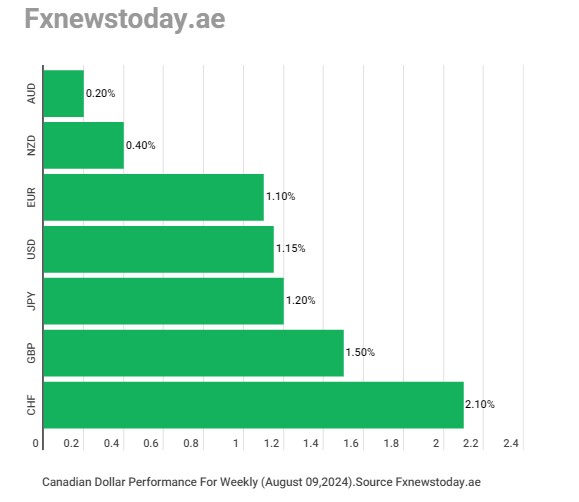

Looking into the details of the Canadian dollar's performance last week against the seven major currencies, it dominated the Swiss franc, rising by 2.1%, climbed by 1.5% against the British pound, increased by 1.2% against the Japanese yen, and by 1.15% against the US dollar. It also rose by 1.1% against the euro, increased by 0.4% against the New Zealand dollar, and grew by 0.2% against the Australian dollar.

Canadian Labor Market

Full-time employment in Canada continued to grow strongly in July, with an increase of 61.6 thousand jobs nearly offsetting the decrease of 64.4 thousand part-time jobs. Meanwhile, the growth of the average hourly wage slowed to 5.2% year-on-year from 5.6% in June.

Strong growth in full-time employment and stable unemployment means the Bank of Canada may be less inclined to worry about the state of the labor market, making an interest rate cut in September less likely on the margin.

However, the significant drop in part-time employment and continued reduction in wage growth also shows that the labor market no longer poses the inflation risk it was once perceived to have.

For this reason, the data also provides a case for the Bank of Canada to continue easing its monetary policy with gradual cuts to the policy interest rate, which was lowered to 4.5% in July.

Global Oil Prices

Global oil prices rose by an average of 3.5% last week, marking the largest weekly gain since June, due to escalating geopolitical risks in the Middle East, which could disrupt oil supplies from the world's largest oil-producing region.

Swiss Franc

The above chart illustrates the significant losses incurred by the Swiss franc last week against the seven major currencies in the foreign exchange market, due to improved risk appetite in global markets.

Stock Market Recovery

Most stock markets in Asia, Europe, and the United States rebounded last week, with this recovery coming amid a slowdown in the unwinding of carry trades and declining fears of a deep recession in the US economy.

Swiss Interest Rates

Recent consumer price data in Switzerland indicates weak internal inflationary pressures on Swiss National Bank policymakers, which increases the likelihood of further Swiss interest rate cuts this year.

With consumer prices slowing in the US, UK, and Europe, external inflationary pressures on the Swiss National Bank are also easing, reinforcing the likelihood of a third Swiss interest rate cut in September.

Ethereum gained ground on Friday even as pressure mounted on high-risk assets amid continuous uncertainty about the Federal Reserve’s policies.

Recent US data showed the economy added just 114 thousand jobs last month, down sharply from 179 thousand in June, while unemployment rose to 4.3% from 4.1%.

The data triggered concerns about a US recession, and the possibility that the Fed might have waited too long to cut interest rates.

Suzan Collins, Boston Fed President, said the Fed might start to cut interest rates soon if inflation kept falling even as the labor sector rebounded.

Ethereum

On trading, ethereum rose 1% at CoinMarketCap as of 21:55 GMT to $2598.1, but marked a heavy weekly loss of 13.7%.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.