(ZCZ24) (CORN) (ZSX24) (SOYB) (TAGS) (KEU24) (DBA) (KCZ24) (SBV24) (CANE)

“No La Niña? Using teleconnections to out-predict computer models for commodity weather forecasting and trading”

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

- Mid-Week Advisory - August 7, 2024

In the coming weeks, I will have a special report about A.I. technology, weather forecasting, and commodity trading. You can sign up here to receive that and see a previous Weather Wealth report (from June), when I became bearish on corn and soybeans, based on my summer weather forecast for good Midwest crops and No La Niña.

https://www.bestweatherinc.com/new-membership-options/

So… how did we “out-forecast” all of the other weather firms and even some A.I. models? What most computer models miss is something we call “connecting the teleconnections.” The lion's share of weather models uses ocean temperatures and local current conditions in thousands of cities to create algorithms that go into the European and GFS weather models. While these models have improved, thus allowing NOAA and many similar agencies to make fairly accurate weather forecasts, they often miss commodity weather more than two weeks in advance.

Teleconnections “connect” the dots between ocean temperatures and weather patterns thousands of miles away.

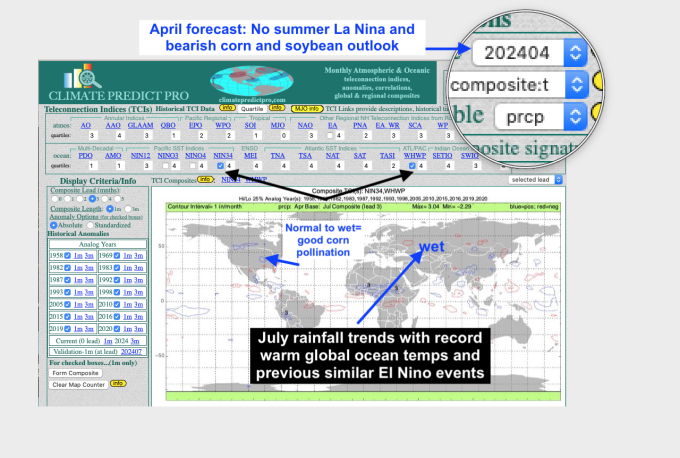

As you can see from my in-house program ClimatePredict (one of the few weather models in the world that incorporates teleconnections and historical weather trends), my prediction last April was that July was going to be great for most midwest corn and soybean crops. That will continue over 80% of the Midwest grain belt through August. Our one concern is the dryness for Kansas and wet weather delaying spring wheat harvesting in Russia.

My program has also been predicting improved global weather for sugar and potential cocoa crops going deeper into 2024 and 2025. Our one concern is Brazil’s coffee areas, where heat and dryness will compromise their crop.

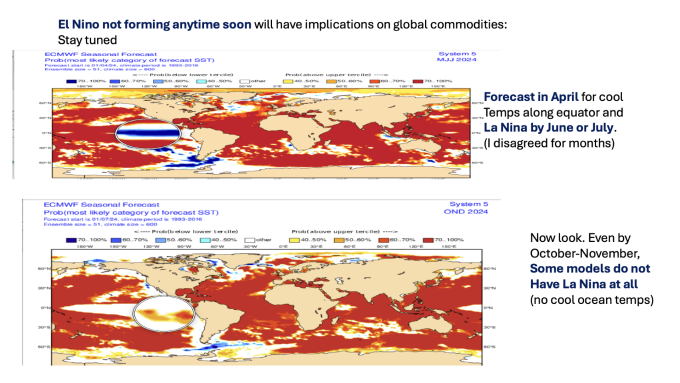

Anyway, at least two-thirds of the above-mentioned years that had many similar summer weather conditions in the Northern Hemisphere did not transition to La Nina until after October or neither at all. Now, two to three months later, many models (such as the European) are not predicting that La Nina will form at all this year. How about that?

Thanks for your interest in commodity weather!

Jim Roemer, Scott Mathews, and The Weather Wealth Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He also is a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he established a unique standing among advisors in the commodity risk management industry.

Trading futures and options involves a significant risk of loss and is not suitable for everyone. Past performance is not necessarily indicative of future results.

On the date of publication, Jim Roemer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.