Burlington, Massachusetts-based Keurig Dr Pepper Inc. (KDP) is a non-alcoholic beverage company. It owns, manufactures, and distributes beverages and single-serve brewing systems in the U.S. and internationally. With a market cap of $47.5 billion, Keurig Dr Pepper operates through the U.S. Refreshment Beverages, U.S. Coffee, and International segments.

The beverage giant has significantly underperformed during the past year. KDP stock is up 2.1% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 15.8% gains over the same time frame. In 2024, KDP gained 2.9% compared to SPX’s 8.7% return on a YTD basis.

Zooming in further, KDP has outpaced the Nasdaq Food & Beverage ETF’s (FTXG) marginal returns on a YTD basis and an 8% decline in the past 52 weeks.

Shares of Keurig Dr Pepper rose 1.3% on Jul. 25 and remained in green for the next two trading sessions after the release of its Q2 earnings. It surpassed Wall Street’s topline estimates and matched the EPS projections while reporting a quarterly growth of 3.5% in revenues and 7.1% in EPS. Moreover, it witnessed an improvement in margins and reaffirmed its full-year guidance bolstering investors’ confidence in the company’s prospects.

For the current fiscal year, ending in December, analysts expect KDP to report an EPS growth of 7.3% to $1.92. The company has a history of beating or matching consensus EPS estimates over the past four quarters.

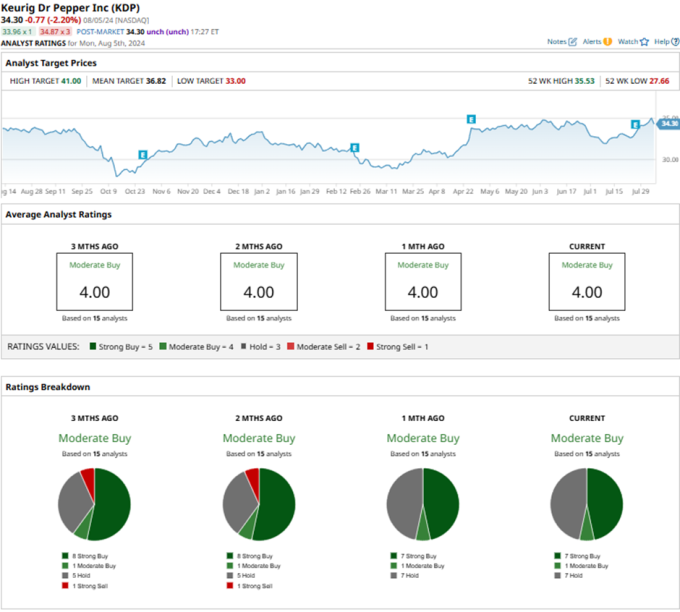

Among the 15 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, one “Moderate Buy,” and seven “Holds.”

On Jul. 29, Barclays plc (BCLYF) analyst Lauren Lieberman maintained a “Buy” rating on Keurig Dr Pepper with a price target of $37.

KDP’s mean price target of $36.82 represents a premium of 7.3% to current price levels. The Street-high target of $41 indicates a potential upside of 19.5%.

More Stock Market News from

- Are Wall Street Analysts Bullish on Walt Disney Stock?

- Host Hotels & Resorts Stock Outlook: Is Wall Street Bullish or Bearish?

- This CFO Invested $1.1M in His Company's Stock After Earnings

- Do Wall Street Analysts Like EOG Resources Stock?

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.