Houston, Texas-based Halliburton Company (HAL) provides energy, engineering, and construction services and manufactures products for the energy industry. Valued at $28.2 billion by market cap, the company offers services and products and integrated solutions to customers in the exploration, development, and production of oil and natural gas (NGM24).

Shares of this leading energy equipment and services provider have underperformed the broader market considerably over the past year. HAL has declined 18.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 18.5%. In 2024 alone, HAL stock is down 12%, while the SPX is up 12.1% on a YTD basis.

Narrowing the focus, HAL’s underperformance looks less pronounced compared to the SPDR S&P Oil & Gas Equipment Services ETF (XES). The exchange-traded fund has dropped 4.8% over the past year. Besides, the ETF’s 4.8% returns on a YTD basis outshine the stock’s double-digit losses over the same time frame.

HAL’s overall weak price momentum compared to the broader market can be attributed to the current wave of industry consolidation that is creating a shift in the oilfield services sector, resulting in reduced opportunities for providers.

Moreover, on Jul. 19, HAL shares closed down 5.6% following the release of its Q2 earnings report. The company's revenue of $5.83 billion fell short of the consensus estimate of $5.95 billion. However, its adjusted EPS of $0.80 aligned with Wall Street expectations. Additionally, Halliburton reported $1.08 billion in cash flow from operations and $793 million in free cash flow.

For the current fiscal year, ending in December, analysts expect HAL’s EPS to grow 1.6% to $3.18 on a diluted basis. The company’s earnings surprise history is impressive. It beat or matched the consensus estimate in each of the last four quarters.

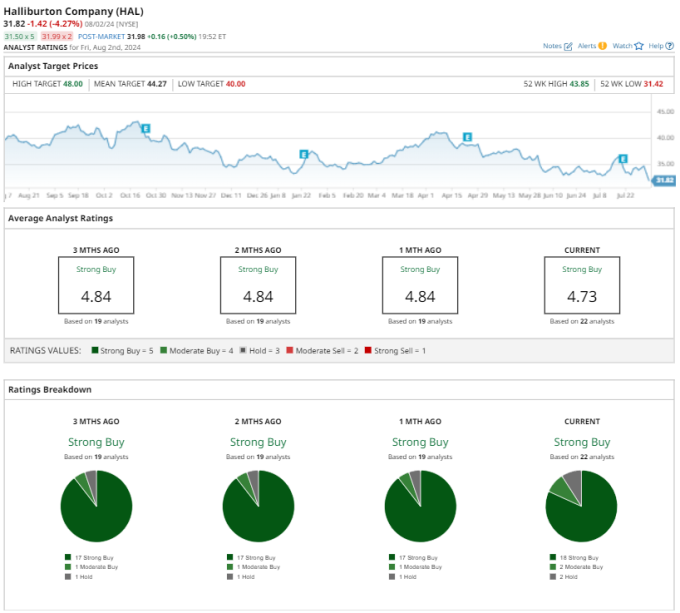

Among the 22 analysts covering HAL stock, the consensus rating is a “Strong Buy.” That’s based on 18 “Strong Buy” ratings, two “Moderate Buys,” and two “Holds.”

This configuration is slightly more bullish than a month ago, with 17 suggesting a “Strong Buy,” and one advising a “Moderate Buy.”

On Jul. 29, Jefferies’ analyst maintained a “Buy” rating on HAL stock but lowered the price target to $47 from $50, implying a potential upside of 47.7% from current levels.

The mean price target of $44.27 represents a 39.1% premium to HAL’s current price levels. The Street-high price target of $48 suggests an upside potential of 50.8%.

More Stock Market News from

- Are Wall Street Analysts Bullish on CSX Corporation Stock?

- 3 Energy Dividend Stocks to Buy This August

- Are Wall Street Analysts Predicting Morgan Stanley Stock Will Climb or Sink?

- Global Equity Markets Plunge on Risk-Off Sentiment in Asset Markets

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.