Dollar Under Pressure Due to Interest Rates and Yen

• Rising speculations about Japanese interest rate hikes

• Increasing inflationary pressures on the Bank of Japan

• Full pricing of US interest rate cut probabilities

Due to the rapid unwinding of carry trade positions ahead of the Bank of Japan meeting, the Japanese yen has surged in the foreign exchange market, showing a stellar performance against most major and minor currencies.

Speculations have increased about a second interest rate hike in Japan this year, coupled with a reduction in bond purchases, amidst growing inflationary pressures on Japanese monetary policymakers.

As the Bank of Japan accelerates its steps toward normalizing monetary policy, most global central banks are moving towards easing their monetary policies.

This undoubtedly means a narrowing of the interest rate gap between Japan and advanced economies, which had been significantly weighing on the yen's exchange rate and strongly supporting the increase in carry trade positions.

With the probabilities of the US Federal Reserve cutting interest rates twice this year fully priced in, the USD/JPY pair has led the unwinding of carry trade positions.

On the list of winning currencies, the Australian dollar has lagged due to risk aversion in global markets, coupled with concerns about the Chinese economy, Australia's largest trading partner.

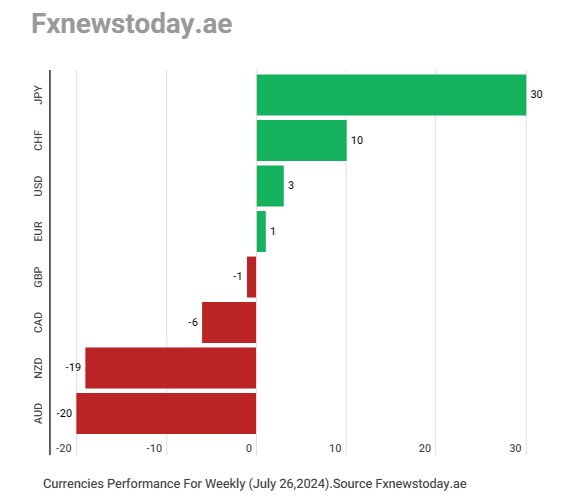

Before delving into the reasons supporting the Japanese yen and heavily pressuring the Australian dollar, let's first look at the performance of the eight major currencies in the foreign exchange market over the past week.

The Japanese yen rose by 30 points on the "FX News Today" weekly currency strength index, followed by the Swiss franc in second place with 10 points, and the US dollar in third place with 3 points. The Australian dollar ranked last with a negative 20 points.

Japanese Yen

Looking at the detailed performance of the Japanese yen last week against the seven major currencies, it surged against the Australian dollar, gaining 4.55%, and reached its highest level in three months at 99.21 yen on Thursday, July 25.

It climbed by 4.45% against the New Zealand dollar, reaching its highest level in five months at 89.80 yen on Thursday. It increased by 3.2% against the Canadian dollar, reaching a four-month high of 109.89 yen on Thursday.

It added 2.8% against the British pound, reaching a two-month high of 195.85 yen on Thursday. It rose by 2.65% against the euro, reaching a two-month high of 164.82 yen on Thursday.

It gained 2.4% against the US dollar, reaching a two-and-a-half-month high of 151.94 yen on Thursday. It increased by 1.8% against the Swiss franc, reaching a two-month high of 172.33 yen on Thursday, July 25.

What is Carry Trade?

Carry trade is one of the best and most important strategies used by many experts and traders in the trading world. It is a way to build long-term trading positions to take advantage of interest rate differentials between currencies in the forex market.

Carry trade transactions in the forex market involve selling a low-yielding currency and buying a high-yielding currency, financing the trading position daily, weekly, or any period chosen by the trader, allowing them to benefit from the interest rate differential.

The low-yielding currency is referred to as the "funding currency," while the high-yielding currency is the "yield currency." In the USD/JPY pair, the yield currency is the US dollar, and the funding currency is the Japanese yen.

Traders borrow in the low-yielding yen through forward points daily, weekly, or any period they choose, and lend the high-yielding US dollar through forward points.

If we assume that the yields on the low-yielding currency will continue to decline or the yields on the high-yielding currency will continue to rise, financing this trade daily is an easy way to achieve profits.

Unwinding Carry Trade Positions

Currently, there is an accelerated unwinding of long-term carry trade positions on the Japanese yen due to strong speculations about the upcoming monetary policy meeting of the Bank of Japan scheduled for late July.

Sources told Reuters that the Bank of Japan is likely to discuss whether to raise interest rates and unveil a plan to halve bond purchases in the coming years, indicating its intention to steadily retreat from its massive monetary stimulus.

In contrast, weak economic data in the United States has raised the probabilities of the Federal Reserve cutting US interest rates by 25 basis points in September from 94% to 100% and in November from 98% to 100%.

Thus, the Bank of Japan is set to take new steps towards normalizing monetary policy for the world's third-largest economy, while the Federal Reserve is close to easing monetary policy and starting a cycle of US interest rate cuts.

Inflation in Tokyo

Data last week showed that core inflation in Tokyo rose by 2.2% annually in July, up from 2.1% the previous month, meeting market expectations of a 2.2% increase.

Prices in Japan are currently accelerating above the Bank of Japan's 2.0% inflation target, increasing the likelihood of additional interest rate hikes in Japan this year.

Bank of Japan Meeting

The Bank of Japan meets on July 30-31 to study the appropriate monetary policy for the world's third-largest economy. It is expected to announce a plan to reduce government bond purchases, with a high probability of a 10 basis point interest rate hike for the second time this year.

Australian Dollar

The image above shows the broad losses suffered by the Australian dollar last week against the seven major currencies in the foreign exchange market due to risk aversion and concerns about the Chinese economy.

Risk Aversion

The massive rise in the Japanese yen has indeed turned the markets upside down, sparking a broad sell-off in most global stock markets led by technology stocks, as well as a decline in precious metals led by gold and cryptocurrencies led by Bitcoin.

Investors are reassessing their leveraged bets, leading to changes in their investment strategies and attempts to mitigate increasing risks in the volatile market environment.

Chinese Economy

Unexpected interest rate cuts in China have raised concerns that Chinese authorities are struggling to revive the world's second-largest economy. The People's Bank of China implemented a surprise interest rate cut last Monday, followed by a reduction in the lending rate on its medium-term facilities on Thursday.

- Markets await BOJ meeting decisions

- Speculation about second Japanese rate hike this year

The yen rose in Asian trade against a basket of major rivals, extending gains for the second day against the dollar, and on track for touching 2-⅕ month highs amid speculation about another interest rate hike by Bank of Japan this year.

The yen is buoyed by a drop in US 10-year treasury yields ahead of the Federal Reserve’s meeting tomorrow, expected to provide important clues on the future of US interest rates.

The Price

The USD/JPY fell 0.4% today to 153.01 yen, with a session-high at 154.35.

Yen rose 0.1% on Friday against the dollar, resuming gains and moving away from 2-⅕ month highs at 151.94 yen per dollar.

Yen rose 2.35% last week, the fourth weekly profit in a row, and the largest since late April after the rapid unwinding of carry trades.

BOJ

Tomorrow, Tuesday, the Bank of Japan is holding its policy meeting, at which it might raise interest rates by 10 basis points to 0.20%.

The BOJ will likely announce a steep cut in the monthly purchases of government bonds, according to recent data.

The BOJ’s efforts to normalize policies come at a time when most other central banks have already tightened their policies for years and now moved on to rate cuts.

US Yields

US 10-year treasury yields fell 0.4% on Monday, sharpening losses for the third session and plumbing two-week lows at 4.171%, hurting the dollar’s standing.

The developments came ahead of the Federal Reserve’s policy meeting tomorrow, at which it’ll likely provide fresh clues on the odds of a rate cut at the September meeting.

A shrinkage of the Japan-US long-term yields gap would boost the yen’s standing against the dollar and other major rivals.

Ethereum rose on Friday amid mixed performance by high-risk assets following important US inflation data that could have bearing on the future of US monetary policies.

US core personal spending, excluding food and energy, rose by 0.2% m/m in June, and 2.6% y/y, matching expectations.

The US consumer confidence index released by the Michigan University fell 2.6% m/m to 66.4 in July.

There’s now a 23% chance of a 0.5% Fed interest rate cut at the September policy meeting, and a 100% chance of at least a 0.25% rate cut.

Ethereum

Ethereum rose 4.9% on Coinmarketcap as of 21:34 GMT to $3267, while marking a weekly loss of 6.8%.

US stock indices rose on Friday as analysts assess the latest US inflation data released today.

Official data showed core personal spending, excluding energy and food, rose 0.2% m/m in June, and 2.6% y/y, matching expectations.

Investors continue to assess latest earnings results by major corporations for the second quarter of 2024, with both Alphabet’s and Tesla’s results awaited this week.

On trading, Dow Jones rose 1.6%, or 656 points as of 16:44 GMT to 40,591, while S&P 500 rose 1%, or 56 points to 5455, as NASDAQ added 0.8%, or 155 points to 17,337.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.