Macau is best known as the casino capital of Asia. But the former Portuguese colony, on China’s south coast, is hoping to gain a reputation for more reputable ways to make money. In August trading began on the mcex, a market that is the first of its kind. Investors are not exchanging currencies, debt or equity. Instead, they are buying the future revenues of businesses in mainland China.

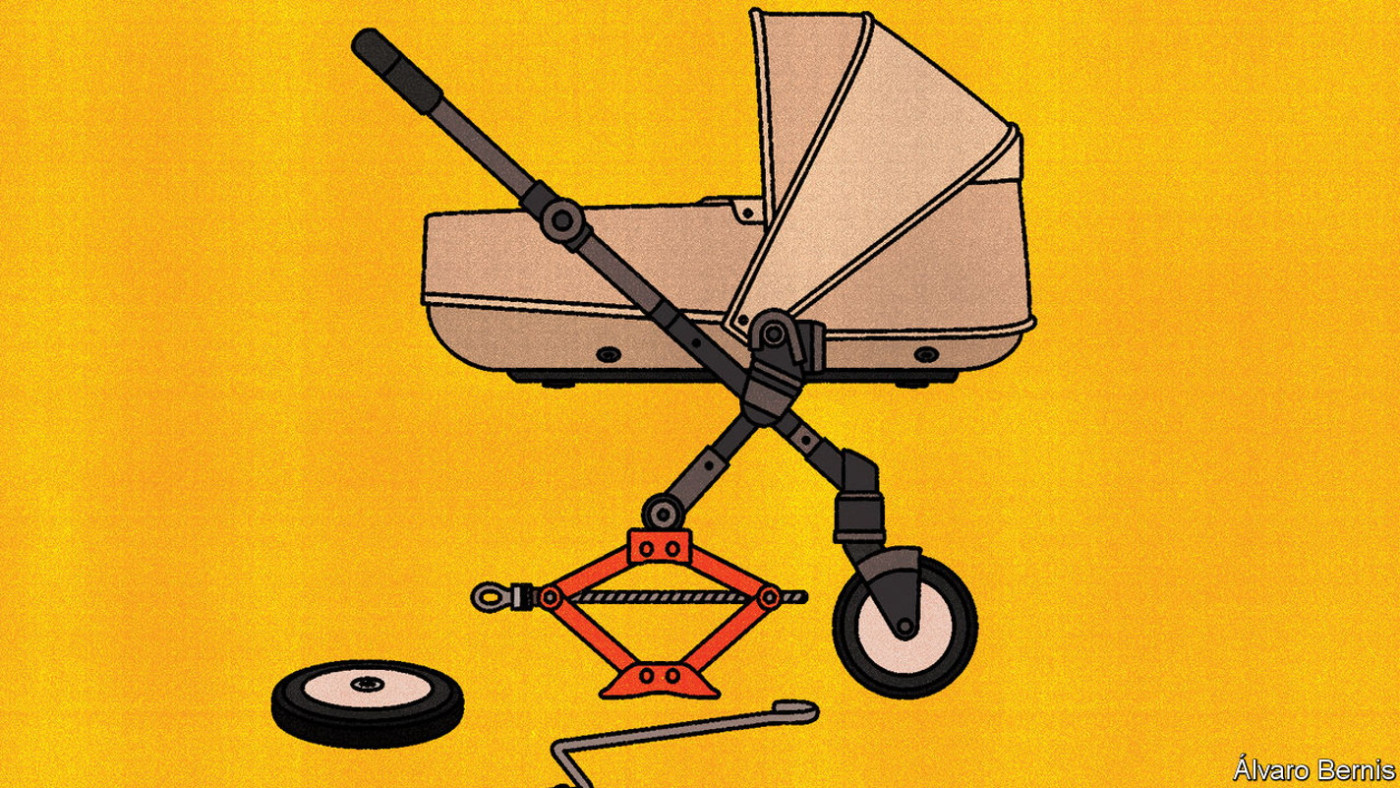

If successful, the exchange may help solve a problem that plagues smaller firms both in China and elsewhere: the difficulty of finding finance. Charles Li, a former boss of Hong Kong’s stock exchange and the creator of the new market, has said that investors tend to eschew lending to such businesses simply because the risks and rewards are poorly matched, with borrowers burdened if a venture flops and financiers short-changed if it goes well. For bigger companies, the solution is listing on a public market—something beyond the means of their smaller peers.

Mr Li believes he may have solved this mismatch. mcex allows investors to buy and sell a new type of financial instrument called a Daily Revenue Obligation (dro). Contract owners gain a fraction of a business’s revenue for a fixed period of time, in effect buying the right to future income. Issuance has been strong. dros worth almost 2.2bn yuan ($300m) were offered on the exchange in the first month of trading.

Selling future revenues is a good deal for small firms. Owners get access to capital without diluting their stake and without repayment obligations. For investors, the advantage is less clear (indeed, no information is available about their appetite so far). Micro Connect, which owns the exchange, claims they can enjoy “equity-like returns”. Their exposure is, however, rather large. Small firms often fail. Whereas a loan secured against assets has limited downside for its financier, the risk for a dro holder is limited only by the size of the investment. They have no claims on the assets of the business if it goes bankrupt.

But Micro Connect does have a couple of selling points. If financial instruments designed to fund firms that banks won’t lend to and investors won’t buy sounds unpalatable, allocators can diversify their risk by buying up pools of dros, known as a “Daily Revenue Portfolio”. The underlying dros are unrated, but the pools are given a risk indicator under a framework developed by a Chinese rating agency, which relies on predictions of cash flows.

Mr Li’s financial innovation also offers foreign investors something valuable: access to China. After decades of trying, overseas investors still have few good options. Cross-border private-equity deals have collapsed; “keepwell agreements”, between parent firms and subsidiaries, have been the subject of years-long court disputes. mcex promises to be different. dros are Macau-issued copies of contracts agreed on the mainland. Micro Connect takes on the enforcement risk in mainland China and offers investors the assurance of a contract enforceable under Macanese law.

The company that issues a dro will have its revenues verified and disbursed by local banks each day, and recorded on a blockchain, providing investors with real-time insight into the performance of the business in which they have an interest. Although technology cannot eliminate accounting trickery, such as changing when invoices are issued, it can prevent fraud. It is almost impossible for a business to earn and not disclose cash revenues in China’s entirely digitised economy.

China’s entrepreneurs may be especially eager to make use of the scheme now. Banks are scrutinising lending more closely owing to the economy’s struggles, so firms are looking elsewhere for capital. Many are turning to outfits beyond the banking system, known as “shadow lenders”, from which China Beige Book, a data firm, says borrowing is at near-record highs as a share of total lending. This helps explain why China’s smaller firms are keen. Whether these are the sorts of businesses in which foreign investors want to invest is another question entirely. ■

Correction (September 29th 2023): An earlier version of this article incorrectly described MCEX as an over-the-counter market. Sorry.

For more expert analysis of the biggest stories in economics, finance and markets, sign up to Money Talks, our weekly subscriber-only newsletter.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.