5 | Change is coming in 2025

US biomass-based diesel imports are on track to exceed one billion gallons in 2024. Effective January 1, the government will no longer incentivize biofuel imports as the current IRA blenders tax credit becomes a producers credit (45Z), encouraging domestic biofuel production.

The question is - where will the additional 8 billion+ pounds of needed biomass-based diesel feedstocks come from?

Note: Chart is for illustration purposes, assuming we swap biomass-based diesel fuel imports with domestic production one-for-one.

4 | Fair Share

Oilshare has rallied sharply in recent weeks as soybean oil has outperformed meal. Today's oilshare near 41% is notably higher than the mid-upper 30s we spend May and June at.

Prior to the boom in renewable diesel demand, oil held a one-third share of the value of a bushel of beans on average (meal = the other two-thirds).

When biomass-based diesel production began skyrocketing in 2021 and the years following, old norms went out the window as the industry fervently began crushing for oil amid explosive feedstock demand.

As a result, oilshare averaged 43% from 2021 to 2023 - a more-than 30% increase from historical norms and relatively close to where we sit today.

3 | Lookin good!

Here's a look at current US corn conditions versus other years the crop was rated this ‘good/excellent’ or better in mid-July:

Assuming ratings hold, current conditions imply we are headed for a final yield larger than trend with 2020 being the exception due to poor finishing weather/the derecho that impacted 12 million acres across the I-states.

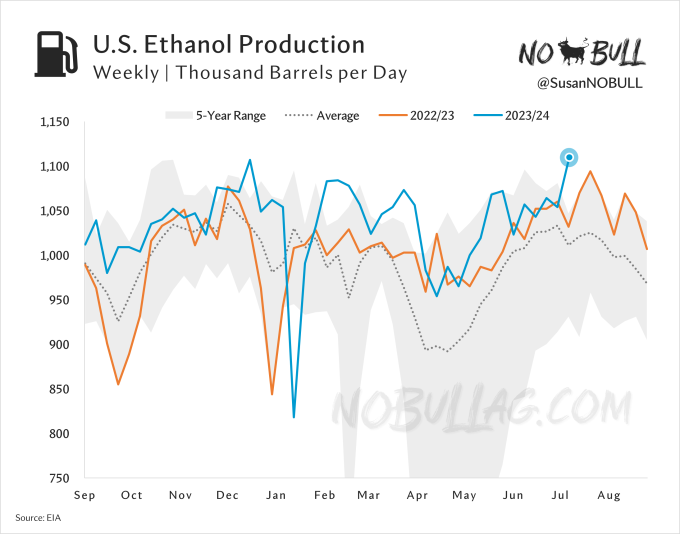

2 | Ethanol production, strong like bull

Ethanol production for the week ending July 12 was notable, jumping 4.9% week-on-week to 1,106 thousand barrels per day.

The surge in production was not only a 29-week high, but ranks last week’s production among the top weeks on record only behind 1,108 kbpd in December 2017 and 1,107 kbdp in December of last year.

1 | The Bottom Line

Last week's July WASDE held a few surprises for US corn as USDA raised feed/residual an unexpected 75 million bushels, providing an assist alongside a 75-million-bushel increase in exports to drop 2023/24 ending stocks below 2 billion bushels for the first time this marketing year.

The increase in old crop demand and resulting decrease in carryout flowed into 2024/25, helping offset the production increase with larger area. After additional adjustments higher in new crop feed/residual and export demand, 2024/25 ending stocks were down 5 million bushels on the month at 2.097 billion bushels.

Looking at ending stocks in terms of days of supply on hand helps illustrate the massive swings in stocks we have lived the past 5 years.

More days of supplies on hand = lower prices. The correlation is clear. In fact, history says anytime the US is above 50 days of supply on hand, average farm prices sink below the all-important $4 mark.

For the full version of this post or to subscribe, visit NoBullAg.Substack.com.

Thanks!

On the date of publication, Susan Stroud did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.