The US dollar gained ground in European trade on Monday against a basket of major rivals, about to mark the first profit in four days on haven demand after a failed assassination attempt on ex-President Donald Trump.

The developments came ahead of an important speech later today in Washington by Fed Chair Jerome Powell on inflation and the future of interest rates.

The Price

The dollar index rose 0.25% today to 104.32, with a session-low at 104.07.

The index closed down 0.4% on Friday, the third loss in a row, with a five-week low at 104.04 as US treasury yields continue to sustain losses.

The index gave up 0.8% last week, the second weekly loss in a row on the increasing odds of two US interest rate cuts this year.

The gains come after a failed assassination attempt on ex-US President Donald Trump in a rally during the weekend.

The attempt boosted Trump’s odds of winning the elections, with investors viewing Trump’s flexible fiscal policies and support for raising tariffs as beneficial for the dollar, but potentially weakening for US treasury bonds.

US Rates

According to the Fedwatch tool, there’s a 94% chance of a Fed rate cut in September, and a 98% chance of such a cut in November.

Powell

Now investors await a crucial speech by Fed chair Jerome Powell later today in Washington DC to gauge the likely path ahead for policies.

Gold prices fell in European trade on Monday on track for the second straight session away from two-month highs on profit-taking, as the dollar rebounds against a basket of major rivals.

Later today, Fed Chair Jerome Powell will speak about the inflation fight in the US and the future of interest rates in a speech in Washington DC.

Prices

Gold prices fell 0.4% to $2401 an ounce, with a session-high at $2415, after losing 0.2% on Friday, the first loss in four days, away from a two-month high at $2424.

The precious metal rose 0.8% last week, the third weekly profit in a row as both the dollar and US yields dropped.

The Dollar

The dollar index rose 0.2% on Monday on track for the first profit in four sessions away from five-week lows at 104.04 against a basket of major rivals.

The recovery comes as investors shun risks after a failed assassination attempt on ex-US President Donald Trump in a rally during the weekend.

The attempt boosted Trump’s odds of winning the elections, with investors viewing Trump’s flexible fiscal policies and support for raising tariffs as beneficial for the dollar, but potentially weakening for US treasury bonds.

US Rates

According to the Fedwatch tool, there’s a 94% chance of a Fed rate cut in September, and a 98% chance of such a cut in November.

Powell

Now investors await a crucial speech by Fed chair Jerome Powell later today in Washington DC to gauge the likely path ahead for policies.

The SPDR

Gold holdings at the SPDR Gold Trust remained flat yesterday at 835.09 tonnes, the highest since June 7.

• The Japanese currency sweeps most major and minor currencies

- Decline in US yields supported Japanese currency gains

- The Japanese yen moves away from the lowest levels in 38 years

Thanks to the intervention of the Japanese Central Bank in the foreign exchange market to stop the excessive weakness in the levels of the local currency, the Japanese yen topped the list of winning currencies last week, sweeping most major and minor currencies, achieving the best weekly performance since late April, as new buying positions accelerated in tandem with covering short positions.

While the Bank of Japan previously intervened in the exchange market relying on a strategy of low liquidity and momentum to achieve the best support at the lowest cost, it seems to have abandoned this strategy. The bank currently relies on a new strategy based on strong liquidity and accelerated momentum.

The sharp decline in long-term US Treasury yields also supported the Japanese currency's gains, as cooler inflation data in the United States boosted the likelihood of the Federal Reserve cutting interest rates at least twice this year.

Returning to the list of winning currencies, the New Zealand dollar came last, due to a significant shift in the Reserve Bank of New Zealand's stance from tightening to easing, boosting the likelihood of cutting New Zealand interest rates this year.

Before continuing with the reasons that supported the Japanese yen and severely pressured the New Zealand dollar, let's first review the performance of the eight major currencies in the foreign exchange market over the past week.

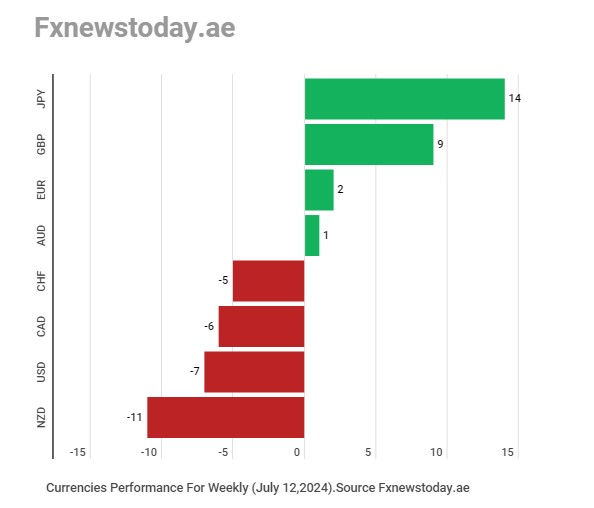

The Japanese yen rose by 14 points on the "FX News Today" weekly index for measuring currency strength, followed by the British pound in second place with 9 points, the euro in third place with 2 points, and the New Zealand dollar in last place with a negative 11 points.

Japanese Yen

Looking at the details of the Japanese yen's performance last week against the seven major currencies, it swept the New Zealand dollar, rising by 2.25%, and reached its highest level in three weeks at 96.10 yen on Friday, July 12.

It rose by 1.85% against the US dollar, reaching its highest level in three weeks at 157.35 yen on Friday, and increased by 1.8% against the Canadian dollar, reaching its highest level in three weeks at 115.45 yen.

It added 1.7% against the Swiss franc, reaching its highest level in four weeks at 176.05 yen on Friday, and rose by 1.3% against the Australian dollar, reaching its highest level in two weeks at 106.75 yen.

It increased by 1.2% against the euro, reaching its highest level in two weeks at 171.45 yen on Friday, and rose by 0.5% against the British pound, reaching its highest level in a week at 203.82 yen on Friday.

Japanese Central Bank

Daily transaction data from the Japanese Central Bank on Friday showed that the Bank of Japan spent between 3.37 trillion and 3.57 trillion yen (21.18 billion to 22 billion dollars) on buying yen on Thursday, less than three months after the last intervention in the foreign exchange market.

With the yen continuing to achieve strong gains against most major and minor currencies on Friday, speculation increased that the Japanese Central Bank may have intervened for the second consecutive day to support the local currency.

The Bank of Japan intervened at the end of April and early May, spending nearly 9.8 trillion yen (61.55 billion dollars) to support the currency. There will be a report at the end of the month from the Ministry of Finance that will confirm the amount spent on the new intervention.

Strategy of Exploiting Low Liquidity

The Japanese Central Bank intervened for at least two days in late April and early May in the foreign exchange market by buying large quantities of yen, especially after trading below the 160-yen barrier per US dollar for the first time since 1990.

The first intervention occurred on Monday, April 29, during a Japanese holiday, and the second on Wednesday, May 1, late after the stock markets closed on Wall Street, with the intervention strategy focusing on operating during times of very low market liquidity.

The intervention strategy during periods of calm clearly has a greater impact, giving the Japanese Central Bank more benefit for the money it spends in supporting the local currency.

New Intervention Strategy

The Bank of Japan has abandoned the intervention strategy during times of low liquidity, relying on a new intervention strategy that exploits times of strong liquidity and accelerated market momentum.

Opinions and Analyses

- G10 FX Global Company President "Steve Englander" said: If the Bank of Japan intervened on Thursday, they likely intervened on Friday as well.

- Englander added: This could mean the Japanese currency's rise is due to closing positions betting on a yen decline.

- UBS Currency Strategy Head "James Malcolm" said: Friday's move might have been the result of intervention or price checking. The Bank of Japan sometimes calls traders to ask for price levels, which could indicate potential intervention and cause market movements by itself.

- Malcolm added: The Bank of Japan needs to change tactics to keep the market on its toes and show that intervention is serious. Thursday's intervention did not seem to cost them much.

US Bond Yields

The yield on US 10-year Treasury bonds fell last week by about 2.25 percentage points, recording its lowest level in four months at 4.168%, which reduced investment opportunities in the US dollar.

This development in the US bond market came after the release of cooler-than-expected inflation data in the United States for June, reducing inflationary pressures on Federal Reserve policymakers.

Following this data, the pricing of futures contracts for the likelihood of a US interest rate cut by about 25 basis points in September increased from 73% to 84%, and the likelihood of a cut in November from 85% to 93%.

The narrowing of the 10-year Treasury bond yield gap between Japan and the United States makes Japanese currency yields an investment target for short-sellers and financing deals, which supports the rise in the yen exchange rate.

New Zealand Dollar

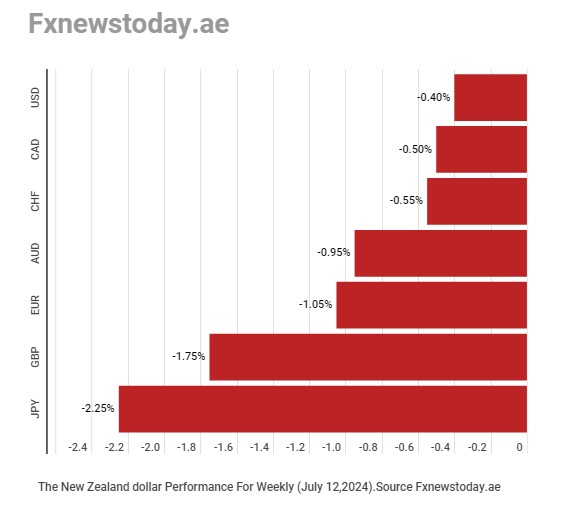

The image above illustrates the extensive losses incurred by the New Zealand dollar last week against the seven major currencies in the foreign exchange market due to the Reserve Bank of New Zealand.

Reserve Bank of New Zealand

According to most expectations, the Reserve Bank of New Zealand kept interest rates unchanged last week for the seventh consecutive meeting, maintaining the benchmark interest rate range at 5.50%, the highest level since October 2008.

In its monetary policy statement, the Reserve Bank of New Zealand said: The members agreed on the necessity of continuing restrictive monetary policy, with this restriction being eased over time in line with the expected decline in inflationary pressures.

In its previous meeting in May, the Reserve Bank of New Zealand said: The policy is expected to remain restrictive for a "prolonged" period, and indicated that an interest rate increase is possible if inflation is not controlled.

On Wednesday, the Reserve Bank of New Zealand said: It expects headline inflation to return to the target range of 1% to 3% in the second half of this year.

The New Zealand central bank added: Some domestic price pressures remain strong, but there are signs that the decline in inflation will align with lower capacity pressures and pricing intentions among companies.

The Reserve Bank of New Zealand, as the frontrunner in withdrawing pandemic-era stimulus among its global central bank peers, has raised interest rates by 525 basis points since October 2021 to curb inflation in the most aggressive tightening since the official interest rate was introduced in 1999.

Raising interest rates has significantly slowed the economy, although recent data showed that New Zealand exited a technical recession in the first quarter of 2024 with a growth of 0.2%.

New Zealand Interest Rates

After the significant shift in the Reserve Bank of New Zealand's stance from tightening to easing, and after expressing confidence that inflation will return to its target range this year, the likelihood of cutting New Zealand interest rates this year has markedly increased.

Markets are currently pricing a 40% chance of a 25 basis point cut in New Zealand interest rates in August, and an 80% chance of a cut in November.

Opinions and Analyses

- Capital Economics economist "Abhijit Surya" said in a note: "The Reserve Bank of New Zealand appeared dovish in its comments, and the committee's messages gave more confidence that the bank will start its easing cycle in November."

- Surya added: The central bank also changed its language on inflation and now believes that monetary policy has "significantly" reduced consumer price inflation.

Yen rose on Monday against a basket of major rivals, maintaining gains for the third straight session against the dollar and trading near three-week highs under supervision of Japanese authorities which might intervene once again in the forex market.

The yen is also boosted by risk aversion as investors buy up safe currencies after the assassination attempt of ex-US President Donald Trump.

The Price

The USD/JPY fell 0.2% today to 157.83 yen, with a session-high at 158.43.

The yen rose 0.4% on Friday against the greenback, the second profit in a row, marking a three-week high at 157.35 as the Bank of Japan intervened.

The yen also rose 1.8% last week against the dollar, the second weekly profit in a row, and the largest since late April.

Intervention

Bank of Japan’s daily operations data showed it spent upwards of nearly $22 billion on Thursday to prop up the currency.

The yen marked strong gains against most major rivals even on Friday, raising speculation it might have intervened once again on Friday.

The BOJ spent nearly $61.55 billion in late April to boost the yen and intervene back then.

Trump Assassination

Republican candidate for the US Presidency Donald Trump was shot in the ear in an assassination attempt during an election rally, with the ex-President surviving without lasting damage.

The assassination attempt will likely boost Trump’s election chances against incumbent president Joe Biden.

The attempt and increasing political violence risks further uncertainty and instability in the US, which constitute risks for the markets.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.