#5 | $5 No More

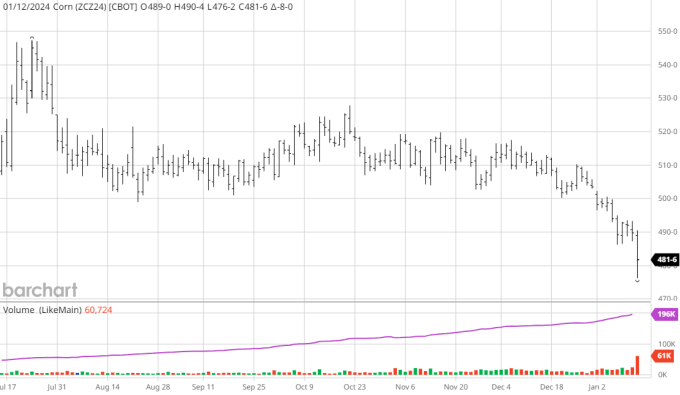

Corn has been painfully grinding lower now for months, making new lows an unfortunate regular occurrence as we have started the new year.

As a result, $5 has become a distant memory, leaving both analysts and producers alike wondering if we ever recover, what level will we be recovering from?

This is probably the worst way to start an article if I am aiming to retain readers, but as they say ~no pain, no gain~ and unfortunately, the most important part of successful marketing means you have to look at what went wrong and figure out how to avoid the same mistake in the future.

Perhaps you just scoffed a bit at the word ‘successful’… sure, success would have been shorting 150% of 2023 production at $6.00 CZ23 but that ship has sailed, therefore it is time to re-evaluate.

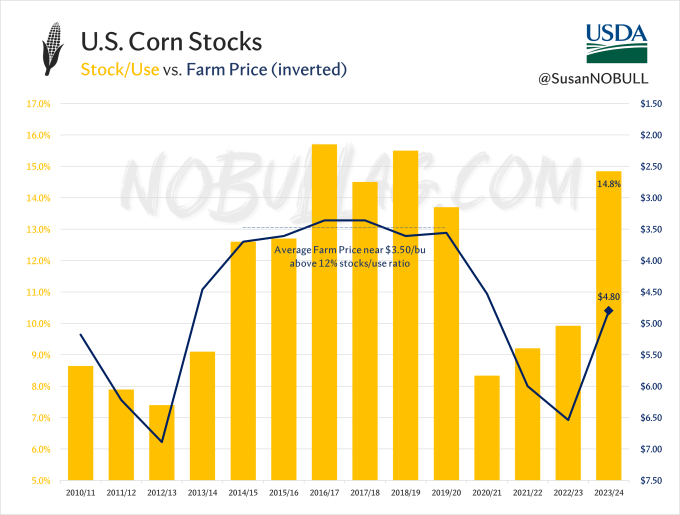

The bottom line is the uncomfortably tight stocks situation of the past three years is gone and we have an uphill battle ahead.

With all signs pointing to a stocks/use ratio near 20% next year, it throws December 24 into the spotlight, especially as old crop futures continue making lower lows. A fellow analyst-friend of mine recently said, “the hardest sales to make are usually the best ones.”

While no one knows definitively what 2024 holds for markets, I am certain pulling the trigger this year will be more difficult than in any of the past few.

#4 | 40%

Oilshare is back at 40% as soybean meal has fallen on its face in recent weeks.

Much of oil’s “strength” (it’s +0.15% YTD is hardly strong, but at least it hasn’t tanked) can be attributed to weakness in meal which has lost 6% since the calendar turned to January.

March meal breached the early-summer lows on Friday, falling $90 from its highs just eight short weeks ago.

#3 | 3 Growing Shorts

The net short in ags continues to grow as funds have increased their bearish bets against corn, soybeans and meal in recent weeks. Soybeans and meal have both seen a sizable decrease in long position in addition to a sizable increase in new shorts.

Corn, on the other hand, has been dominated by new shorts entering the market, pressuring futures to new lows. A growing 2+ billion bushel carryout, paltry demand and prospects for an even heavier balance sheet in the coming year have pushed corn's net position to its shortest since the low-$3 days of June 2020.

#2 | Ethanol, strong like bull

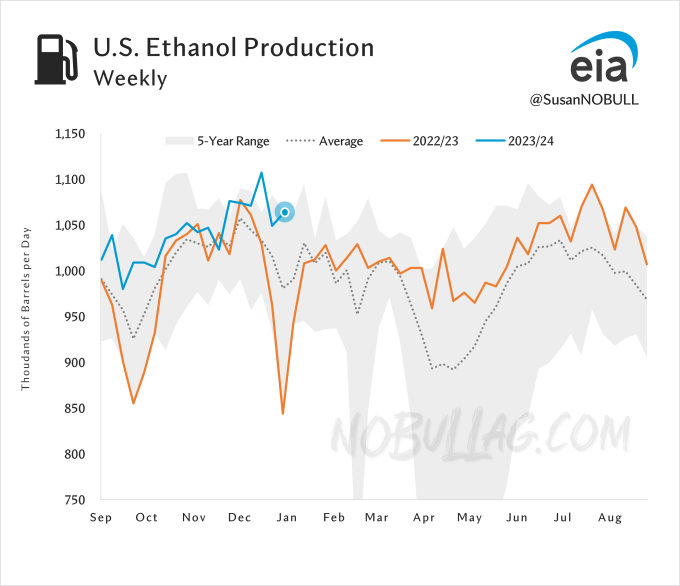

Perhaps the title is a bit overstated, but ethanol production remains strong…

…strong enough that USDA raised their full-year corn demand estimate for ethanol another 50 million bushels in the January WASDE. At 5.675 billion bushels, ethanol demand is set to hit a five-year high in the 2023/24 marketing year.

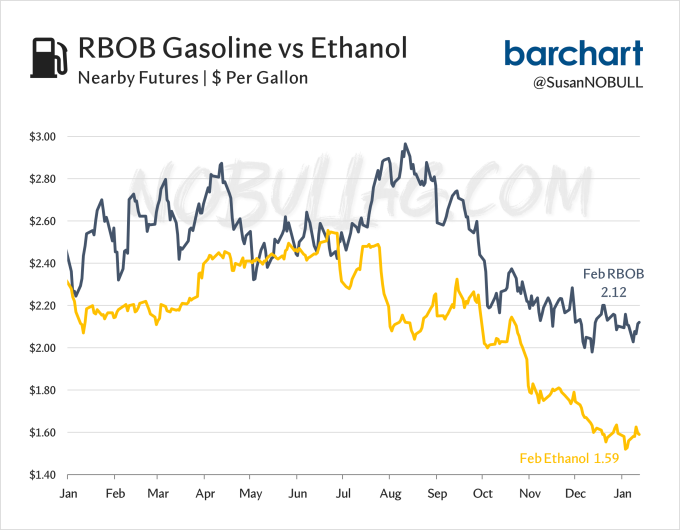

Healthy margins have incentivized production in recent months, plus ethanol's discount to gasoline remains historically wide - bringing the added benefit of higher blending and supporting demand.

#1 | One Big Surprise

Who saw a record corn yield coming in yesterday's 2023 Crop Production report?

Not me… and not anyone amid the analysts who submitted pre-report estimates. In fact, 2023's record 177.3 bpa came in nearly a full bushel above even the highest pre-report guess.

States with the largest bushels-per-acre increases from November include Nebraska +9, Missouri +6, Wisconsin +5, Minnesota +4. Indiana and Ohio both were up 3 bushels from the last report, hitting new all-time records of 203 and 198bpa, respectively.

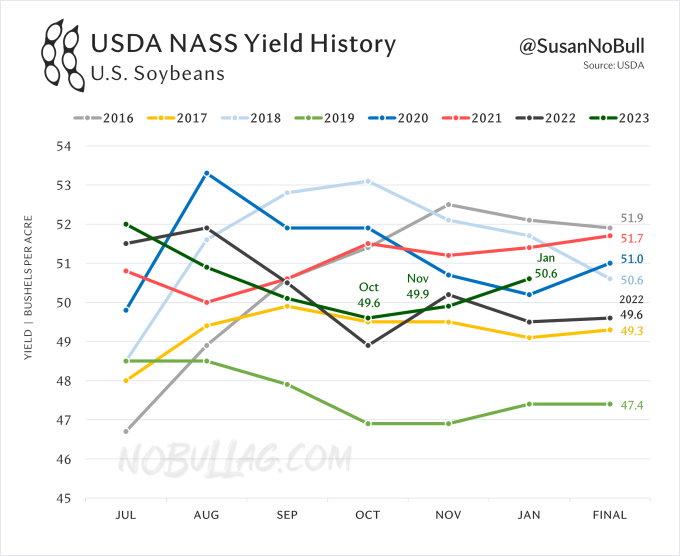

Soybean yield also surprised to the upside, although its 50.6 bpa is well-off the long-standing record of 51.9 in 2016.

State-by-state changes from November were not nearly as dramatic as corn, with North Dakota +1.5, Illinois +2, Wisconsin +2 and Missouri +3. Indiana and Ohio were both unchanged, maintaining their record yields from November.

For full versions of Susan's updates, visit NoBullAg.Substack.com.

On the date of publication, Susan Stroud did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.