EQT Corporation (EQT), headquartered in Pittsburgh, Pennsylvania, is a natural gas production company focused on the Appalachian Basin. Valued at $16.14 billion by market cap, the company operates in Pennsylvania, West Virginia, and Ohio and sells natural gas and natural gas liquids to marketers, utilities, and industrial customers. The largest natural gas producer in the U.S. is expected to announce its fiscal second-quarter earnings for 2024 after the market closes on Tuesday, Jul. 23.

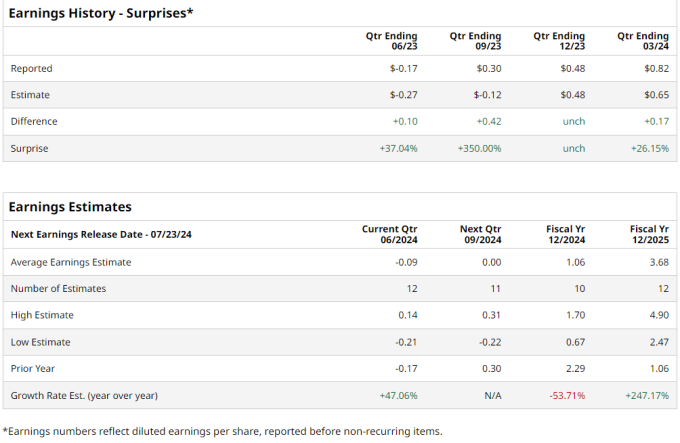

Ahead of the event, analysts expect EQT to report a loss of $0.09 per share on a diluted basis, 47.1% narrower than the $0.17 per share loss in the year-ago quarter. The company beat or matched the consensus estimates in each of the last four quarters. During the first quarter, the company announced the acquisition of Equitrans Midstream, creating America’s first large-scale integrated natural gas business.

For fiscal 2024, analysts expect EQT to report EPS of $1.06, down 53.7% from $2.29 in fiscal 2023.

EQT stock has significantly underperformed the S&P 500’s ($SPX) 16.9% gains on a YTD basis, with shares down 5.5% during this period. Similarly, it has underperformed the S&P 500 Energy Sector SPDR’s (XLE) 5.9% returns over the same time frame.

On Apr. 23, EQT reported its Q1 results. Its total operating revenues fell 46.9% year over year to $1.41 billion, falling short of Wall Street’s revenue projections. Its adjusted EPS declined 51.8% year over year to $0.82 but surpassed the consensus estimates by 26.2%. The company generated a free cash flow of $402 million during the first quarter. Assuming gas prices are between $2.75 MMBtu and $5 MMBtu, EQT estimates to generate between $7.5 billion and $25 billion in cumulative free cash flow in the 2025 to 2029 period. EQT’s shares closed up more than 3% in the session following the day the results were released but have been on a downtrend since then.

Analysts’ consensus opinion on EQT stock is bullish, with a “Moderate Buy” rating overall. Out of 21 analysts covering the stock, 10 advise a “Strong Buy” rating, one has a “Moderate Buy” rating, and 10 recommend a “Hold.” The average analyst price target for EQT is $44.91, indicating a 22.9% potential upside from the current levels.

More Stock Market News from

- Chip Stock Strength Pushes the S&P 500 and Nasdaq 100 to Record Highs

- What to Expect From RTX's Q2 2024 Earnings Report

- Nike Stock Forecast: Can NKE Rebound from Its 52-Week Lows?

- 5 Standout Energy Stocks to Scoop Up this July

On the date of publication, Dipanjan Banchur did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.