Sterling Shines in the Week of Labour Party's Election Victory

- English currency outperforms most major and minor currencies

- Labour Party returns to power in the UK after 14 years

- Labour Party leader "Keir Starmer" forms the new British government

Amid positive long-term expectations for the currency, the sterling led the foreign exchange market last week, outperforming most major and minor currencies. This occurred during historic general elections in the UK, which resulted in a landslide victory for the opposition Labour Party.

The Labour Party swept hundreds of seats across the country, ending 14 years of Conservative Party control. Labour leader "Keir Starmer" was appointed British Prime Minister on Friday, ending an era that saw five different Conservative leaders.

The conclusion of general election activities and the smooth transition of power from the ruling party to the opposition provides greater political stability in the UK, unlike the political situations in the US and Europe.

This stability means that investors can remove "UK political risks" from their list of concerns for now, focusing entirely on the country's economic and monetary conditions.

Analysts believe that the prospects for political stability in the UK and Labour's desire to establish closer ties with the European Union support the sterling in the long term.

Returning to the list of winning currencies, the US dollar ranked last after a series of grim economic data in the US increased the likelihood of at least two US interest rate cuts before the end of this year.

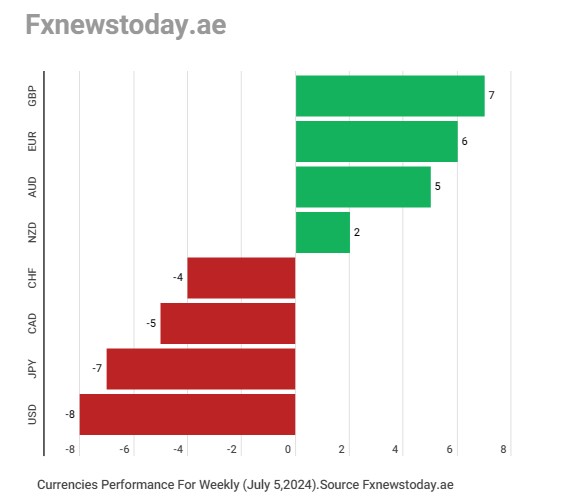

Before detailing the reasons that supported the sterling and heavily pressured the US dollar, let's first look at the performance of the eight major currencies in the foreign exchange market over the past week.

The sterling rose by 7 points on the "FX News Today" weekly currency strength index, followed by the euro at 6 points, the Australian dollar at 5 points, and the US dollar ranked last at -8 points.

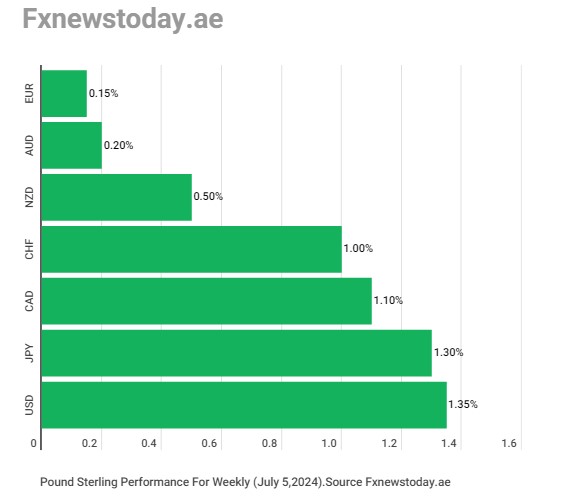

Sterling

Looking at the sterling's performance against the seven major currencies last week, it surged against the US dollar by 1.35%, reaching its highest level in three weeks at $1.2817 on Friday, July 5.

It rose by 1.3% against the Japanese yen, reaching a 16-year high at 206.44 yen on Friday. It increased by 1.1% against the Canadian dollar, reaching a three-week high at $1.7438 on Friday.

It added 1.0% against the Swiss franc, reaching a five-week high at 1.1514 francs on Thursday, and rose by 0.5% against the New Zealand dollar, reaching a two-month high at $1.0940 on Wednesday.

It increased by 0.2% against the Australian dollar and rose by 0.15% against the euro, reaching a one-year high at $1.5997 on Wednesday.

UK General Elections

Millions of people across England, Scotland, Wales, and Northern Ireland voted on Thursday for their local representatives in the House of Commons, which consists of 650 members.

According to official results, the centre-left Labour Party won 412 out of 650 seats in parliament, while the Conservative Party seats dropped to just 121, and the Liberal Democrats secured 71 seats.

These results gave Labour a majority of 170 seats, the second-largest majority in its history after former Prime Minister "Tony Blair's" 179-seat majority in 1997.

Notably, if a party gains a majority, it means it does not need to rely on other parties to pass laws. The larger the majority, the easier it is to govern.

Following Labour's landslide victory, party leader "Keir Starmer" took office as the new Prime Minister at 10 Downing Street, succeeding outgoing Prime Minister "Rishi Sunak".

Events move quickly in British politics; there is no significant time gap between the election result announcement and the installation of the new Prime Minister. Rishi Sunak left 10 Downing Street, the UK's equivalent to the White House, within 24 hours, and Keir Starmer was swiftly inaugurated thereafter.

The process involves specific procedures; Sunak resigned to the King, and Starmer received a formal invitation from the King to form the new government during a meeting at Buckingham Palace.

What Does Labour's Victory Mean for UK Markets?

The arrival of the new Labour government has not significantly moved markets yet, but analysts expect British assets to become more attractive from now on.

Analysts at Jefferies said in a note on Friday: Despite concerns raised by the strong performance of the right-wing Reform Party in the UK, Labour's election victory in the UK will help make the UK appear "relatively stable".

Jefferies analysts added in a research note that this historic victory for the opposition Labour Party, along with the expected regulatory reforms in the country, "could increase the attractiveness of UK assets".

Beata Manthey, European equity strategist at Citi Group, said: History shows that UK markets tend to trade flat on average six months after Labour's victory but "will be significantly higher after one year".

Manthey explained: On a relative basis, the UK market has tended to underperform one or two months after Labour's victory, while it achieved decent relative performance over time afterward.

Kamall Sharma, FX strategist at Bank of America, said: It seems that the UK election is not an event for UK markets due to polling dynamics, and this is one of the factors that will support the sterling as an indicator of political stability compared to other places.

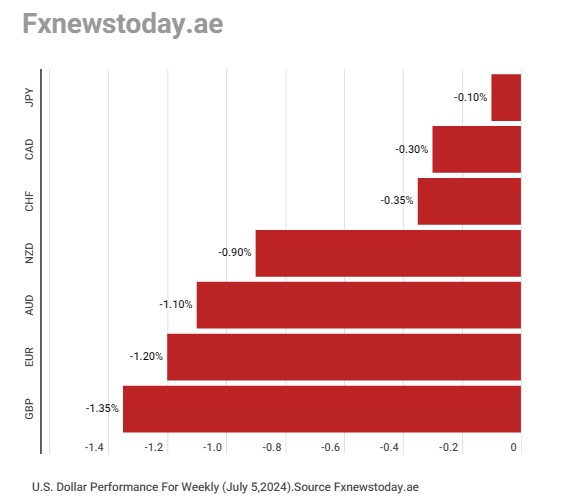

US Dollar

The image above illustrates the broad losses the US dollar suffered last week against the seven major currencies in the foreign exchange market, due to increased likelihood of the Federal Reserve cutting interest rates in September and November.

Grim Data

Data released last week in the US showed the private sector added fewer jobs than expected in June, with a sudden contraction in the services sector during the same month, in addition to a slowdown in new non-farm jobs and a rise in the unemployment rate in June.

The private sector added about 150,000 new jobs in June, below the expected 163,000, and May's jobs were revised up from 152,000 to 157,000.

The US Institute for Supply Management reported that the services sector contracted unexpectedly to 48.8 points in June, worse than market expectations of growth at 52.6 points, and the sector grew at 53.8 points in May.

This unexpected contraction is the first since January 2023, in the latest data indicating a current rapid slowdown in the US economy during the second quarter of this year.

The US economy added about 206,000 jobs in June, slightly better than the expected 191,000, and May's jobs were revised down from 272,000 to 218,000, with the unemployment rate rising to 4.1% from 4.0% in May.

US Interest Rates

Following this data and according to the "FedWatch" tool from the CME Group: The pricing of futures contracts for the likelihood of a 25 basis point US interest rate cut in September increased from 67% to 78%, and the likelihood of a cut in November rose from 79% to 87%.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.