Kinder Morgan, Inc. (KMI) is a leading North American energy infrastructure company with a market cap of $43.9 billion, focusing on its extensive network of pipelines and storage facilities for natural gas, crude oil, refined petroleum products, and more. The company is expected to announce its fiscal Q2 earnings results on Wednesday, July 17.

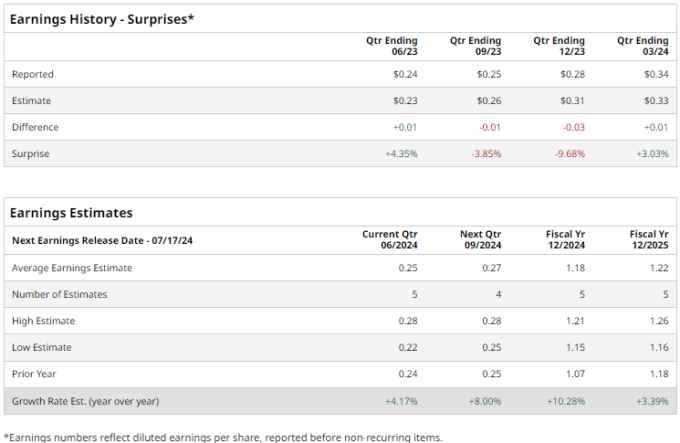

Ahead of this event, analysts are expecting the pipeline and terminal operator to report a profit of $0.25 per share, up 4.2% from $0.24 per share in the year-ago quarter. The company has surpassed Wall Street's bottom-line estimates in two of the past four quarters while missing on two other occasions. Higher volumes in its natural gas pipelines segment helped the company surpass the consensus EPS estimate by 3% in the most recent quarter.

For fiscal 2024, analysts expect KMI to report EPS of $1.18, up 10.3% from $1.07 in fiscal 2023.

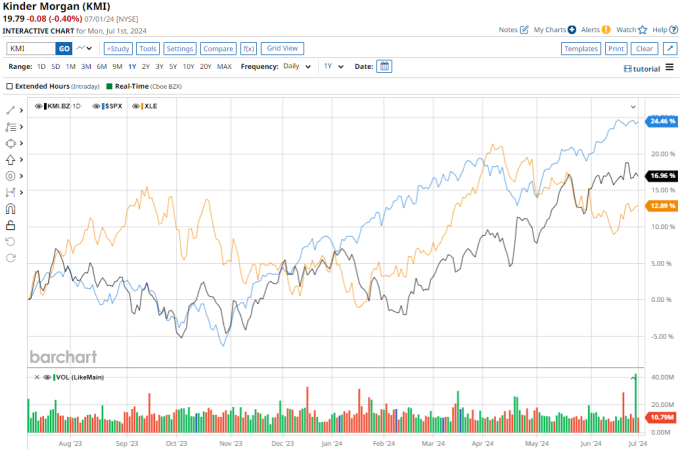

Shares of Kinder Morgan have surged 14.6% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 23% gains during this period. However, it has outperformed the S&P 500 Energy Sector SPDR's (XLE) 13.1% return over the same time frame.

Initially, shares of KMI dropped following its lower-than-expected Q4 earnings released on Jan. 17, attributed to higher interest costs and weaknesses in key segments such as natural gas pipelines and CO2 transportation. However, its recent price surge is fueled by its strong Q1 earnings reported in April, meeting profit forecasts and reaffirming its annual outlook amid expectations of substantial growth in natural gas demand, new data center demand, and increased LNG exports.

Analysts' consensus rating on Kinder Morgan stock is cautiously optimistic overall, with a "Moderate Buy" rating. Out of 18 analysts covering the stock, five recommend a "Strong Buy," one has a "Moderate Buy" rating, 11 give a "Hold" rating, and one suggests a "Moderate Sell." This configuration has remained fairly the same over the past three months.

The average analyst price target for KMI is $20.94, suggesting a potential upside of just 5.8% from the current levels.

More Stock Market News from

- What to Expect From U.S. Bancorp's Next Quarterly Earnings Report?

- What to Expect From Northern Trust's Q2 2024 Earnings Report

- What You Need to Know Ahead of Bank of America's Earnings Release

- What to Expect From Lockheed Martin's Next Quarterly Earnings Report

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.