- Heading into Friday's session, all the talk is about what USDA's latest imaginary supply and demand numbers might be rather than REAL market fundamentals we can see every day.

- We need to keep in mind these reports are released during trading hours for one reason: To generate trade.

- Most of the attention will be on USDA's latest guesses for corn and soybeans, with few in the industry paying attention to wheat.

PREVIEW

It’s USDA’s Data Dump Day. Yes, it’s that time again. The annual dumping of USDA data is scheduled for noon (ET), a day that 99% of the industry looks forward to more than Christmas. As I’ve said in the past, when it comes to hype, USDA’s January report day is the equivalent of the Super Bowl, Daytona 500, and Kentucky Derby all rolled into one. It’s a day of mixed emotions for me, with my general thought being of an annual kidney stone that has to be passed. As Friday unfolds, we have to keep in mind one crucial fact: USDA reports are not about fundamentals, or transparency, or leveling the playing field for all. No, these reports are about generating trade volume. It’s why brokers are the loudest voices telling everyone how important this nonsense is. It brings to mind a quote from Warren Buffett, “What gives you opportunities is other people doing dumb things.” Now, just for fun, let’s take a look at what really matters.

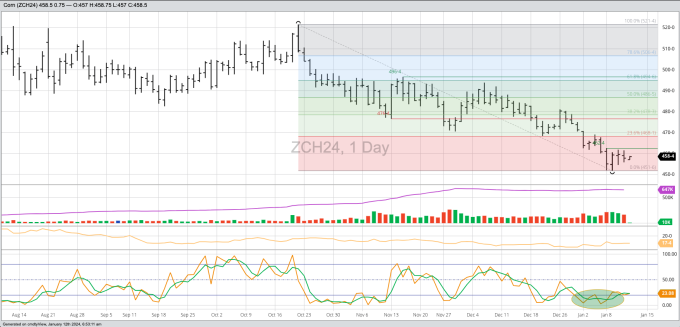

Corn: King Corn will get more active once USDA dumps its load. The March issue (ZCH24) is heading into Friday’s fracas with a 10.75-cent range between its previous 4-day high of $4.6250 and 4-day low of $4.5175. One of the simplest methods of technical analysis tells us a breakout, in either direction, puts targets at the breakout point plus the previous range. This creates a possible trading range between $4.7325 and $4.41 before the closing bell rings today. Thursday evening’s national average basis calculation came in at 25.5 cents under March futures as compared to last Friday’s figure of 27.0 cents under and the previous 5-year low weekly close for this week of 32.75 cents under March[i]. Futures spreads were neutral at Thursday’s close and I’m expecting them to still be neutral when we head to Ceres (or its local equivalent) after the day is done. For the record, I’ll be looking at USDA’s latest demand guesses for US corn. Recall the December round of estimates kept feed (5.65 bb), ethanol (5.325 bb), and exports (6.74 bb) unchanged from the previous month. This sets the stage for today’s changes.

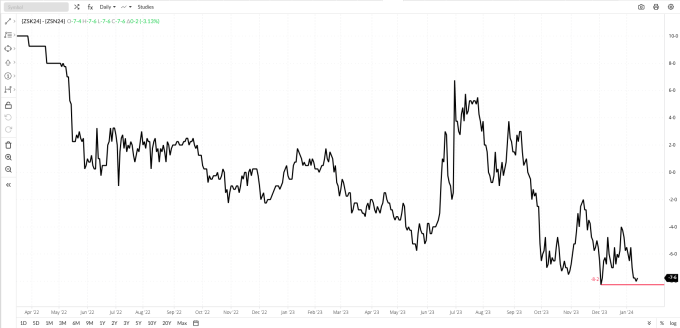

Soybeans: Heading into Friday’s session, futures spreads remain neutral-to-bullish with all eyes on the May-July after it closed within 0.25 cent of its low daily close of 8.25 cents carry Thursday. As for national average basis, the latest calculation came in at 54.5 cents under March futures (ZSH24), unchanged from last Friday’s final figure and below the previous 5-year average weekly close for this week of 44.5 cents under March[ii]. While most of the yammering will be about USDA’s latest guess on Brazilian soybean production, as with corn, I’ll be watching for changes in demand for US supplies. Keep in mind total sales (total shipments plus unshipped sales) were running 17% behind the same week last year with USDA’s December guess on export demand down 12% from last year.

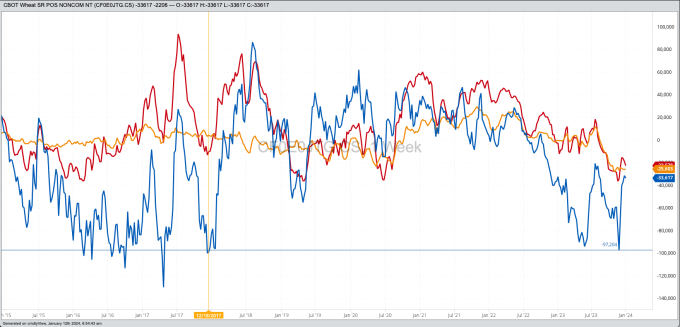

Wheat: A look back at Thursday’s session, when March Chicago (ZWH24) closed 7.0 cents lower, shows total open interest in the market increased by 4,400 contracts, with March adding 1,500 contracts on its own. This again tells us funds were adding short futures positions ahead of today’s data dump. Why? I can think of a few reasons: First, the noncommercial side is not afraid of anything USDA might make up with its latest wheat numbers. Second, funds know few will be paying attention to wheat today anyway. Third, the SRW markets REAL fundamentals remain neutral (futures spreads)-to-bearish (basis). Given all that, though, the door is open to a round of short covering if corn and soybeans get carried away in post-report enthusiasm. The most interesting wheat number, at least to me, will be the latest CFTC Commitments of Traders report (legacy, futures only) noncommercial net-futures positions released later this afternoon[iii].

STAY TUNED FOR THE REVIEW LATER TODAY.

[i] The previous 5-year average weekly close for this week is 13.75 cents under March corn futures.

[ii] The previous 5-year low weekly close for this week is 80.5 cents under March soybean futures from 2019.

[iii] Recall last week’s updated showed funds continuing to hold net-short futures positions in all three wheat markets.

More Grain News from

- Wheat Market Fades through Thursday

- Corn Finishes Thursday Red

- Soybeans Firm up on Thursday

- Cocoa Prices Push Higher on Smaller Cocoa Supplies from the Ivory Coast

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.