Incorporated in 1919, Chicago-based Conagra Brands, Inc. (CAG) is a major player in U.S. consumer-packaged food goods, with a $13.6 billion market cap. It is expected to announce its fiscal Q4 earnings before the market opens on Thursday, July 11.

Ahead of the event, analysts expect Conagra Brands to report a profit of $0.56 per share, down 9.7% from $0.62 per share in the year-ago quarter. However, the company has consistently outpaced Wall Street’s profit estimates in its recent quarterly reports. Its adjusted EPS of $0.69 for the last reported quarter dipped 9.2% annually, yet surpassing the consensus estimate by 7.8%. This downturn was fueled by amplified expenditures in advertising, promotions, and rising operational costs, compounded by economic headwinds like inflationary pressures dampening consumer spending.

Looking ahead, analysts foresee Conagra Brands' fiscal 2024 profits of $2.62 per share, down 5.4% from $2.77 per share in fiscal 2023. However, fiscal 2025 EPS is expected to grow 2.7% annually to $2.69.

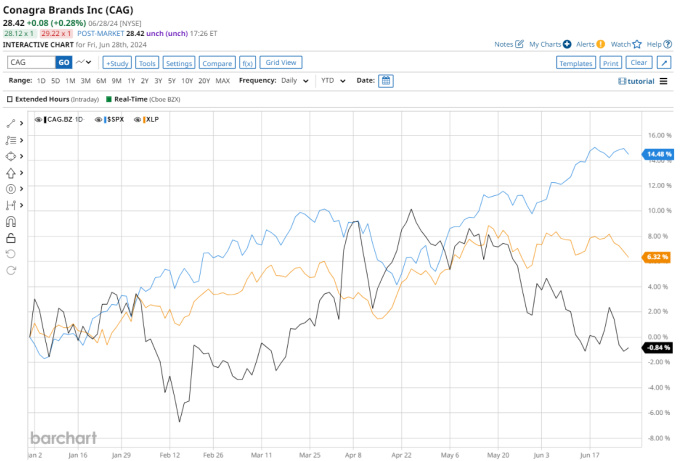

CAG stock has dipped marginally on a YTD basis, significantly underperforming the broader S&P 500 Index's ($SPX) 14.5% gain and the S&P 500 Cons Staples Sector SPDR’s (XLP) 6.3% return over the same time frame.

Conagra Brands navigates a landscape marked by inflationary pressures on ingredients, packaging, and labor costs, potentially impacting profit margins. Supply chain disruptions persist as a risk, while increased competition in packaged foods adds pressure to maintain market share. Evolving consumer preferences toward health-conscious and fresh options pose further challenges, urging Conagra to innovate to sustain its position amidst shifting market dynamics.

Nevertheless, on April 4, Conagra Brands' stock surged 5.4% following its Q3 earnings beat, driven by strong domestic retail performance, especially by investments in refrigerated and frozen foods. Updated fiscal 2024 guidance, with an adjusted operating margin target of 15.8%, underscored confidence amid inflation. Stable organic sales and adjusted EPS outlooks, alongside improved balance sheet metrics, reinforced investor optimism in Conagra's strategic resilience.

The consensus opinion on Conagra Brands stock is cautious, with a “Hold” rating overall. Out of 13 analysts covering the stock, one advises a “Strong Buy” rating, while the remaining 12 analysts recommend a “Hold.” The average analyst price target for Conagra Brands is $31.33, indicating a potential upside of 10.2% from the current levels.

More Stock Market News from

- Stocks Set to Open Mixed as Investors Await FOMC Minutes and U.S. Jobs Data

- PepsiCo’s Q2 2024 Earnings: What to Expect

- Constellation Brands Earnings Preview: What to Expect

- Disney's Strategic Dilemma And The Case For Spinning Off ESPN

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.