SpreadEdge Capital specializes in seasonal spread trading across a wide variety of commodity markets. A spread trade is the simultaneous purchase and sale of the same commodity with different delivery dates. SpreadEdge publishes a weekly Newsletter that provides several seasonal spread trade opportunities every week.

Overview

The Commitment of Traders (COT) report, issued by the Commodity Futures Trading Commission (CFTC), offers a weekly snapshot of the positions taken by different market participants in the U.S. futures markets. This information aids traders and analysts in comprehending market sentiment and developments. Published every Friday at 3:30 PM Eastern Time, the COT report reflects positions held as of the previous Tuesday's closing business hours. Peak Trading Research assesses the latest COT report, examining alterations in price and open interest to provide an appraisal of net fund positioning daily.

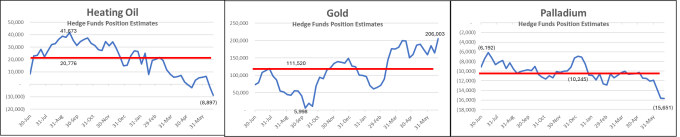

Hedge Fund Position Estimates

Heating Oil

Heating Oil finish last week at its lowest hedge fund positions for the past 52 weeks. Note that hedge funds have sold over 50,000 contracts since the high in September. Hedge funds have plenty of capital to add to their existing positions and can drive prices up quickly when they begin to buy.

Palladium

Palladium is likewise at its lowest hedge fund positions for the past 52 weeks. Note that the range is much tighter for Palladium so this extreme level is not nearly as significant as is with Heating Oil.

Gold

Gold is on the opposite side of the ledger. Gold has increased over 200,000 contracts since early October and is currently sitting at its highest hedge fund position over the past 52 weeks. Gold has been hovering between 150k and 200k since early April and is showing no signs of weakness.

More Information

Use coupon code “SpreadEdge” and get the Weekly Newsletter and Daily Alerts for $1 for the first month.

For a limited time, you can receive my Futures Training Videos for free with a 3-month, 6-month, or 12-month subscription.

For a FREE eBook about the SpreadEdge seasonal spread strategy.

More Information

The SpreadEdge Weekly Newsletter is published every weekend and provides a broad overview of the important seasonal, technical, and fundamental indicators within the Energy, Grains, Meats, Softs, Metals and Currency markets. In addition, spread trade recommendations and follow-up on open trades is also provided. For a free copy of the Weekly Newsletter, please send an email to info@SpreadEdgeCapital.com

Darren Carlat

SpreadEdge Capital, LLC

(214) 636-3133

Darren@SpreadEdgeCapital.com

www.SpreadEdgeCapital.com

Disclaimer

SpreadEdge Capital, LLC is registered as a Commodity Trading Advisor with the Commodity Futures Trading Commission and is an NFA member. Past performance is not indicative of future results. Futures trading is not suitable for all investors, The risk associated with futures trading is substantial. Only risk capital should be used for these investments because you can lose more than your original investment. This is not a solicitation.

On the date of publication, Darren Carlat did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.