(NGJ25) (NGQ24) (NGU24) (UNG) (BOIL) (KOLD)

“Clues for natural gas summer weather and trading”

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

- Tuesday Evening Report: June 18, 2024

The natural gas market rallied over $3.10 a week ago only to fall back on a variety of bearish fundamentals (storage inventories well above the 5-year average and increased U.S. production); but, forecasts for extreme heat potentially lasting into July, helped the market rally back on Tuesday.

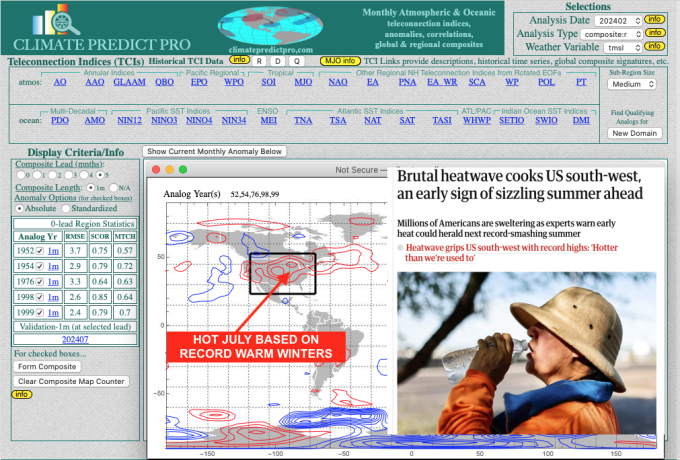

So… what has been my early summer forecast for the last few months? My in-house program Climatepredict.com looks at various studies and global teleconnections, plus the record-warm global oceans. In this study, I looked at the warmest winters on record (February being the focal point). While it's just one study, notice the hot July I expect across

much of the nation.

So… what is the conservative way to play natural gas? My Weather Spider, which rates and scores global fundamentals and technical signals, became bullish in the $2.60 area a couple of weeks ago, then… natgas futures soared. The ETF (BOIL) was up 30% at one point. However, last week I did suggest (around $3.10) that prices were overbought in the short term.

One way is to sell conservative September natural gas put options on further breaks in the underlying futures. Not a home run, but buying way out-of-the-money call options may not make sense given (again) the hefty storage situation.

Feel free to join farmers, futures hedgers, option and ETF traders around the world who want better weather forecasts, as well as trading ideas from a seasoned meteorologist and registered Commodity Trading Advisor. Download a 2-week free trial to Weather Wealth (if you have not done so before), here. https://www.bestweatherinc.com/membership-sign-up/

Thanks for your interest in commodity weather!

Jim Roemer, Scott Mathews, and The Weather Wealth Team

- Please feel free to learn about Jim Roemer, our track record, and how we use weather to help traders, hedgers, and investors. If you have any questions, please don't hesitate to drop me a line - Scott Mathews, Editor

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He also is a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he established a unique standing among advisors in the commodity risk management industry.

Trading futures and options involves a significant risk of loss and is not suitable for everyone. Past performance is not necessarily indicative of future results. There is no warranty or representation that accounts following any trading program will be profitable.

On the date of publication, Jim Roemer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.