Howdy market watchers!

Wheat harvest is finally here! Just one month ago, many would have said that Oklahoma wheat harvest would be nearly complete by June 1st. Mother Nature decided otherwise and provided close to optimal filling weather in May, although with some hailstorms, that is now showing up in the bin.

Despite late rains on an almost mature crop, test weights have continued to hold up well. Throughout the state and now into Kansas, test weights are all coming in above the benchmark 60 pounds per bushel. There were a few reports in southern Oklahoma of 58-59 pounds as additional rains in the past week have slowed progress, but those cases have been few. Yields have also been better than expected partly due to higher test weights given that yields are calculated on a 60 pound per bushel basis and so higher test weights adds bushels for every acre harvested. We haven’t heard of any yields below 40 bushels per acre (bpa) with most exceeding 50 bpa to as high as 90-100 bpa on select fields. All in all, it is highly likely that total production of this year’s winter wheat crop is going to come in well above forecast.

Back in May, one wheat crop tour expected the Oklahoma wheat crop was expected to be around 90 million bushels on a statewide average yield of 33.68 bpa while others expected 37.3 bpa and total production of 102.2 million bushels, but on a larger harvested acre base. We will see larger numbers when all is said and done and the wheat market is already reflecting this.

After the major rally sparked by Russian dryness and concerns over freeze damage and fund short covering, we’ve had eight down days of the past nine trading sessions with a high-low range of 91 cents. Friday’s low reached the 50 percent retracement level of the broader move, finding support at that level and closing around 10 cents off session lows. With harvest progressing with better-than-expected yields, I could see July KC wheat contracts falling to the $6.45 area, which is basically at the crossover of the 50- and 200-day moving averages. Unfortunately, this seems likely given that Thursday was an inside day on (September) KC wheat and then broke lower on Friday suggesting follow through in that direction for the next session.

However, that could then become major support depending on the drought and freeze damage news out of the Black Sea region with Russia declaring a “state of emergency” for the wheat crop in 10 regions. We are unsure as to what that really means and is likely to release disaster support to local farmers, but the market’s reaction is that it has already been “priced in” at this stage.

China announced purchases of domestic wheat for state reserves over concern the situation could result in Russian export limitations. Having said that, Russia’s wheat crop is “made” in June while the US crop is “made” in May. With heat persisting at the present time in Russia, this market could be setting up for another rally once key support is reached.

Bottomline, if you’re selling physical wheat here, give me a call and stay with this market in case we see a rally after the US harvest. Note, there is a chart gap on September KC wheat that will fill at $7.69, nearly one dollar higher than where we closed on Friday. It’s harvest, but stay vigilant and give me a call anytime you need an update or would like to get orders working.

It is also worth mentioning that if conditions improve in the Black Sea region, we could also see further downside. The 100-day moving average is at $6.25-level just for perspective.

Russia’s wheat crop has now been cut to nearly 80 million metric tons from starting estimates at 94 million metric tons, a 14 percent reduction. Turkey’s announcement Friday of import bans specifically for wheat from June 21 to October 15th to “protect local producers amid price fluctuations” was another blow to the demand side for wheat prices. Lower wheat export prices from Russia have impacted domestic grain farmers in all regions around the region.

The large, outside chart reversal higher of the US dollar on Friday triggered by the much-better-than-expected May jobs report also weighed on grain futures, particularly wheat. A stronger US dollar makes US origin wheat and other crops more expensive on the international market.

Nonfarm payrolls rose 272,000 last month, above Dow Jones estimates of 190,000 jobs and April’s 165,000 jobs. Unemployment rose to 4 percent, which the first time it has reached that level since January 2022. Those numbers are somewhat contradictory and seem to indicate that more people are participating in the workforce again and more of those people are looking for a job versus finding placement. Money is tighter everywhere, and these labor force figures seem to finally indicate that reality.

Row crop prices have also been in a down trend as US planting has accelerated after dryer weather mitigated earlier rain delays. This week’s corn crop condition ratings were the first of the season and came in 5 percent higher than expected at 75 percent, matching the highest initial rating in 6 years. Plantings were 91 percent complete. Soybean planting is now 78 percent complete, slightly behind expectations and 11 percent behind last year, but 5 percent ahead of average. We will have the first soybean crop ratings of the season in next Monday’s report.

The sharp rebound in corn and soybean futures on Thursday was largely seen as a “dead cat bounce” and fund short covering as a warmer, dryer summer could be in store, was followed by action Friday with nearly all the gains taken back. The Brazilian government devalued the Real currency that sparked farmer selling of old crop and new crop and led to pressure to end the week. At the current exchange rate around R$4.20 to $1 US dollar, this is the lowest level in history. Developments in Brazil’s monetary policy will have an impact on soybean futures going forward. China did buy US soybeans on Friday. We are seeing more access by China to South America row crops with last year’s opening of Brazil corn that has now expanded to Argentine corn as announced in the past couple weeks.

The Federal Reserve FOMC meets next week with the Eurozone cutting interest rates this week. We will likely see another pause, but the tone of the language will be watched closely. Markets have rebounded this past week with a slightly lower close on Friday, but well off the recent lows. With key moving averages above, the Dow Jones needs to push above the 39,000 level to push higher.

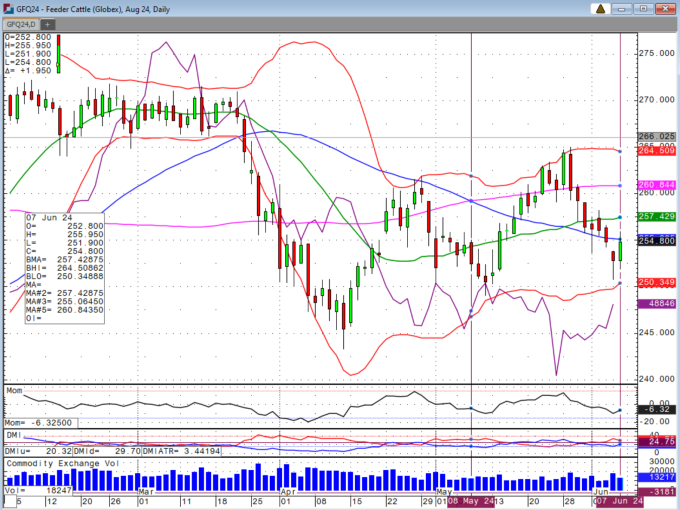

This is what the cattle market needs after a tough seven consecutive sessions of weaker chart action. Feeder cattle gapped lower Thursday on more bird flu news, but rebounded firmly on Friday closing just below the 50-day moving average. While this market has lost $15 per cwt since late May, we are just now at the bottom of the large bull channel. I now think this market has the potential to rebound to the top of the channel to the $266 level on August feeders.

Fed cash cattle trade reached $190 in western Nebraska this week and I think the Live cattle futures may have also found support at the bottom of its bull channel. Next week’s equity market action post-FOMC will probably be the biggest tell for the direction of the cattle market in the near term.

For right now, I’m bullish and if you’ve sold cattle down here or have had LRPs expire, consider re-owning the opportunity on the upside of this market.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available.

It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at http://www.sidwellstrategies.com/disclaimer.

On the date of publication, Brady Sidwell did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.