Baker Hughes Company (BKR), based in Houston, Texas, is one of the world's largest oilfield service providers. Valued at $32.31 billion by market cap, it offers a broad portfolio of technologies and services across the global energy and industrial value chains. The company operates through two main segments: Oilfield Services & Equipment (OFSE) and Industrial & Energy Technology (IET). Serving a diverse range of clients, Baker Hughes supports various sectors from upstream to downstream, onshore to offshore, and businesses of all sizes.

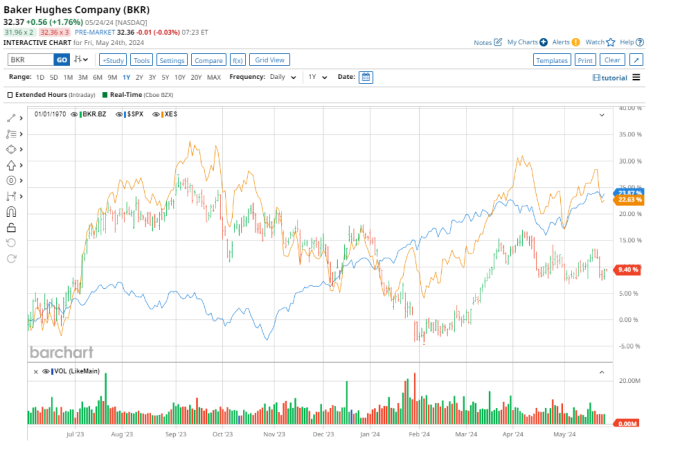

Baker Hughes has underperformed the broader market over the past year. The stock has gained 12.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 28.9%. In 2024, BKR stock is down 5.3%, while the SPX is up 11.2% on a YTD basis.

Narrowing the focus, BKR’s underperformance looks less pronounced compared to the SPDR S&P Oil & Gas Equipment & Services ETF (XES). The exchange-traded fund has gained about 24.6% over the past year. The ETF’s 8.2% gains on a YTD basis compare to the stock’s loss over the same time frame.

On Apr. 23, Baker Hughes outperformed analysts' predictions for Q1 profit due to increased demand for its drilling services abroad and raised its dividend. The stock gained 1.7% on the day it released earnings, however declined 1% the following day.

For the current fiscal year, ending in December, analysts expect BKR’s EPS to grow 30% to $2.08 on a diluted basis. The company's earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

Among the 21 analysts covering BKR stock, the consensus rating is a “Strong Buy.” That’s based on 17 “Strong Buy” ratings, one “Moderate Buy,” and three “Holds.”

This configuration is slightly more bullish than three months ago, with 16 suggesting a “Strong Buy.”

On Apr. 29, Wells Fargo analyst Roger Read maintained a “Hold” rating on Baker Hughes with a price target of $35.00. However, on Apr. 25, Jefferies analyst Lloyd Byrne maintained their bullish stance on Baker Hughes, giving a “Buy” rating.

The mean price target of $40.95 represents a 26.5% premium to BKR’s current price levels. The Street-high price target of $46 suggests an ambitious upside potential of 42.1%.

More Stock Market News from

- Are Wall Street Analysts Predicting Corning Stock Will Climb or Sink?

- Stocks See Mild Pressure from Hawkish Fed Comments

- 2 Stocks Under $10 Wall Street Says Are 'Strong Buys'

- This Energy Dividend Stock Insider Just Invested Another $372K

On the date of publication, Rashmi Kumari did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.