Marathon Oil Corporation (MRO) is a leading oil and natural gas exploration and production company with a market cap of $14.99 billion. Headquartered in Houston, Texas, it explores, produces, and markets crude oil and condensate, natural gas liquids, and natural gas in the U.S. and internationally.

MRO stock has underperformed the broader market over the last year. The stock has gained 16.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 28.3%. But in 2024, the gap narrowed, with MRO stock rising 9.4%, while the SPX is up 11.3% on a YTD basis.

Zooming in further, MRO’s gains over the past 52 weeks are easily overshadowed by the SPDR S&P Oil & Gas Exploration & Production ETF (XOP). The exchange-traded fund has gained about 24.8% over this period. Moreover, the ETF’s 10.5% gains on a YTD basis outweigh the stock’s returns over the same time frame.

On May 1, Marathon Oil reported its Q1 earnings, beating Wall Street estimates on EPS but missing on revenue. The stock lost 2.8% on the day it released earnings and the following day but recovered after that.

For the current fiscal year, ending in December 2024, analysts expect MRO’s EPS growth of 10.7% year over year to $2.89 on a diluted basis. The company's earnings surprise history is robust. It beat the consensus estimate in each of the last four quarters.

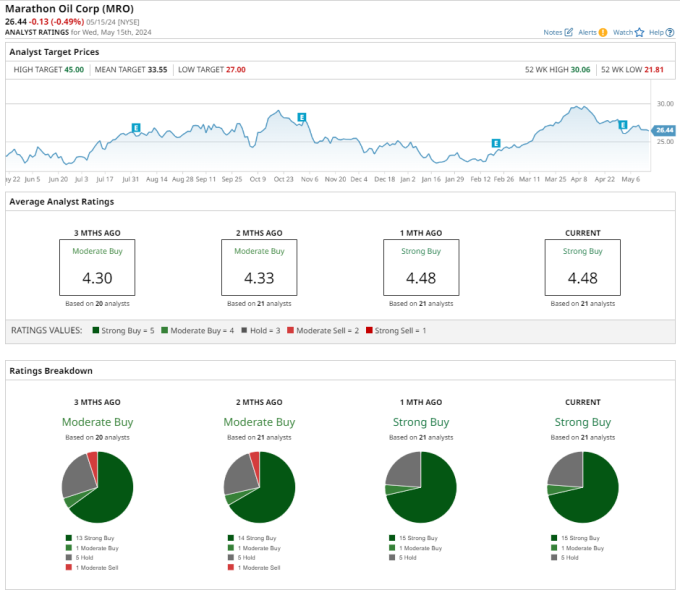

Among the 21 analysts covering MRO stock, the consensus rating is a “Strong Buy.” That’s based on 15 “Strong Buys,” one “Moderate Buy,” and five “Holds.”

This configuration is slightly bullish compared to when 20 analysts covered the stock three months ago, and the consensus rating was “Moderate Buy.” That rating was based on 13 “Strong Buys,” one “Moderate Buy,” five “holds,” and one “Moderate Sell.”

On May 14, Mark Lear from Piper Sandler maintained a “Buy” rating on Marathon Oil, with a price target of $34.00, which indicates a 28.6% upside from the current levels.

The mean price target of $33.55 represents a 26.9% premium to MRO’s current price levels. The Street-high price target of $45 suggests an ambitious upside potential of 70.2%.

More Stock Market News from

- Do Wall Street Analysts Like Southwest Airlines Stock?

- Down 17% From Highs, Should You Buy This Growth Stock On Sale?

- Boston Scientific Stock: Is Wall Street Bullish or Bearish?

- 3 Top-Quality Dividend Kings to Own In May

On the date of publication, Rashmi Kumari did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.