APA Corporation (APA) is one of the world's leading independent energy companies engaged in the exploration, development, and production of natural gas, crude oil, and natural gas liquids, with operations in the United States, Egypt, and the North Sea. Founded in 1954 and with a market cap of $11.3 billion, the company is not just involved in traditional energy production; it also has a diverse mix of conventional and unconventional resources, as well as a side business in renewable energy through a partnership with TotalEnergies SE (TTE).

APA Corporation stock has significantly underperformed the broader market over the last year. APA has declined 8.4% over this time frame, while the broader S&P 500 Index ($SPX) rallied nearly 26.6%. In 2024 alone, the stock has lost 15.8%, compared to SPX's 9.5% gains on a YTD basis.

Narrowing the focus, APA’s underperformance looks even more pronounced in comparison to the iShares U.S. Oil & Gas Exploration & Production ETF (IEO). The exchange-traded fund has gained 28.1% over the past year, compared to APA’s loss for the period.

APA Corporation's shares fell following the company’s Q1 earnings release on May 1, as the company's year-over-year decline in revenues and earnings disappointed investors. The stock lost 3% on the earnings release day and 4.3% the following day.

For the current fiscal year, ending in Dec. 2024, analysts expect APA to report EPS growth of 8.4% year over year to $4.91 on a diluted basis. The company's earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

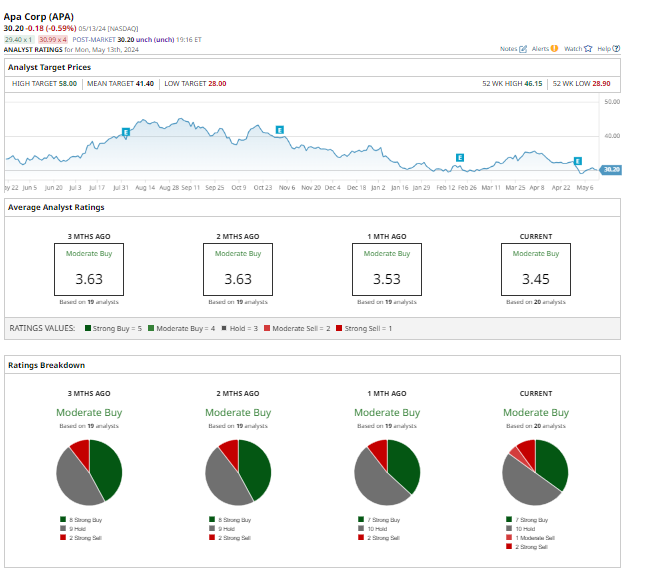

Among the 20 analysts covering APA stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, 10 “Holds,” one “Moderate Buy,” and two “Strong Sells.”

This configuration is slightly more bearish than three months ago, with eight analysts suggesting a "Strong Buy" rating on the stock.

On May 2, Wells Fargo (WFC) analyst Roger Read maintained a Buy rating on the stock, with a price target of $55.00. In a research report released on Apr. 11, JPMorgan Chase & Co. (JPM) raised their target price for APA from $38.00 to $40.00, assigning the stock a neutral rating.

The mean price target of $41.40 indicates an upside potential of 37.1% from APA’s current price levels. The Street-high price target of $58 suggests the stock could rally as much as 92.1%.

More Stock Market News from

- 3 Cheapest Dividend Aristocrats To Buy And Hold Forever

- Barrick Gold vs. Newmont Mining: Which Gold Stock Is a Better Buy?

- Should You Buy These Semiconductor Stocks On the Dip?

- 3 Options Strategies for Snowflake Earnings Next Week

On the date of publication, Rashmi Kumari did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.