A huge week for Gold, Silver and Copper. Here are several factors supporting this week’s rally.

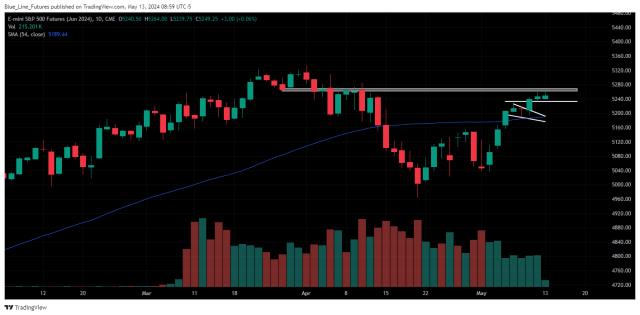

E-mini S&P (June) / E-mini NQ (June)

S&P, last week’s close: Settled at 5246.25, up 7.25 on Friday and 91.50 on the week

NQ, last week’s close: Settled at 18,255, up 40.50 on Friday and 254.25 on the week

E-mini S&P and E-mini NQ futures secured a strong week despite hotter than expected 1-year Consumer Inflation Expectations at 3.5% versus 3.2% via the politically fueled Michigan Consumer survey on Friday. The dataset also highlighted eroding Sentiment and Expectations hitting six-month lows. For the record, many studies are proving the survey to be politically divided, something that always can play a factor in soft data, especially during an election year, as opposed to hard data using analytics. Furthermore, the mounting inflation expectations are likely a byproduct of a worsening consumer; if your wallet is stretched, costs become more of a burden. This sets the stage for a pivotal week ahead. PPI is due tomorrow, and CPI and Retail Sales will be released on Wednesday. Remember, producer prices are a leading indicator of consumer prices. It has been no secret that inflation remained more stubborn in the first quarter than expected at the onset. We are of the belief we begin seeing some of those tailwinds reined in. Fed Chair Powell will also be on the docket tomorrow, speaking at an international conference. He has been noted saying that inflation expectations are a self-fulfilling prophecy; imagine if you know gas prices will be higher next week, you will fill your car up this week.

Price action leading into the opening bell Friday was enthusiastic before a whipsaw of profit taking was met with hotter than expected inflation expectations. Still, the tape worked itself higher from a 10:30 am CT low that now aligns as major three-star support in the E-mini S&P at 5232.75-5236 and a similar level in the E-mini NQ at 18,179-18,204. Thursday’s strength pushed the indices out above a bull-flag consolidation pattern, and we view this major three-star support as defining that breakout and a line in the sand fueling a push toward record highs. Despite our optimism, let us not ignore headwinds. It is no coincidence that price action stopped where it did Friday, as we had major three-star resistance noted overhead, and we must see a break above here in order to keep fueling broader optimism.

Bias: Bullish/Neutral

Resistance: 5260.25-5266.25***, 5272.50-5274.25**, 5287.75-5292.75**, 5207-5208.50***, 5215.25-5221****

Pivot: 5250.75

Support: 5243.25-5246.25***, 5232.75-5236***, 5226.75**, 5218.75-52120.75***, 5213-5215.25***, 5200.75-5204.25***, 5184.75-5191.25***

NQ (June)

Resistance: 18,326-18,348***, 18,485*** 18,558-18,607***

Pivot: 18,255-18,271

Support: 18,228-18,237**, 18,179-18,204***, 18,108-18,129**, 18,042-18,078***, 17,962-17,986**, 17,893-17,930***, 17,805-17,826**, 17,743-17,793*** 17,649-17,690****

Crude Oil (June)

Last week’s close: Settled 78.26, down 1.00 on Friday and up 0.15 on the week

WTI Crude Oil futures shed $1.00 on Friday, in a very disappointing session for the bulls. Given Wednesday’s outside bullish reversal and rejection of the consolidation pocket from March we have been highlighting, the lack of follow through Thursday was unenthusiastic before the psychological $80 mark kept a lid on prices. This morning, we are seeing a rebound into formed resistance created by the overhead damage from Friday’s fallout and noted in the levels below.

There was optimistic news over the weekend with Iraq agreeing to follow OPEC’s lead in extending the voluntary cuts, which is likely helping to buoy the market. However, fears of the trajectory of global growth remain a headwind. From Friday night, CPI data out of China nudged higher than expected +0.3% y/y versus +0.1% expected. However, on Saturday, New Loan data came in below expectations at 730 billion Yuan versus 1,200 billion Yuan expected.

Bias: Neutral/Bullish

Resistance: 78.87-78.92**, 79.13-79.26**, 79.90-79.96***, 80.74-80.88***, 81.93***

Pivot: 78.62-78.79

Support: 78.35-78.43**, 77.87-78.06***, 76.90-76.98***, 75.90-76.07***, 75.04-75.10**

Gold (June) / Silver (July)

Gold, last week’s close: Settled at 2375.0, up 34.7 on Friday and 66.4 on the week

Silver, last week’s close: Settled at 28.506, up 0.141 on Friday and 1.816 on the week

Gold and Silver futures had a tremendous week last week. Still, they finished Friday’s session on a dull note due to the hotter-than-expected 1-year Michigan Inflation Expectations (discussed in more detail in our E-mini S&P / E-mini NQ section). However, some of the soft tape could be attributed to profit-taking amid such a rebound, though we would look for renewed underlying strength today in order to confirm such.

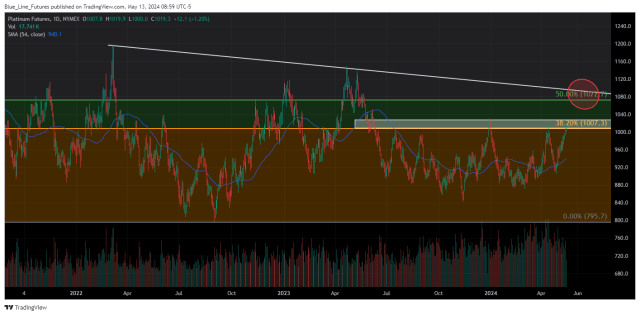

We look at precious and industrial metals broadly in order to gauge our appetite for risk in the metals space and the World Platinum Investment Council noted that Platinum faces its 2nd consecutive annual deficit in 2024, further underpinned by weakening supply (-2%). Although demand is seen dropping by -5% this year, it comes on the heels of a 26% surge in 2023. Platinum is +7% month-to-date but faces a critical resistance area at 1020-1030. A break above here could open the door for a move near 1100.

Early session weakness in both Gold and Silver futures tested into a critical area of support. For Gold, we have key support at 2344-2345.8, but a break below rare major four-star support at 2339.5-2340.3 would neutralize last week’s strength. While price action may have gotten ahead of itself on Gold’s two-day run, we do see more value as it retests this critical area of support, as long as it can hold. As we look to the session ahead, keep in mind that PPI is due tomorrow at 7:30 am CT, and we get comments after from Fed Chair Powell at 9:00 am CT.

Bias: Bullish/Neutral

Resistance: 2359.8**, 2363.1-2367**, 2386.3-2387.7***, 2399.4-2404.3**, 2410.1-2413.8***

Pivot: 2353.9

Support: 2344-2345.8**, 2339.5-2340.3****, 2334.2-2336.6**, 2329-2330.7**, 2316.4-2318***

Silver (July)

Resistance: 28.59-28.61**, 28.71-28.74**, 29.00-29.06**, 29.12-29.26***, 29.37**

Pivot: 28.44-28.50

Support: 28.27-28.32**, 28.17-28.22***, 27.83-27.91***

Micro Bitcoin (May)

Last week’s close: Settled at 60,950, down 1,890 on Friday and 1,640 on the week

Bias: Neutral/Bullish

Resistance: 63,440-63,900**, 64,750-64,975**, 65,335*, 66,045-66,552***, 67,155-67,965***, 68,829**, 71,625-71,646***

Pivot: 62,750-63,105

Support: 62,110-62,590***, 61,725**, 60,950-61,060***, 60,386-60,410****, 59,765**, 56,472-57,355***, 55,000-55,290***, 52,240***, 47,000****

Want to keep reading?

Subscribe to our daily Morning Express for daily insights into Precious Metals like Gold and Silver, Crude Oil and more! Technicals, including our proprietary trading levels, and actionable market bias.

Sign Up for Free Futures Market Research – Blue Line Futures

Sign Up for Free Futures Market Research - Blue Line Futures

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500

Performance Disclaimer

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

On the date of publication, Bill Baruch did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.