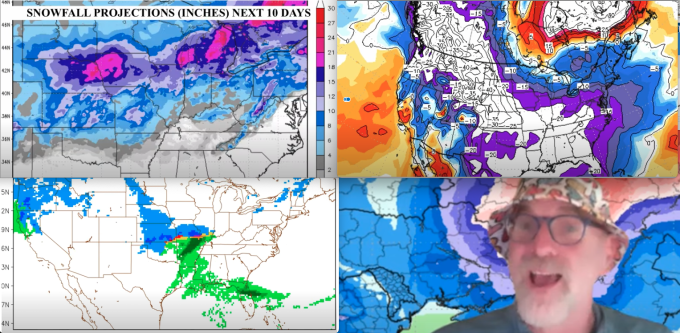

”Why a near record negative NAO index will bring cold and the snowiest weather in years"

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

- Sunday Evening Report -January 7, 2024

A negative NAO index has to do with a warm block near Greenland. (please watch my video above—it explains all of this)

T o V I e w V I d e o : > > > C L I C K H E R E

The opposite is happening over the South Pole (Antarctica), there has been a positive AAO index. This means the vortex stays put, and does not move north. Combined with El Niño, this has brought improved weather for South American soybeans, something I alerted all my subscribers about, in the video we sent to them two weeks ago

Only 4 or 5 El Niño events have seen a very powerful negative NAO index in January. Most of these years saw El Niño weaken by the spring or summer. This will be very important for many agricultural markets and I will be developing trading strategies in options, futures and ETFs based on this scenario.

For now, this is how a negative NAO (warm block over Greenland that forces the Polar Vortex south) affects commodities:

1) Energy/Natural Gas: Coldest weather in at least 2-3 winters coming for Europe and the U.S. starting next week

2) Wheat: Isolated areas of winterkill in Russia and big cold and snows for the Plains. It will be important to monitor snowfall, which looks decent

3) Cocoa: While I was bullish all summer and autumn long on major wet weather and disease issues, the lack of a Harmattan Wind in Ivory Coast and Ghana could prevent any further damage to the cocoa crop

How does a positive AAO index (The vortex that remains over Antarctica and does not move north) affect commodities?

1) Soybeans/Corn: Easing of the northern Brazil drought and potential big Argentina crops

2) Coffee: A hot November and early December likely will lower Brazil coffee production by several million bags, but improved rainfall is on the horizon that will stop further damage.

Join farmers and traders around the world that want an advantage trading agricultural and energy futures with over 100 issues a year of WeatherWealth with frequent weather updates and trading ideas. Download a recent complimentary issue here about El Nino https://www.bestweatherinc.com/new-membership-options/

This free report below was written three weeks ago before we changed the weather forecast for natural gas and energy markets)

Below are some of our headlines from the past few weeks:

Thanks for your interest in commodity weather!

Jim Roemer, Scott Mathews, and The Weather Wealth Team

- Please feel free to learn about Jim Roemer, our track record, and how we use weather to help traders, hedgers, and investors. If you have any questions, please don't hesitate to drop me a line - Scott Mathews, Editor

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He also is a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he established a unique standing among advisors in the commodity risk management industry.

Trading futures and options involves a significant risk of loss and is not suitable for everyone. Past performance is not necessarily indicative of future results. There is no warranty or representation that accounts following any trading program will be profitable.

On the date of publication, Jim Roemer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.