1/5/24

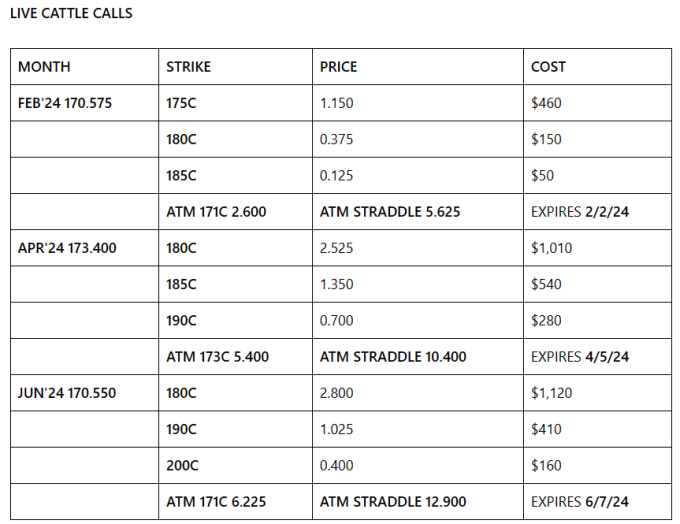

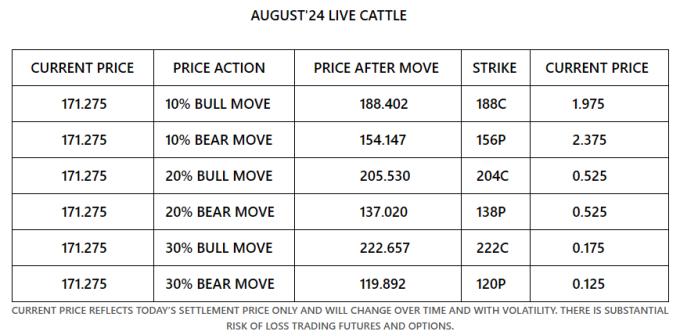

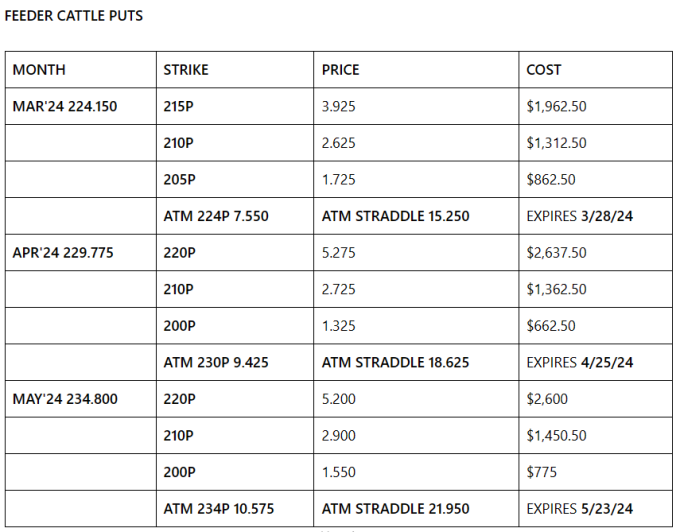

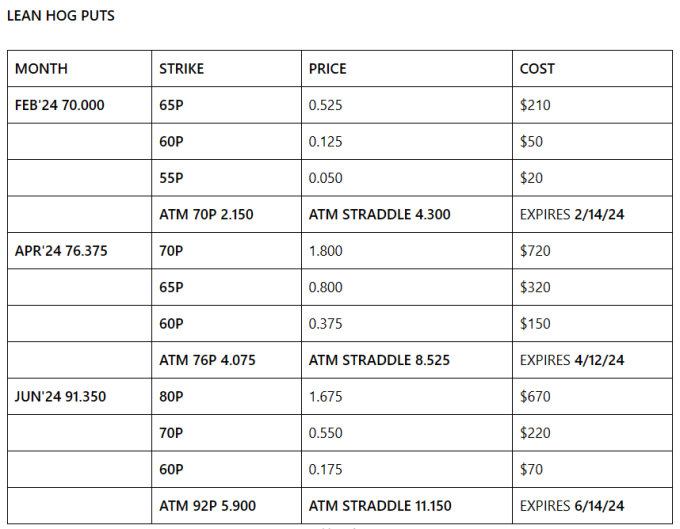

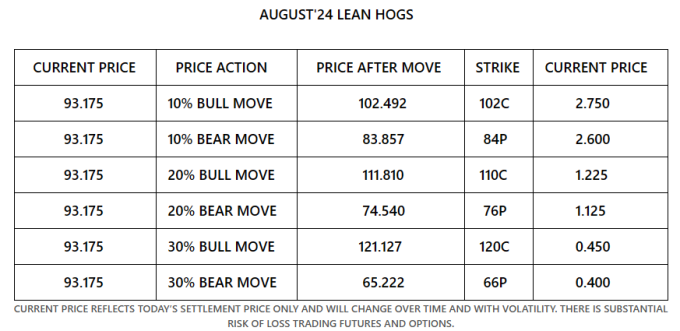

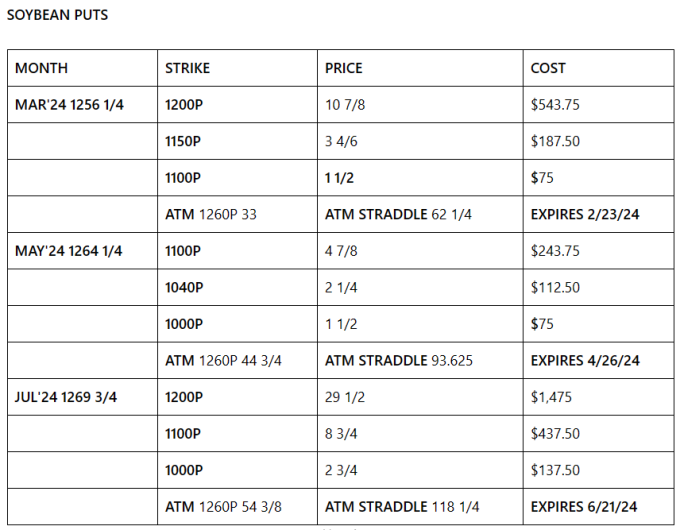

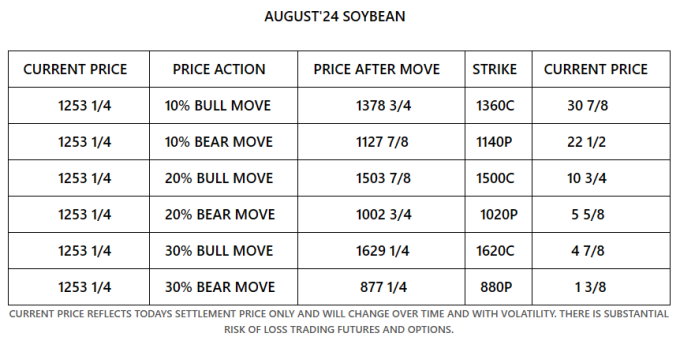

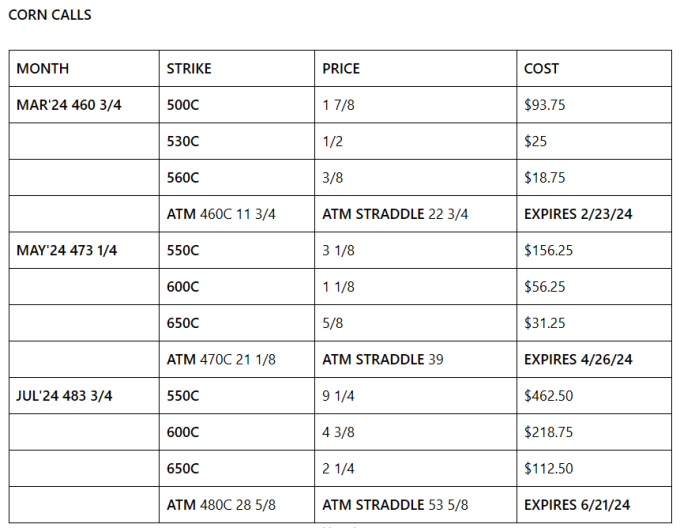

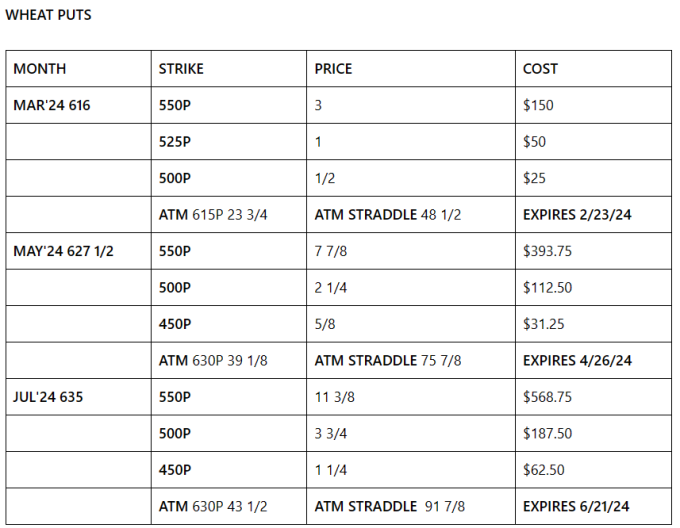

The Cattle and Soybean Markets continued to slide lower today. February'24 Live Cattle was 0.550 lower today and settled at 170.575, just above today's low of 170.100. The 1-month and 52-week low is 162.400. Since 12/5 February'24 Live Cattle are up 1.400 or almost 1%. The Feeders also slid lower today. March'24 Feeder Cattle were down 1.500 today and settled at 224.150. The 1-month and 52-week low is 210.625. Since 12/5 March'24 Feeders are up 6.700 or just over 3%. The Hogs closed higher on the day. February'24 Lean Hogs were 0.950 higher today and settled at 70.000, just under today's high of 70.500. The 1-month and 52-week low is 64.575. Since 12/5 February'24 Lean Hogs are 0.700 higher or just above 1%. The Soybean Market continued to drop today. March'24 Soybeans fell another 11 ¼ cents today and settled at 1256 ¼, just above today's low of 1255, which is also the 1-month low. Since 12/5 March'24 Soybeans are down 70 ½ cents or almost 5 ½%. Now A Public Service Announcement: The 52-week low is 1145 ¼. The Corn closed lower as well. March'24 Corn slid another 5 ¾ cents today and settled at 460 ¾, just above today's low of 460, which is also the 1-month and 52-week low. Since 12/5 March'24 Corn is 29 ¾ lower or over 6%. The Wheat market had a gain today. March'24 Wheat gained 2 ½ cents today and settled at 616, in the middle of today's trading range. The 1-month low is 591 ¼. Since 12/5 March'24 Wheat is down 15 cents or over 2%. I said not long ago that I expected a 50-cent break in the Soybean market after the first of the year, and it's already here. The Option trade I structured before the end of last year is now in the money, and is up 76 1/8 cents, for just one trade package. Thats $3,806.25 for each time you did the trade. I still think the Soybeans are heading a lot lower. There is still time to catch the rest of the break I feel is coming. I still feel that the Cattle Market will continue to grind lower from here as well. There is always risk in any futures or options trade, as everyone knows. Maybe I see things differently, but I still see opportunity. Call me if you would like to talk about it,

I have Option Strike prices every Friday.

I have market commentary and option charts in Pure Hedge – Livestock

and Pure Hedge – Grain at WWW.WALSHTRADING.COM

Call for specific trade recommendations.

1-312-957-8079

1.800.993.5449

Email me for free research.

BAllen@walshtrading.com

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

ballen@walshtrading.com

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

On the date of publication, Bill Allen did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.