Grain/Livestock Overview 4/11/24

Soybeans

(ZSN24)

July

From last week,

Use 1191.00 as the swing point for the week.

Below it, look for the area of 78.6% back to the 2/29/24 low at 1163.00 and the 1151.25 major Gann square. Here too, holding this area is another reason for a good rally, or at least send it back 78.6% to the 3/21/24 high, this level is yet to be determined......

4/11/24

Today's low fell 3 ticks short of 78.6% at 1163.00 and we think holding this level can be the base of the next Bull move along with the fact that it held 61.8% on 2/29/24.

Use 1163.00 as the swing point for the week.

Corn

(ZCK24)

May

From last week,

We still believe that the low put in on 2/26/24 at 78.6% is a level that can send this market on another Bull run, but until it can take out the 442.75 major Gann square it could retest the low and 78.6%, which would be another reason to rally.

Use 442.75 as the swing point for the week again.

4/11/24

We still think what we said last week holds true. With the 8 cent range this week all the levels from last week remain the same.

Use 442.75 as the swing point for the week again.

Wheat

(ZWK24)

May

From last week,

The setback from the 567.00 major Gann square held the previous major Gann square at 543.25, as the sideways trade continued. We are still waiting for it to give us some reason to look for a rally other than hitting the long term target of 486.00. One of those signs would be holding 78.6% on a test of the current low.

Use 567.00 as the swing point for the week again.

4/11/24

It had one close right at the 567.00 major Gann square and then broke from it again keeping the trend very negative. With the new high this week the 78.6% level below moves up a bit.

Use 567.00 as the swing point for the week again.

Below it, the short term target is 78.6% back to the 3/11/24 low at 535.00. Holding this level would be a good sign and possible start of the next leg up based on the ONE44 78.6% rule.

Livestock

Cattle

(LEM24)

June

From last week,

The break from the area of 78.6% on 3/14/24 has come off $16.00 and now hit the short term target of 61.8% at 171.80.

Use 171.80 as the swing point for the week.

4/11/24

There wasn't much of a rally from 171.80 (61.8%) and it is now back at that level again. Without violating this area all the levels from the Special update are the same. With it already hitting 171.80 , one thing to watch for is it trades below 171.80 and then closes above the 172.57 major Gann square, as this can cause a quick rally.

Use 171.80 as the swing point for the week again.

Feeder Cattle

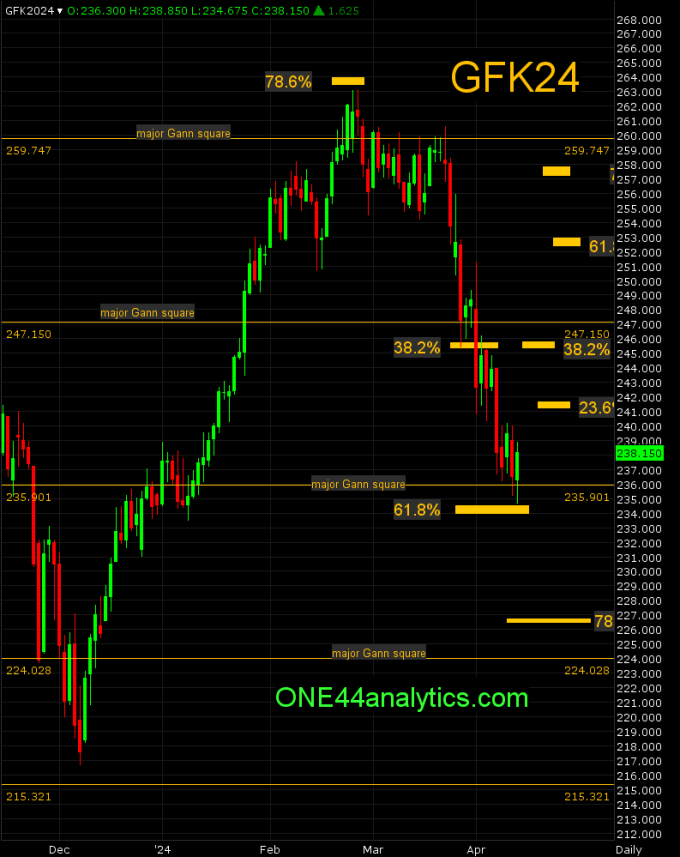

(GFK24)

May

From last week,

May looks identical to April, it also hit 78.6% back to the contract high and we are looking for a bigger break from this area. It has been trading at the 259.75 major Gann square for all of March.

The 38.2% level (246.00) held for a few days before the big break on Monday closed below it. This turns the long term trend negative here too and has us looking for the long term target of 78.6% the other way at 226.80 based on the ONE44 78.6% rule.

Use 246.00 as the swing point for the week again.

Below it, the long term target remains 78.6% at 226.80 based on the ONE44 78.6% rule. The short term target is the area of the 235.90 major Gann square and 61.8% back at 234.55.

4/11/24

The break below the 246.00 swing point quickly took it to the short term target area of 235.90 and 234.55 (61.8%). Holding this area will bring in the ONE44 61.8% rule. The long term target is still 78.6% below based on the ONE44 78.6% rule.

Use 234.55 as the swing point for the week.

ONE44 Analytics where the analysis is concise and to the point

Our goal is to not only give you actionable information, but to help you understand why we think this is happening based on pure price analysis with Fibonacci retracements, that we believe are the underlying structure of all markets and Gann squares.

If you like this type of analysis and trade the Grain/Livestock futures you can become a Premium Member.

You can also follow us on YouTube for more examples of how to use the Fibonacci retracements with the ONE44 rules and guidelines.

Sign up for our Free newsletter here.

FULL RISK DISCLOSURE: Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Commission Rule 4.41(b)(1)(I) hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Past performance is not necessarily indicative of future results.

On the date of publication, Nick Ehrenberg did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Disclosure Policy here.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.